?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

The study examines the effect of compliance with national governance frameworks on the relationship between corporate governance and the performance of publicly traded companies in Ghana. A sample of 31 companies listed on the Ghana Stock Exchange was drawn for the study based on their annual reports spanning from 2013 to 2022. A new national governance quality index composed of items drawn from world governance indicators and a corporate governance index was developed by principal component analysis. The study used the Huber M-estimation Robust Least Squares (HMRLS) regression method. The findings of our study reveal that corporate governance practices adversely affect the level of firm performance. However, our results demonstrate that compliance with national governance and institutional frameworks plays a significant moderating role in the relationship between corporate governance and firm performance. The study offers managerial implications, as listed firms can adopt effective national governance and institutional quality practices to improve firm performance.

Impact statement

This study investigates the relationship between corporate governance and business performance in Ghana, with a special focus on determining whether adherence to national governance frameworks has a significant impact. This research enhances the current understanding of corporate governance in Ghana and its impact on the performance of companies. This study offers useful information to policymakers, regulators, and business organisations in Ghana. This will result in improved corporate practices and greater performance of companies in Ghana. It will further aid stakeholders’ comprehension of the significance of complying with national governance frameworks. Ultimately, the findings in this research would promote a culture of transparency, responsibility, and ethical behaviour in the business industry. This would enhance the overall economic progress and investor confidence in Ghana.

Reviewing Editor:

1. Introduction

Corporate governance is a critical element of modern business management and has attracted substantial attention in both academic and corporate circles. The effectiveness of corporate governance practices within firms is widely acknowledged as a key determinant of their financial performance and overall sustainability (Nasrallah & El Khoury, Citation2021; Shahwan, Citation2015). It is essential to ensure that firms are managed efficiently, ethically, and in a manner that aligns with the interests of their shareholders and stakeholders (Han et al., Citation2024; Khan, Citation2023a). While this relationship has been extensively explored in developed economies, there is a growing interest in understanding how it manifests in developing nations, such as Ghana, and the potential impact of broader national governance quality on this dynamic.

Ghana has witnessed significant changes in its corporate governance landscape over the past decades. The nation has been proactive in adopting measures to improve corporate governance, which is reflected in revised corporate governance codes and regulations aimed at enhancing transparency and accountability (Antwi et al., Citation2022; Coleman & Wu, Citation2021). However, the extent to which the quality of national governance infrastructure – which includes the country’s legal systems, regulatory frameworks, and overall business climate – affects corporate governance practices and subsequently influences firm performance is emergent. Also, Ghana has weak corporate governance systems as compared to most developed countries. Most corporate boards are mere ‘rubber stamps’, with membership mainly politicians and families and friends affiliations. Most Ghanaian firms also rely primarily on bank loans for financing (Acheampong et al., Citation2023). The capital market has a passive role in financing as compared to developed markets. Furthermore, its capital market does not efficiently communicate information but instead has weak corporate governance, which results in information asymmetry and agency problems.

Our study contributes to the literature on corporate governance (CG), national governance quality (NGQ), and firm performance in several ways. First, this study complements the previous literature on corporate governance and firm performance from Ghana (Adusei, Citation2012; Asiedu & Mensah, Citation2023; Ledi & Ameza-Xemalordzo, Citation2023; Sackey et al., Citation2019; Sarpong-Danquah et al., Citation2022, Citation2018; Tornyeva & Wereko, Citation2012). To the best of our knowledge, this is the first study to analyze the moderating role NGQ plays in the relationship between CG and firm performance. Our study contributes to the literature by showing how NGQ can moderate this relationship by following the resources’ complementary phenomenon. Also, our study contributes to the literature by using principal component analysis (PCA) for both the CG index and NGQ index, which has never been covered before in any study.

The motivation of this study is to address this knowledge gap by examining the relationship between CG practices, quality national governance, and firm performance in Ghana. Specifically, we seek to investigate whether national governance quality significantly influences the effectiveness of corporate governance in improving firm performance. In doing so, we consider several dimensions of corporate governance in the Ghanaian context.

The results of this study have significant ramifications for regulators, investors, boards of companies, CEOs, and researchers looking at the relationship between CG, NGQ, and firm performance. The format is as follows for the remaining sections of this study: The literature review is presented in Section 2. The research methods used are described in Section 3. Section 4 presents the findings and analysis. The research’s conclusions and potential policy implications, recommendations, and directions for future research are covered in the fifth section.

1.1. Why Ghana?

Ghana, in West Africa, is a major economy in Sub-Saharan Africa (SSA), making it an interesting place to research how national governance framework compliance affects corporate governance and business performance. The country has historical ties to British colonial rule, which has influenced various aspects of its legal systems, governance structures, education systems, and business practices. Additionally, the nation has put in place accounting systems that take international standards like the International Financial Reporting Standards (IFRS) into consideration. Moreover, Ghana also has legal systems that are based on a common law tradition, which is derived from English law. This provides a foundation for legal frameworks and regulations related to business, contracts, and commercial activities. Additionally, Ghana’s economy is characterized by natural resources such as gold, cocoa, and oil, which play a significant role in its export revenue. Also, Ghana has a stable multi-party democracy with periodic peaceful transitions of power. According to the 2022 Worldwide Governance Indicators published by the World Bank, Ghana is positioned among the politically stable nations within the Sub-Saharan Africa (SSA) region.

The long-standing and extensive collapse of prominent companies over several decades has heightened interest in the topic in both advanced and emerging countries (Antwi et al., Citation2022). Crises and business failures have fueled the evolution of corporate governance (Adegbite, Citation2012; Ledi & Ameza-Xemalordzo, Citation2023). The main reason for this is the notable business collapses that have mainly taken place in the Western world and have been linked to failures in corporate governance. Corporate governance issues are widely recognised as a significant factor contributing to the collapse of many enterprises across all sectors of the African economy (Banahene, Citation2018; Ofoegbu et al., Citation2018; Ssekiziyivu et al., Citation2018). The level of corporate governance compliance in some African nations, including Ghana, is low due to a notable discrepancy in enforcement, insufficient board independence, imbalanced power dynamics, and inadequate disclosure practices. During the early 2000s, several companies in Ghana, such as Ghana Cooperative Bank Limited, Divine Sea Foods Limited, Bonte Gold Mines Limited, Juapong Textiles Limited, Bank for Housing and Construction Limited, and Ghana Airways Limited, experienced a collapse as a result of inadequate governance practices (Banahene, Citation2018; Ledi & Ameza-Xemalordzo, Citation2023; Sarpong-Danquah et al., Citation2018). In recent years, Capital Bank and UT Bank were absorbed by Ghana Commercial Bank (GCB). Similarly, five banks, comprising Unibank, Beidge Bank, Sovereign Bank, Heritage Bank, and Royal Bank, consolidated to form Consolidated Bank Ghana (CBG). These events have been traced to a lack of well-established corporate governance structures and a lack of information disclosure to those who matter (Sarpong-Danquah et al., Citation2022). In response to these recurrent corporate problems, the Ghana Security and Exchange Commission (SEC) implemented a set of guidelines for corporate governance that align with the principles outlined by the OECD in 2004 (Adegbite, Citation2012; Sarpong-Danquah et al., Citation2022).

