Abstract

The development of new industries in peripheral regions has gained renewed attention recently. Yet, the processes through which peripheral regions can mobilize external resources and capabilities, and turn them into locally sticky resources for structural change and longer-term economic prosperity, have not been sufficiently conceptualized. This article proposes anchoring-based regional system building as a third route, which stands between conventional globalist and regionalist approaches. Based on a case study of the emergence of a globally leading electric vehicle battery industry in Ningde, China, the article explores in depth the system resource-mobilization processes and dynamic capabilities by anchor tenants and regional stakeholders that allow peripheral regions to make long jumps in the product space. We show that if the anchoring process is smartly managed, developing emerging industries in peripheral contexts is not necessarily a casino strategy but can be a strategic approach for quickly and deeply transforming the industrial fabric of regional economies.

In recent years, how regions can diversify or transform their industrial structures has regained attention in economic geography (Balland et al. Citation2019; Trippl et al. Citation2020; Boschma Citation2021). Developing new-to-the-world industries is seen as one of the key strategies for increasing regional competitive advantage over time (Balland et al. Citation2019; Hassink, Isaksen, and Trippl Citation2019; Gong et al. Citation2022a). Yet, important gaps remain in our conceptual understanding of how peripheral regions can realize structural change and high-level economic development by leveraging the windows of locational opportunity opened by emerging industries (Boschma Citation1997; Gong et al. Citation2022a).

At a generic level, the literature provides two complementary analytical inroads for explaining industrial development in space: (1) regionalist models emphasizing endogenous diversification and path development processes (Frenken, Van Oort, and Verburg Citation2007; Martin Citation2010; Trippl et al. Citation2020; Boschma Citation2021) and (2) globalist models analyzing how embedding in global value chains (GVCs) or strategic coupling in global production networks (GPNs) induces economic development (Morrison, Pietrobelli, and Rabellotti Citation2008; MacKinnon et al. Citation2019; Yeung Citation2021a). While insightful, they both contain important gaps for analyzing how and where emerging industries initially develop (for exceptions, see Storper and Walker Citation1989; Boschma Citation1997), whether and how peripheral regions are able to attract and embed them, and how they can be used as a catalyst for sustained regional development (Breul, Hulke, and Kalvelage Citation2021).

Drawing on and complementing the insights from the regionalist and the globalist approaches, this article aims to conceptualize a third route of regional development, elaborating on the mechanisms that allow peripheral regions to build up the resources needed for attracting, anchoring, and scaling emerging industries. We call this development trajectory anchoring-based regional development. While prior literature has outlined the contours of this development model (e.g., Binz, Truffer, and Coenen Citation2016; Jeannerat and Crevoisier Citation2016), our understanding of the system-building processes and dynamic capabilities that enable this particular development trajectory is still scant.

The remainder of the article is organized as follows: The first section reviews the regionalist and globalist perspectives on regional economic development and outlines the dual development challenge of emerging industries. The second section suggests a conceptual framework for the anchoring-based regional development route developed in the article. The methodology section motivates the case selection and research methods, while the empirical section uses the emergence of the electric vehicle (EV) battery and related industries in Ningde, China, as a case in point for illustrating and validating our conceptual framework. The discussion section derives the key system-building processes and dynamic capabilities that enable anchoring-based regional development. The concluding section outlines our framework’s novel contributions to economic geography and regional studies.

Global–Local Industrial Dynamics and the Development of Emerging Industries in Regions

In economic geography and regional studies, the foundations of regional economic development are addressed from two distinct theoretical vantage points, that is, a regionalist versus globalist perspective (Yeung Citation2021a; Boschma Citation2022).

Regional Economic Development: The Globalist and Regionalist Position

The regionalist approach explains innovation-based regional development by the availability of specific regional assets or resources such as industrial capabilities, comparative institutional advantages, or innovation support structures. Evolutionary economic geography (EEG) as a typical regionalist approach highlights the importance of preexisting industrial capabilities in a region for successful diversification (Neffke, Henning, and Boschma Citation2011; Boschma Citation2017; Xiao, Boschma, and Andersson Citation2018). Another strand, the regional industrial path development literature, emphasizes the importance of systemic factors such as institutional arrangements and innovation system structures as well as agentic processes shaping regional development trajectories (Martin Citation2010; Hassink, Isaksen, and Trippl Citation2019; Trippl et al. Citation2020). Differences notwithstanding, regionalist approaches share an inside-out perspective on regional economic development and have only more recently started exploring the role of external linkages (Boschma et al. Citation2017; Isaksen and Trippl Citation2017; Trippl, Grillitsch, and Isaksen Citation2018) or the interplay of local assets and extraregional networks (Bathelt, Malmberg, and Maskell Citation2004; Heiberg, Binz, and Truffer Citation2020; Boschma Citation2022).