One of the main menaces of the Ghanaian system is acknowledged to be corruption and the failure to follow institutional frameworks. This problem persists and is escalating, despite repeated demands for strict adherence to the rules and their implementation by the SEC (Adegbite, Citation2012; Ledi & Ameza-Xemalordzo, Citation2023). Consequently, several Ghanaian establishments (the majority of them being financial institutions) experienced a collapse over the period from 2017 to 2019, leading to job losses and prompting investors and the government to withdraw their financial resources. The Ghanaian government incurred substantial financial losses, amounting to more than $1.2 billion, in its efforts to restore stability and sustainability (Ledi & Ameza-Xemalordzo, Citation2023; Maama, Citation2021). Businesses in Ghana were at risk of disappearing due to a significant decline in public trust. This devastating calamity might potentially adversely affect Ghana’s GDP, as it mainly depends on the industrial and banking sectors.

Adhering to national governance and institutional frameworks is considered a crucial tool for firms in Ghana to attract investors and enhance their financial performance. Therefore, businesses in Ghana should adhere to the country’s regulations and refrain from engaging in corrupt practices throughout their reporting procedures. The utilisation of national governance indices has been recognised as an efficacious mechanism to restore confidence in Ghanaian enterprises among foreign investors (Acheampong et al., Citation2023; Wu, Citation2021).

Research is scarce regarding the impact of NGQ on the correlation between corporate governance and business performance in emerging economies, namely in Africa. Zattoni et al. (Citation2017) and Wu (Citation2021) contend that contextual variables, such as institutional requirements or standardisation, and the governance structures of these nations exert a substantial influence on the relationship between CG and performance. Given the significant disparities between developing and developed economies in terms of the implementation and theoretical underpinnings of CG, it is crucial to examine both concepts from a local standpoint, considering the historical, cultural, and ethnic factors that impact the execution of corporate governance. Consequently, Ghana is a perfect site for studying the CG-NGQ nexus.

2. Literature review

2.1. Theoretical framework

The research framework recognises the complementary roles of agency theory and institutional theory in understanding the intricate relationship between corporate governance and firm performance in Ghana. Agency theory provides insights into micro-level corporate governance mechanisms, while institutional theory places these mechanisms in the macro-level context of national governance quality. Agency theory is a prominent theoretical framework that provides insights into the relationship between corporate governance and firm performance. It centres on the principal-agent relationship within a corporation, where shareholders (principals) delegate authority to managers (agents) to make decisions on their behalf (Jensen & Meckling, Citation1976). This delegation of authority can lead to agency conflicts when managers pursue their interests, which may not align with the interests of shareholders (Jensen, Citation1993). Effective corporate governance mechanisms are crucial to mitigating these conflicts. In the context of corporate governance, agency theory suggests that elements such as board composition, ownership structure, and disclosure practices play a vital role in reducing agency costs and enhancing firm performance (Jensen & Meckling, Citation1976). For example, a board with a significant proportion of independent directors can act as a monitoring mechanism to ensure that managerial actions are aligned with shareholder interests, ultimately improving firm performance.

Institutional theory, on the other hand, focuses on the impact of the broader institutional environment on organisational behaviour and practices (Scott, Citation1995). It emphasises the influence of formal and informal rules, norms, and institutions on shaping corporate governance structures. According to this theory, societal norms, legal systems, and regulatory frameworks have an impact on organizations. The quality of the national institutional environment, including governance quality, can significantly affect corporate governance practices (Scott, Citation1995). In this research, the institutional theory emphasises how the quality of national governance in Ghana, including the quality of its legal and regulatory institutions, can shape the practices and effectiveness of corporate governance within Ghanaian firms. The institutional environment provides the context within which corporate governance operates, influencing the behaviour of firms and their responses to governance regulations and norms. This study seeks to explore the dynamic interplay between agency theory and institutional theory within the Ghanaian context. It aims to look into how agency theory-guided corporate governance practices and institutional theory-influenced national governance quality collectively affect firm performance in Ghana.

2.2. Corporate governance in Ghana

Corporate governance in Ghana has gained increasing prominence in recent years as the country seeks to attract investment and enhance the competitiveness of its business sector. Legislation and regulatory bodies play a major role in shaping Ghana’s regulatory framework for corporate governance. The Securities and Exchange Commission Act of 1993, the Companies Act of 2019, and the Securities and Exchange Commission’s (SEC) Code of Corporate Governance are the key legal documents. These laws and regulations set out the rules for corporate governance practices in the country. The SEC's Code of Corporate Governance offers comprehensive guidance on a variety of governance issues, including the make-up and functions of boards of directors, audit committees, and executive management duties. It encourages transparency and disclosure by requiring listed companies on the Ghana Stock Exchange to publish annual reports that conform to international financial reporting standards (IFRS).

One of the central elements of corporate governance in Ghana is the composition of boards of directors. The Companies Act of 2019 mandates that a company’s board should have a minimum of two directors, with at least one being a Ghanaian resident. This regulation aims to ensure that there is local representation and knowledge within boards. Furthermore, the Code of Corporate Governance promotes board independence. It recommends that a substantial majority of board members should be non-executive directors, with at least one-third being independent. Independent directors are expected to provide unbiased judgment and serve as a check on management.

In Ghana, corporate governance also seeks to protect shareholder rights and ensure that they are treated fairly. Shareholders have the right to vote at general meetings and are entitled to receive financial information, including annual reports and audited financial statements, on time. The Companies Act of 2019 introduced provisions for proxy voting, allowing shareholders to appoint someone else to vote on their behalf. This provision enhances shareholder participation in corporate decision-making. Despite the progress made in corporate governance in Ghana, challenges persist. These include issues related to compliance, enforcement, and the capacity of regulatory bodies. Some companies, particularly those in the informal sector, may struggle to adhere to governance requirements fully. To address these challenges, Ghana continues to pursue reforms in corporate governance. The SEC and other stakeholders are working to enhance awareness and education about governance principles among businesses. The government is also exploring ways to strengthen the regulatory framework further.

2.3. National governance quality

Governance systems, which consist of laws, rules, and regulations, are essential to a nation’s governmental infrastructure (Acheampong et al., Citation2023; Khan, Citation2023b; Sun et al., Citation2015). National governance quality refers to the overall quality of the governance system in a country, including the institutions, laws, and policies that govern economic and political activities (Kaufmann et al., Citation2010). As a result, the legal environment may mirror the regulatory quality and rule of law characteristics of a national government. Several studies in recent years have examined the correlation between a country’s level of governance and its firm performance, and the findings have consistently pointed to the importance of governance at the national level in determining company success. One way the quality of the national government influences the performance of businesses is through its effect on the amount of corruption. Research demonstrates that nations with greater levels of corruption tend to have firms with poorer levels of performance (Bello et al., Citation2020; Mauro, Citation1995; Ojeka et al., Citation2019). This is because corruption decreases market confidence and raises the cost of doing business. For instance, businesses in nations with high levels of corruption may be obliged to pay bribes for licenses and permits, which raises their expenses and decreases their competitiveness (Kaufmann et al., Citation2010).

In addition to affecting corporate performance, the quality of national governance influences the volume of investment in a country. Research has shown that nations with stronger governance tend to have higher levels of investment, which in turn leads to greater economic growth and development (Nguyen et al., Citation2021; Raza et al., Citation2020; Zattoni et al., Citation2017). This is because investors are more willing to invest in nations with a stable political climate, low corruption levels, and well-functioning institutions (Kaufmann et al., Citation2010). National governance quality influences corporate performance through the regulatory environment. Countries with greater governance quality tend to have more clear and predictable regulatory frameworks, which lower business risks and boost investment (Raza et al., Citation2020). In nations with high levels of corruption and poor governance, for instance, businesses may confront arbitrary laws and legal impediments that restrict their competitiveness and growth potential (Kaufmann et al., Citation2010).

According to the research discussed above, socio-cultural, national governance systems, and institutional frameworks play a significant role in determining companies’ successes (Acheampong et al., Citation2023; Tarighi et al., Citation2023). Businesses are, therefore, required to disclose or report on how these national governance policies and institutional frameworks affect their operations. This research highlights the importance of good governance at the national level in promoting the competitiveness, growth, and profitability of firms, particularly in emerging economies.

2.4. Corporate governance and firm performance

The empirical literature on the relationship between corporate governance and firm performance provides substantial evidence of the importance of various governance mechanisms, board size (Areneke, Citation2018; Kapil & Mishra, Citation2019; Mertzanis et al., Citation2019; Tessema, Citation2019), board independence (Alabdullah et al., Citation2014; Elnahass et al. Citation2022; Fauzi & Locke, Citation2012; Kapil & Mishra, Citation2019; Navarro & Urquiza, Citation2015; Neralla, Citation2021; Sarpong-Danquah et al., Citation2018; Zattoni et al., Citation2017) executive compensation, CEO characteristics, board diversity (Khan, Citation2023a; Nel et al., Citation2020; Sarpong-Danquah et al., Citation2018), ownership structure, and corporate social responsibility (Aqib & Zaman, Citation2023; Ayoungman et al., Citation2023; Nazir, Citation2023) in influencing firm performance.

Asiedu and Mensah (Citation2023) conducted a study that established a causal relationship between corporate governance (CG) and firm performance, with financial reporting quality (FRQ) acting as a mediator. Their findings demonstrated a direct positive impact of CG on firm performance as well as an indirect effect mediated by FRQ. In another investigation by Siddiqui et al. (Citation2023), the focus was on exploring the influence of corporate governance and corporate reputation on the disclosure of corporate social responsibility (CSR) and firm performance. Their study revealed a significant association between CSR disclosure and corporate reputation. Furthermore, the research emphasised the role of CEO integrity, ownership concentration, and corporate reputation in facilitating CSR disclosure and enhancing firm performance.

Ledi and Ameza-Xemalordzo (Citation2023) conducted a study exploring the correlation between corporate governance, corporate social responsibility (CSR), and the performance of manufacturing companies, with a particular focus on corporate image. Their findings revealed that corporate governance has a significant impact on stimulating CSR performance, suggesting a strong interconnection between the two. Moreover, the research demonstrated that effective corporate governance practices not only enhance the corporate image but also have a positive influence on overall firm performance. Furthermore, the study emphasised a noteworthy positive relationship between CSR, corporate image, and performance within the manufacturing sector. Khan (Citation2023a) has demonstrated that enhancing female autonomy yields a beneficial effect on the environment through the enhancement of technical advancement.

These studies collectively underscore the critical role of governance structures, incentives, and ethical practices in determining firm success. They also demonstrate the relevance of this research in diverse industries and settings, emphasising its broad applicability and significance in the corporate world. However, there is ongoing research and debate on the nuanced aspects of this relationship, and further investigations are required to gain a deeper understanding of the complexities involved. From the history of previous research that has explored this theme, this paper has set the following null (H0) and alternative (H1) hypotheses:

H0: Corporate governance negatively affects firm performance in Ghana.

H1: Corporate governance positively affects firm performance in Ghana.

2.5. Corporate governance, national governance quality, and firm performance

Research shows that the quality of both company and national governance significantly affects business results (Acheampong et al., Citation2023; Nabi et al., Citation2023). Corporate governance is seen as an important determinant of firm performance as it affects the allocation of resources, the incentives of managers, and the protection of minority shareholder rights (La Porta et al., Citation1999). Research has shown that when the impact of national governance quality is taken into account, the relationship between corporate governance and business success becomes more complex. For instance, the ability of corporate governance measures to influence firm performance may be constrained in nations with poor national governance quality (Raza et al., Citation2020). This is because the presence of weak institutions and a high level of corruption may reduce the effectiveness of corporate governance mechanisms in protecting the interests of shareholders and promoting the efficiency of the firm (Mauro, Citation1995). According to Zattoni et al. (Citation2017), although board independence has little direct influence on performance, national-level institutions greatly mitigate the link. The national environment is more likely to affect how well board arrangements work in line with the law.

According to Lu and Wang (Citation2021), corporate governance and cultural background have an impact on how businesses perform in terms of the environment and how they disclose their social responsibility activities. According to them, companies in nations with better legal systems are less likely to submit voluntary CSR disclosures, showing that external governance is effective and can partially replace internal control. In nations with minimal power distance, individuality, femininity, high uncertainty avoidance, and a long-term orientation, businesses thrive. Wu (Citation2021) also observed that the adverse effects of CG on business performance have been greatly mitigated by the rule of law and high regulatory quality. This implies that although there is a relationship between corporate governance and firm performance, the strength of this correlation is diminished for companies operating in countries with fragile legal frameworks. Nguyen et al. (Citation2021) found that the success of businesses operating in countries with above-average national governance quality tends to be positively impacted by gender diversity on boards. As the quality of national governance declines, the impact of gender diversity on company performance declines and begins to be detrimental to businesses. Tarighi et al.'s (Citation2023) research observed that the coronavirus pandemic worsened Iranian corporate performance. In support of agency theory, they found out that board independence, board meeting frequency, and board financial expertise are correlated positively with firm value. Based on the background of previous studies in this field, this paper formulates the following null (H0) and alternative (H1) hypotheses:

H0: Compliance with national governance frameworks does not strengthen the relationship between CG and firm performance in Ghana.

H1: Compliance with national governance frameworks strengthens the relationship between CG and firm performance in Ghana.

2.6. Conceptual framework

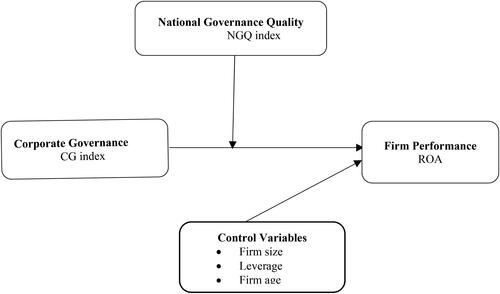

Corporate governance in this research is represented by constructing a CG performance index for the individual firms. On the other hand, return on assets estimates the dependent variable, which is firm performance. The decision to consider ROA relies mainly on the fact that ROA has been employed by prior researchers for firms’ performance measurement (Kapil & Mishra, Citation2019; Nguyen et al., Citation2021; Shahzad et al., Citation2021; Wu, Citation2021). The quality of national governance serves as a moderating variable in this research. The conceptual framework used to accomplish the goal of the study is shown in .

3. Research method

3.1. Data and sample selection

The primary objective of this research was to investigate how the quality of national governance influences the connection between corporate governance and the performance of 31 businesses listed on the Ghana Stock Exchange (GSE) for approximately 10 years, from 2013 to 2022. As indicated in , the sample, comprising 31 companies, was purposefully selected from a population of 42 firms. The selection was contingent on the availability of comprehensive annual reports for these firms for at least five years during the study’s duration. The deliberate inclusion of firms from various industries aimed to ensure the study’s findings could be broadly applicable.

Table 1. Sample size determination.

The data about NGQ is gathered through clinical data analysis from the annual reports of companies. Data concerning firm performance and corporate governance practices are manually collected from the annual reports of 31 firms listed on the GSE. provides detailed information on the variables, including their measurements and abbreviations.

Table 2. Variable description and measurements.

3.2. Variable measurements

3.2.1. Dependent variable (firm performance)

Firm performance is used as a dependent variable in this study. In the financial field, financial performance metrics are very significant in assessing firm performance. We have used return on assets (ROA) as a measure of firm performance. The use of ROA is justified as it is widely used by prior researchers (such as Alabdullah et al., Citation2014; Areneke, Citation2018; Asiedu & Mensah, Citation2023; Elnahass et al., Citation2022; Kapil & Mishra, Citation2019; Mertzanis et al., Citation2019; Navarro & Urquiza, Citation2015; Neralla, Citation2021; Sarpong-Danquah et al., Citation2018; Tessema, Citation2019; Zattoni et al., Citation2017) in corporate finance literature. ROA was computed as follows:

where EATit refers to profit after tax for a firm i in year t, and TAit also refers to total assets for a firm i in year t.

3.2.2. Corporate governance (independent variable)

The CGI is an independent index of governance mechanisms developed through PCA. This consists of 13 composite items covering significant aspects of corporate governance such as board composition, ownership structures, audit quality, stakeholder engagements, compliance with laws, and other firm governance indices. The CGI is developed as follows:

where X represents the score obtained in the variables of CG, and M is the total number of items of CG (M = 13). This indicator takes the value 1, indicating firm-level disclosure of the CG system, or 0 for non-disclosure.

3.2.3. National governance quality (moderator)

The study used a national governance quality index (NGQI) developed via PCA composed of 12 governance indices related to effective governance in a country. We draw some of the variables from WGI indices (Acheampong et al., Citation2023; Kaufmann et al., Citation2010; Sun et al., Citation2015). The NGQI is developed as follows:

where X represents the score obtained in the variables of NGQI, and M is the total number of items of national governance (M = 12). This indicator takes the value 1, indicating firm-level compliance with Ghana’s governance systems and institutional framework, or 0 for non-compliance.

3.3. Model specification

We employ a panel data analysis method, including the pooled OLS, fixed effects, and random effects models. The models are specified as follows:.

(1)

(1)

(2)

(2)

where ROAit refers to the return on assets (the dependent variable) for firm i in year t, and αi represents the firm-fixed effect. The CGIit is the corporate governance index for firm i in year t, which is the independent variable. The NGQIit (the moderating variable) stands for compliance with national governance frameworks for firm i in year t, and the (CGIit * NGQIit) stands for the interaction term for corporate governance and compliance with national governance systems. The CONTROLSit stands for the control variables (firm size, leverage, and age) for firm i in year t. The β1, β2, and β3 are the coefficients for CGIit, NGQIit, and the (CGIit * NGQIit), respectively. The βx stands for the coefficient for the control variables. The regression error term is represented by eit. It is assumed that the error term follows a symmetrical bell-shaped distribution centered around zero.

3.4. Estimation approach

Regression models applied to panel datasets often encounter challenges as the data rarely fulfills all the underlying assumptions. According to Beyaztas and Bandyopadhyay (Citation2022), when using the least squares (LS) method on panel data, the existence of outliers can frequently introduce biases and inefficiencies in estimating the model parameters. As a consequence, this can undermine the reliability of the inferences drawn from the analysis. In some corporate governance research, panel data is commonly derived from companies grouped by industry or organized into years, which implies repeated measurements of values (Gitundu et al., Citation2016). This repetitive nature can lead to a high correlation of errors between different observations, known as autocorrelation of errors, and deviations from a normal distribution. These variations between groups can contribute to differences in variances or heteroscedasticity (Schmidheiny, Citation2013). Heteroscedasticity among the data values, as mentioned by Saunders et al. (Citation2009), can lead to biased, inconsistent, and less accurate or invalid results. To determine an appropriate panel data estimation approach for the study, we initially assessed the heterogeneous effects, and non-normal distributions of the research data for the explanatory variables in the models. The Breusch-Pagan/Cook-Weisberg test yielded a test statistic of 7.52 and a p-value of 0.0061, providing evidence to reject the null hypothesis of homoscedasticity. Additionally, the Jarque-Bera statistic of 211.2734 with a probability of 0.0000 strongly indicates that the data does not follow a normal distribution. Robust estimation techniques are necessary to mitigate endogeneity issues, account for heterogeneous effects, and accommodate the non-normal distributions in the research data (Susanti et al., Citation2014). Therefore, the study opted for the Huber M-estimation Robust Least Squares (HMRLS) regression technique as the most suitable approach for this investigation. The HMRLS regression technique is a form of robust regression method that is used when the residual distribution deviates from normality or when outliers have a significant impact on the model (Beyaztas & Bandyopadhyay, Citation2022; Draper & Smith, Citation1998). The Huber estimator, developed by Huber in 1964, is the most widely adopted general approach for robust regression analysis (Hampel, Citation1992). The Huber function is defined as follows:

where u is the residual or the difference between the observed value and the predicted value, and c is a parameter that determines the threshold for when the loss function changes from a quadratic form to a linear form.

The HMRLS technique is well-suited for this study due to its key features. Specifically, the technique is able to effectively manage the presence of outliers in the data and account for heterogeneity issues, which are common challenges when analyzing relationships between corporate governance, national governance quality, and firm performance. Additionally, the HMRLS technique is nearly as efficient as the traditional least squares (LS) method, making it a suitable choice for this type of analysis (Morrison, Citation2021).

4. Results and discussions

4.1. Descriptive statistics

provides descriptive statistics for the study’s variables. The mean ROA is 2.11%, indicating that the firms in the sample report a low level of financial performance. This reflects management’s inability to exploit available resources to generate a reasonable return for shareholders. Also, the company reported a corporate governance index (CGI) of 0.5615, suggesting average corporate governance practices in Ghana. The standard values for national governance quality measures fall between −2.5 and 2.5 (Kaufmann et al., Citation2010). However, the study reported a mean of 0.3333, suggesting that on average, firms in the sample operate in a fairly well-governed country.

Table 3. Descriptive statistics.

As per , the listed companies’ average size was GHȼ5.4215 million. The level of leverage of companies registered on the Ghana Stock Exchange was 67.59% on average between 2013 and 2022. Finally, the firms had an average age of 34 years since incorporation.

4.2. Correlation analysis

shows the variables’ correlation matrix. Some explanatory factors are significantly related to the dependent variable. In particular, firm performance seems to be positively linked with national governance quality, firm size, and age. Previous literature supports positive relationship indicators (Nguyen et al., Citation2021). The study further observed an adverse relationship between firm performance, corporate governance mechanisms, and firm leverage.

Table 4. Correlation matrix.

4.3. Unit root test

presents the results of unit root tests conducted on the research variables. Unit root tests are used to determine whether a time series or panel data is stationary or exhibits a unit root, indicating non-stationarity. The ADF (Augmented Dickey–Fuller) test and the LLC (Levin, Lin, and Chu) test are used for this test. The test statistics are reported for both the level of the variable and its first difference.

Table 5. Results of unit root test.

For the variable ‘ROA’ (return on assets), the ADF test statistic at the level is 68.4991, which is statistically significant at the 10% level (*). This suggests that the variable is likely non-stationary at this level. However, the ADF test statistic for the first difference is 90.3422, which is statistically significant at the 1% level (**). This indicates that after taking the first difference, the variable becomes stationary. Similarly, for the variable ‘CGI’ (corporate governance index), both the ADF and LLC test statistics at the level are statistically significant at the 5% and 1% levels (** and ***, respectively). However, after differencing the variable, both test statistics are highly significant at the 1% level (***). This suggests that the first difference of the variable is stationary. The results for the variables ‘NGQI’ (national governance quality index), ‘SIZE’ (firm size), ‘LEV’ (firm leverage), and ‘AGE’ (firm age) also show a similar pattern. The ADF and LLC test statistics at this level are statistically significant at varying levels of significance (*, **, or ***), indicating non-stationarity. However, after differencing the variables, the test statistics become highly significant at the 1% level (***), suggesting stationarity. Based on the results of the unit root tests, it appears that the variables in the study (except for ‘AGE’) are non-stationary at their level but become stationary after taking the first difference. This suggests that these variables have a unit root and may require differencing to achieve stationarity before including them in regression analysis.

4.4. Diagnostic tests

presents the various diagnostic tests conducted to validate the kind of regression technique to adopt for the analysis. They include tests for multicollinearity, heteroscedasticity, and data normality.

Table 6. Diagnostic tests.

As shown in , the VIF and tolerance values indicate there is no significant multicollinearity among the independent variables in the model. This is because all their VIFs are less than 10, as suggested by Muthusi (2017), indicating that the independent variables can be included in the regression analysis without a major concern about multicollinearity affecting the results. As suggested by Chatterjee and Hadi (Citation2012, p. 236), a value of VIF greater than 10 is typically considered a sign of the existence of collinearity problems.

However, the test statistic for the Breusch-Pagan/Cook-Weisberg test is 7.52, and the probability (prob > χ2) associated with the test statistic is 0.0061. This indicates that there is strong evidence to reject the null hypothesis of homoscedasticity. Therefore, the test results suggest that heteroscedasticity is present in the regression model, meaning that the variance of the residuals is not constant across different values of the independent variables. Similarly, a Jarque-Bera statistic of 211.2734 and a probability of .0000 indicate strong evidence against the hypothesis that the data follows a normal distribution. This suggests that the distribution of the variables being analysed is likely skewed, indicating potential deviations from the assumptions of normality. Given the various checks performed on the data, not all suppositions have been fulfilled; subsequently, the pooled ordinary least squares (OLS) regression was improper. We, therefore, used the Huber M-estimation Robust Least Squares (HMRLS) regression method to analyse the results. The benefits of ordinary least squares (OLS) and the Huber M-estimator are combined in this method, which can handle outliers and data that does not follow the rules of normality and homoscedasticity.

4.5. Effect of corporate governance on firm performance

shows the results of the regression analysis on the relationship between the corporate governance index (CGI), which was self-developed using principal component analysis (PCA), and firm performance (measured by ROA). The results indicate that there is a negative association between CGI and ROA, suggesting that an increase in corporate governance practices is associated with a decrease in firm performance. However, this negative association is statistically insignificant at the conventional level of 5% significance. The result does not provide enough evidence to reject the null hypothesis (H0), which suggests a negative impact of corporate governance on firm performance. This result seems to be inconsistent with the findings of previous studies conducted by Asiedu and Mensah (Citation2023) and Ledi and Ameza-Xemalordzo (Citation2023), who observed a positive relationship between corporate governance and firm performance in Ghana. This discrepancy could be due to differences in the methodology, sample size, measurement of variables, variations in periods, or specific contextual factors considered in the studies. Furthermore, research by Khan (Citation2023a) indicates that enhancing female autonomy has a positive impact on firm success. The outcome of the study further weakens the perspective of agency theory, which argues that better firm governance aligns management’s interests with those of shareholders, thereby enhancing firm performance. This implies that, contrary to what agency theory suggests, the relationship between corporate governance and firm performance is more nuanced and context-dependent.

Table 7. Effect of CG on firm performance (ROA), with firm-level characteristics as the control variables.

Firm size and firm age are found to have a positive effect on firm performance as control variables, meaning that larger firms and more established firms tend to exhibit better performance than smaller and younger firms. This finding is consistent with previous research conducted by Kapil and Mishra (Citation2019), Mertzanis et al. (Citation2019), Tessema (Citation2019), Areneke (Citation2018), and Sarpong-Danquah et al. (Citation2018), which also reported a positive relationship between firm size and age and firm performance. The positive effect of firm size on firm performance can be attributed to various factors, such as larger firms often having greater access to resources, economies of scale, and bargaining power, which can enhance their competitiveness and profitability. They may also have a more established market presence and customer relationships (Aqib & Zaman, Citation2023; Nazir, Citation2023), which can contribute to their performance. Similarly, firm age is positively associated with firm performance due to several reasons. Older firms tend to have accumulated knowledge, experience and established relationships with customers, suppliers, and other stakeholders (Ayoungman et al., Citation2023). They may have developed effective business strategies, a strong brand reputation, and a strong track record, which can positively impact their performance. Furthermore, they develop the core competence that helps them have the market power to outperform smaller and less competitive firms in the industry. On the other hand, higher levels of debt or leverage negatively impact firm performance, aligning with the notion that excessive debt levels can impose financial constraints, increase interest expenses, and limit the flexibility of firms in making strategic decisions. High leverage can also increase the risk of financial distress (Asiedu & Mensah, Citation2023), which can hinder firm performance.

4.6. Moderating effect of NGQ on the relationship between CG and firm performance

presents the regression analysis conducted on firm performance, including an interaction term between the corporate governance index (CGI) and the national governance quality index (NGQI). Both the CGI and NGQI were developed using principal component analysis (PCA). In addition, the analysis controlled for firm size, leverage, and firm age.

Table 8. The moderating effect of NGQ on the relationship between CG and firm performance (ROA), with firm-level characteristics as the control variables.

Table 9. The moderating effect of NGQ on the relationship between CG and firm performance (Tobin Q), with firm-level characteristics as the control variables.

The results indicate a statistically significant positive relationship between firm performance and the interaction term of CGI and NGQI at a significance level of 5%. The significance of the interaction term between CGI and NGQI implies that the effectiveness of corporate governance practices in driving firm performance is contingent on the quality of the broader national environment. When both corporate governance and national governance quality are favorable, their combined effect leads to improved firm performance. This finding provides support for the alternative hypothesis (H1) of the study, which posits that compliance with national governance frameworks strengthens the relationship between CG and firm performance in Ghana. Importantly, these results align with previous literature (Lu & Wang, Citation2021; Nguyen et al., Citation2021; Raza et al., Citation2020; Tarighi et al., Citation2023; Wu, Citation2021; Zattoni et al., Citation2017) that has explored the relationship between corporate governance, institutional quality, and firm performance. For instance, Raza et al. argue that countries with better governance quality tend to have more transparent and predictable regulatory frameworks, which reduce the risks associated with doing business and increase investment. The current study’s findings align with this perspective, suggesting that strong national governance frameworks positively influence the relationship between corporate governance and firm performance. The finding further underscores the significance of taking into account the wider institutional context when examining the influence of corporate governance on firm performance, as emphasized by Acheampong et al. (Citation2023) and Nabi et al. (Citation2023). These results indicate that relying solely on corporate governance practices may not be adequate to enhance firm performance. Therefore, having a robust institutional framework is vital for effectively translating good governance into favorable outcomes.

4.7. Robustness check

Due to the limitations of accounting-based performance measures, the study used the Tobin Q (a market-based performance measure) as a form of robustness check. The study is performed by using the quality of national governance and firm characteristics, respectively, as moderator and control variables.

The coefficients presented in demonstrate that the outcomes remained consistent when using different measures of firm performance. The results consistently show a significant relationship, aligning with the previous findings. Moreover, the results remain robust in explaining the substantial moderating impact of national governance quality on the relationship between corporate governance and firm performance, as indicated in . Additionally, the results of corporate governance remain both insignificant and robust when utilising an alternative measure of firm performance.

5. Conclusion and recommendations

This study empirically examines the moderating role of national governance quality on the relationship between corporate governance and firm performance, focusing on Ghanaian listed companies. The sample consists of 31 firms for 10 years, from 2013 to 2022, aiming to investigate whether corporate governance practices influence firm performance in Ghana. The specific impact of national governance quality as a moderator on this relationship remains uncertain. The study makes a new contribution to the field of finance by looking at how the quality of national governance and institutional frameworks affects the link between good corporate governance and firm performance in Ghana. It does this by using analytical evidence from institutional theory and agency theory. Moreover, the study introduces a new index for national governance quality and corporate governance using principal component analysis (PCA).

The corporate governance structure in emerging markets such as Ghana, where family members and politically exposed persons largely own and monitor firms, differs from established markets. This context gives rise to significant agency problems between marginal investors and the governing family. To address this gap, this study aims to shed light on the subject. The study reveals significant findings regarding the impact of corporate governance on firm performance in Ghana. The study concludes that an adverse relationship exists between corporate governance and firm performance. This supports the null hypothesis (H0) and contradicts the canons of agency theory. However, the research concludes that compliance with national governance and institutional frameworks significantly affects the relationship between corporate governance and performance. This aligns with the tenets of institutional theory and further supports the alternative hypothesis (H1). The result implies that improvements in a country’s government efficiency can enhance corporate governance practices, leading to improved firm performance. These results align with previous literature on corporate governance and firm performance. These results remain robust when alternative proxies of firm performance are employed.

The recognition that the impact of corporate governance practices on firm performance is contingent on the broader institutional environment has various policy implications across different timeframes. In the short term, policymakers should concentrate on improving corporate governance frameworks through the implementation and enforcement of regulations that foster transparency, accountability, and ethical conduct in corporate activities. These initiatives can establish a conducive environment for the effective implementation of corporate governance practices. In the medium term, policymakers should prioritise enhancing the quality of institutions, encompassing legal and regulatory frameworks, mechanisms for contract enforcement, and protection of property rights. By doing so, they can contribute to the development of a more stable and predictable business environment, which, in turn, supports the effectiveness of corporate governance practices. Looking ahead to the long term, policymakers need to engage in comprehensive institutional reforms aimed at addressing systemic barriers that impede effective corporate governance. These reforms may involve changes in areas such as corporate insolvency laws, shareholder rights, and the independence of boards. By implementing such reforms, policymakers can foster a culture of good governance and create an enabling environment for sustainable firm performance.

The long period covered in this study allows for the examination of major events such as pandemics and the introduction of the first corporate governance code. However, it is important to note that this study analyses data from a single developing country. Nevertheless, considering cultural and legal variations, the results may have implications for other developing economies. Future research could extend the analysis to an international sample encompassing multiple countries to explore the impact of specific corporate governance mechanisms on firm performance. Additionally, further investigation is invited to explore the bi-directional relationship between corporate governance and firm performance.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Data availability statement

Data for the study is obtained from publicly available sources and can also be made available upon request.

Additional information

Notes on contributors

Isaac Luke Agonbire Atugeba

Isaac Luke Agonbire Atugeba holds a BSc and MPhil degrees in computerized accounting and industrial finance from Kumasi Technical University and KNUST, respectively. He is currently a PhD candidate at the Accra Institute of Technology/Open University of Malaysia. His background is largely in accounting and finance, with an interest in econometrics. He is also a lecturer at Bolgatanga Technical University, Ghana. His research interests are in corporate governance, sustainability accounting and reporting, financial reporting, national governance systems, and accounting education in general.

Emmanuel Acquah-Sam

Emmanuel Acquah-Sam (PhD) is a senior lecturer and the Dean of the Faculty of Humanities and Social Sciences at Wisconsin International University College, Ghana. He holds a PhD in Business Administration, an MPhil in Economics, and a B.A. in Economics. He also has certificates in economics and finance-related courses. His research and teaching interests are in economics and finance.

References

- Acheampong, J., Baidoo, P., & Somuah, C. O. (2023). The influence of values, beliefs, and norms on succession planning and organizational culture: An investigation of their role in long-term success and survival. Archives of the Social Sciences: A Journal of Collaborative Memory, 1(1), 67–77.

- Adegbite, G. (2012). Corporate governance developments in Ghana: The past, the present, and the future. Public and Municipal Finance, 1(2), 38–49.

- Adusei, M. (2012). Determinants of bank board structure in Ghana. The International Journal of Business and Finance Research, 6(1), 15–23.

- African’Xchanges. (2023). https://afx.kwayisi.org/gse/

- Alabdullah, T. T. Y., Yahya, S., & Ramayah, T. (2014). Corporate governance mechanisms and Jordanian companies’ financial performance. Asian Social Science, 10(22), 247–262. https://doi.org/10.5539/ass.v10n22p247

- Antwi, I. F., Carvalho, C., & Carmo, C. (2022). Corporate governance research in Ghana through the bibliometric method: A review of existing literature. Cogent Business & Management, 9(1), 2088457. https://doi.org/10.1080/23311975.2022.2088457

- Aqib, M., & Zaman, K. (2023). Greening the workforce: The power of investing in human capital. Archives of the Social Sciences: A Journal of Collaborative Memory, 1(1), 31–51.

- Areneke, G. N. (2018). Comparative study of the impact of compliance with corporate governance regulations & internal governance mechanisms on the financial performance of listed firms in Africa. [Ph.D. thesis]. The Open University.

- Asiedu, M. A., & Mensah, E. (2023). Re-examining the corporate governance-firm performance nexus: Fresh evidence from a causal mediation analysis. Cogent Economics & Finance, 11(1), 2223414. https://doi.org/10.1080/23322039.2023.2223414

- Ayoungman, F. Z., Shawon, A. H., Ahmed, R. R., Khan, M. K., & Islam, M. S. (2023). Exploring the economic impact of institutional entrepreneurship, social innovation, and poverty reduction on carbon footprint in BRICS countries: What is the role of social enterprise? Environmental Science and Pollution Research International, 30(58), 122791–122807. https://doi.org/10.1007/s11356-023-30868-z

- Banahene, K. O. (2018). Ghana banking system failure: The need for restoration of public trust and confidence. International Journal of Business and Social Research, 8(10), 1–5.

- Bello, M. S., Said, R. M., Johari, J., & Kamarudin, F. (2020). Moderating role of corruption control on firm-level determinants of corporate sustainability disclosure compliance in Nigeria. Studies of Applied Economics, 39(4), 1–14.

- Beyaztas, B. H., & Bandyopadhyay, S. (2022). Data driven robust estimation methods for fixed effects panel data models. Journal of Statistical Computation and Simulation, 92(7), 1401–1425. https://doi.org/10.1080/00949655.2021.1996576

- Chatterjee, S., & Hadi, A. S. (2012). Regression analysis by example. John Wiley & Sons.

- Coleman, M., & Wu, M. (2021). Corporate governance mechanisms and the corporate performance of firms in Nigeria and Ghana. International Journal of Productivity and Performance Management, 70(8), 2319–2351. https://doi.org/10.1108/IJPPM-01-2020-0020

- Draper, N. R., & Smith, H. (1998). Applied regression analysis (3rd ed.). Wiley Interscience Publication, United States.

- Elnahass, M., Salama, A., & Yusuf, N. (2022). Earnings management and internal governance mechanisms: The role of religiosity. Research in International Business and Finance, 59, 101565. https://doi.org/10.1016/j.ribaf.2021.101565

- Fauzi, F., & Locke, S. (2012). Board structure, ownership structure, and firm performance: A study of New Zealand listed firms. Asian Academy of Management Journal of Accounting and Finance, 8(2), 43–67.

- Gitundu, E. W., Kiprop, S. K., Kibet, L. K., & Kisaka, S. E. (2016). Corporate governance and financial performance: A literature review of measurements and econometric methods of data analysis in research. Research Journal of Finance and Accounting, 7(14), 116–125.

- Hampel, F. R. (1992). Introduction to Huber (1964). Robust Estimation of a Location Parameter, 2(3), 479–491. https://doi.org/10.1007/978-1-4612-4380-9_34

- Han, Y., Bao, M., Niu, Y., & Rehman, J. (2024). Driving towards net zero emissions: The role of natural resources, government debt and political stability. Resources Policy, 88, 104479. https://doi.org/10.1016/j.resourpol.2023.104479

- Huber, P. J. (1964). Robust estimation of a location parameter. The Annals of Mathematical Statistics, 35(1), 73–101. https://doi.org/10.1214/aoms/1177703732

- Jensen, M. C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. The Journal of Finance, 48(3), 831–880. https://doi.org/10.1111/j.1540-6261.1993.tb04022.x

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behaviour, agency costs, and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

- Kapil, S., & Mishra, R. (2019). Corporate governance and firm performance in emerging markets: Evidence from India. Theoretical Economics Letters, 09(06), 2033–2069. https://doi.org/10.4236/tel.2019.96129

- Kaufmann, D., Kraay, A., & Mastruzzi, M. (2010). The worldwide governance indicators: Methodology and analytical issues. World Bank Policy Research Working Paper, (5430), 1–18.

- Khan, E. U. (2023). The Post-Brexit paradigm: Investigating the effects of foreign direct investment on economic growth in the United Kingdom. Archives of the Social Sciences: A Journal of Collaborative Memory, 2(1), 94–110.

- Khan, M. (2023a). Shifting gender roles in society and the workplace: Implications for environmental sustainability. Politica, 1(1), 9–25.

- La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (1999). Corporate ownership around the world. The Journal of Finance, 54(2), 471–517. https://doi.org/10.1111/0022-1082.00115

- Ledi, K. K., & Ameza-Xemalordzo, E. (2023). Rippling effect of corporate governance and corporate social responsibility synergy on firm performance: The mediating role of corporate image. Cogent Business & Management, 10(2), 2210353. https://doi.org/10.1080/23311975.2023.2210353

- Lu, J., & Wang, J. (2021). Corporate governance, law, culture, environmental performance, and CSR disclosure: A global perspective. Journal of International Financial Markets, Institutions & Money, 70, 1–20.

- Maama, H. (2021). Achieving financial sustainability in Ghana’s banking sector: Is environmental, social and governance reporting contributive? Global Business Review, 0(0). https://doi.org/10.1177/09721509211044300

- Mauro, P. (1995). Corruption and growth. The Quarterly Journal of Economics, 110(3), 681–712. https://doi.org/10.2307/2946696

- Mertzanis, C., Mohamed, A. K. B., & Mohamed, E. K. A. (2019). Social institutions, corporate governance and firm performance in the MENA region. Research in International Business and Finance, 48(1), 75–96. https://doi.org/10.1016/j.ribaf.2018.12.005

- Morrison, T. S. (2021). Comparing various robust estimation techniques in regression analysis. [Master’s thesis]. Mankato, Minnesota State University. Cornerstone: A Collection of Scholarly and Creative Works for Minnesota State University. https://cornerstone.lib.mnsu.edu/etds/1179

- Muthusi, D. M., (2017). Internal controls and financial performance of commercial banks in Kenya, Unpublished Master’s Thesis, Kenyatta University, Kenya.

- Nabi, A. A., Asghar, M., Ayub, F., Tunio, F. H., Soho, N. U., & Ahad, M. (2023). Work-life synergy: Examining commitment’s role in fostering well-being amidst competing demands. Archives of the Social Sciences: A Journal of Collaborative Memory, 2(1), 111–120.

- Nasrallah, N., & El Khoury, R. (2021). Is corporate governance a good predictor of SMEs financial performance? Evidence from developing countries (the case of Lebanon). Journal of Sustainable Finance & Investment, 12(1), 13–43. https://doi.org/10.1080/20430795.2021.1874213

- Navarro, M. C. A., & Urquiza, F. B. (2015). Board of directors’ characteristics and forward-looking information disclosure strategies [Paper presentation]. Paper Presented at the EEA Annual Congress, Glasgow.

- Nazir, U. (2023). The winds of change are blowing: Globalization’s impact on renewable energy and environmental challenges. Archives of the Social Sciences: A Journal of Collaborative Memory, 2(1), 78–93.

- Nel, G., Scholtz, H., & Engelbrecht, W. (2020). Relationship between online corporate governance, transparency disclosures, and board composition: evidence from JSE listed companies. Journal of African Business, 23(2), 304–325. https://doi.org/10.1080/15228916.2020.1838831

- Neralla, N. G. (2021). Can corporate governance structure effect on corporate performance: An empirical investigation from Indian companies? International Journal of Disclosure and Governance, 19(3), 282–300. https://doi.org/10.1057/s41310-021-00135-z

- Nguyen, T., Nguyen, A., Nguyen, M., & Truong, T. (2021). Is national governance quality a key moderator of the boardroom gender diversity-firm performance relationship? International evidence from a multi-hierarchical analysis. International Review of Economics & Finance, 73, 370–390. https://doi.org/10.1016/j.iref.2021.01.013

- Ofoegbu, G. N., Odoemelam, N., & Okafor, R. G. (2018). Corporate board characteristics and environmental disclosure quantity: Evidence from South Africa (integrated reporting) and Nigeria (traditional reporting). Cogent Business & Management, 5(1), 1551510. https://doi.org/10.1080/23311975.2018.1551510

- Ojeka, S., Adegboye, A., Adegboye, K., Umukoro, O., Dahunsi, O., & Ozordi, E. (2019). Corruption perception, institutional quality and performance of listed companies in Nigeria. Heliyon, 5(10), e02569. https://doi.org/10.1016/j.heliyon.2019.e02569

- Raza, N., Rasheed, A., & Saeed, T. (2020). Corporate governance, national governance quality, and firm performance: A systematic review and bibliometric analysis. Journal of Business Research, 121, 402–411.

- Sackey, F. G., Yeboah, P. K., & Owusu, J. D. A. (2019). Impact of board structure on the performance of rural and community banks in the emerging economy context. Corporate Board Role Duties and Composition, 15(1), 33–42. https://doi.org/10.22495/cbv15i1art4

- Sarpong-Danquah, B., Gyimah, P., Afriyie, R. O., & Asiama, A. (2018). Corporate governance and firm performance: An empirical analysis of manufacturing listed firms in Ghana. Accounting and Finance Research, 7(3), 111–118. https://doi.org/10.5430/afr.v7n3p111

- Sarpong-Danquah, B., Oko-Bensa-Agyekum, K., & Opoku, E. (2022). Corporate governance and the performance of manufacturing firms in Ghana: Does ownership structure matter? Cogent Business & Management, 9(1), 2101323. https://doi.org/10.1080/23311975.2022.2101323

- Saunders, M., Lewis, P., & Thornhill, A. (2009). Research methods for business students, 5e, Pearson Education Limited, UK.

- Schmidheiny, K. (2013). Panel data: Fixed and random effects. Available at www.schmidheiny.name/teaching/panel2up.pdf

- Scott, W. R. (1995). Institutions and organizations: Ideas, interests, and identities. Sage Publications.

- Shahwan, T. M. (2015). The effects of corporate governance on financial performance and financial distress: Evidence from Egypt. Corporate Governance, 15(5), 641–662. https://doi.org/10.1108/CG-11-2014-0140

- Shahzad, F., Saeed, A., Asim, G. A., Qureshi, F., Rehman, I. U., & Qureshi, S. (2021). Political connections and firm performance: Further evidence using a generalized quantile regression approach. IIMB Management Review, 33(3), 205–213. https://doi.org/10.1016/j.iimb.2021.08.005

- Siddiqui, F., YuSheng, K., & Tajeddini, K. (2023). The role of corporate governance and reputation in the disclosure of corporate social responsibility and firm performance. Heliyon, 9(5), e16055. https://doi.org/10.1016/j.heliyon.2023.e16055

- Ssekiziyivu, B., Mwesigwa, R., Bananuka, J., & Namusobya, Z. (2018). Corporate governance practices in microfinance institutions: Evidence from Uganda. Cogent Business & Management, 5(1), 1488508. https://doi.org/10.1080/23311975.2018.1488508

- Sun, S. L., Mike, W. P., Ruby, P. L., & Weiqiang, T. (2015). Institutional open access at home and outward internationalization. Journal of World Business, 50(1), 234–246. https://doi.org/10.1016/j.jwb.2014.04.003

- Susanti, Y., Pratiwi, H., Sulistijowati, S., & Liana, H. T. (2014). M Estimation, S Estimation, and MM estimation in robust regression. International Journal of Pure and Applied Mathematics, 91(3), 349–360.

- Tarighi, H., Hosseiny, Z. N., Akbari, M., & Mohammadhosseini, E. (2023). The moderating effect of the COVID-19 pandemic on the relationship between corporate governance and firm performance. Journal of Risk and Financial Management, 16(7), 306. https://doi.org/10.3390/jrfm16070306

- Tessema, A. (2019). The impact of corporate governance and political connections on information asymmetry: International evidence from banks in the Gulf Cooperation Council member countries. Journal of International Accounting, Auditing and Taxation, 35, 1–17. https://doi.org/10.1016/j.intaccaudtax.2019.05.001

- Tornyeva, K., & Wereko, T. (2012). Corporate governance and firm performance: Evidence from the insurance sector of Ghana. European Journal of Business and Management, 4(13), 95–112.

- Wu, C. (2021). On the moderating effects of country governance on the relationships between corporate governance and firm performance. Journal of Risk and Financial Management, 14(3), 140. https://doi.org/10.3390/jrfm14030140

- Zattoni, A., Witt, M. A., Judge, W. Q., Talaulicar, T., Chen, J. J., Lewellyn, K., Hu, H. W., Gabrielsson, J., Rivas, J. L., Puffer, S., Shukla, D., Lopez, F., Adegbite, E., Fassin, Y., Yamak, S., Fainshmidt, S., & van Ees, H. (2017). Does board independence influence financial performance in IPO firms? The moderating role of the national business system. Journal of World Business, 52(5), 628–639. https://doi.org/10.1016/j.jwb.2017.04.002