The globalist approach, in contrast, is based on an outside-in logic that starts from the strategic considerations of global lead firms, and investigates how regions may get embedded in GVCs/GPNs and adapt their local assets and institutional conditions to those global actors in order to climb the capability ladder (Henderson et al. Citation2002; Coe and Yeung Citation2015). GPN literature often uses the concept of strategic coupling to capture the relationship between a region’s economic development and its embeddedness in each GPN (MacKinnon Citation2012; Yeung Citation2021a; Fu and Lim Citation2022). In more recent GPN 2.0 theorizing, Coe and Yeung (Citation2015) differentiate various types of strategic coupling based on regional preconditions in emerging GPNs. For core regions, strategic coupling is usually indigenous with strong autonomy and control, and the coupling process is characterized by the rise of regional champions and global lead firms. In contrast, semiperipheral regions can only realize functional coupling with specific parts of GPNs. Finally, peripheral regions mostly engage in structural coupling by producing standardized mass products. In this conceptualization, peripheral regions are unlikely to realize indigenous coupling or quickly reach a leading position in an emerging GPN/GVC.

Recent scholarship has proposed combining the regionalist and globalist approaches to provide more capacious explanations of regional development processes (Yeung Citation2021b; Boschma Citation2022). Globalist scholars have begun to acknowledge the significance of the interplay of local and global dynamisms for regional path development (e.g., Dawley, MacKinnon, and Pollock Citation2019; MacKinnon et al. Citation2019; Yeung Citation2021b). Moreover, examples, such as the new Argonauts or returnee entrepreneurs (Saxenian Citation2006; Saxenian and Sabel Citation2008), have also convincingly demonstrated to regionalists that development may be strongly conditioned by extraregional forces.

While such convergences are promising, both approaches share a weakness in dealing with the question of whether and how emerging industries initially develop in peripheral regions, that is, how leapfrogging types of development or long jumps in the product-, knowledge-, or skill-space come about (Hidalgo et al. Citation2007; Zhu, He, and Zhou Citation2017). While the definitions of peripheral regions differ substantially in the literature, the connotation of periphery has recently been broadened substantially, ranging from a geographic to a functional perspective (Eder Citation2019; Pugh and Dubois Citation2021; Nilsen, Grillitsch, and Hauge Citation2022; Glückler, Shearmur, and Martinus Citation2023). In this article, we follow Glückler, Shearmur, and Martinus’s (Citation2023) relational conceptualization of periphery as a distant, dispersed, and disconnected position relative to the core of a field. While some research has explored the potential of peripheral regions in inducing slow, social, and non-R&D (research and development) types of innovations (e.g., Fitjar and Rodríguez-Pose Citation2011; Shearmur Citation2015), this article aims to unravel whether and how peripheral regions can develop radically new, innovative industries that are often expected to emerge only in core regions (i.e., the innovation despite periphery narrative [Glückler, Shearmur, and Martinus Citation2023]).

Emerging Industries and Their Dual Development Challenge

Emerging industries hold the potential to induce high added value as well as growth and transformative potentials (Ter Wal and Boschma Citation2011; Gong et al. Citation2022a). The ability to locate and develop emerging industries is accordingly seen as a critical success factor for a region's long-term prosperity and competitiveness (Ter Wal and Boschma Citation2011). Yet, only a few regions are able to do so due to the dual development challenge of emerging industries: to simultaneously develop regional support structures and industry-specific resources from scratch.

First, according to work on windows of locational opportunity (Walker and Storper Citation1989; Boschma Citation1997) and recent findings on the development of new-to-the-world industries (Boschma et al. Citation2017; Binz and Gong Citation2022), the regional support structures needed by emerging industries do not (or only partially) exist in any region. In the industry’s nascent phase, all regions thus must actively construct or adapt their innovation support structures in a way that becomes attractive for the emerging industry (Walker and Storper Citation1989; Boschma Citation1997).

Second, in this early phase, the industry-specific resources required by an emerging industry often develop in dispersed networks (Binz and Truffer Citation2017; Boschma et al. Citation2017). Emerging industries often start from small or midsized start-ups, which experiment with disruptive technologies with the relevant innovation processes being spread among various places around the world (Binz and Gong Citation2022). Entrepreneurs in the emerging industry thus need to actively search for attractive market contexts, leading R&D hubs, or supportive institutional arrangements. As dominant technological trajectories and product designs have not yet formed, it is very difficult for regional stakeholders to foresee what types of knowledge, technological capabilities, (niche) markets, or investment models could most effectively attract and support emerging firms (Yap and Truffer Citation2019).

This points to a key conundrum for existing theoretical vantage points in explaining how emerging industries develop in peripheral regions. The regionalist approach relegates peripheral regions to a slow development process in which they have to gradually build up absorptive capacity and endogenously diversify their way out of a structurally unfavorable initial position (Hidalgo et al. Citation2007; Doloreux and Dionne Citation2008; Balland et al. Citation2019). In particular, the quantitative EEG literature discourages them from attempting to make large jumps in the knowledge space, since leapfrogging into more complex industries that are far from current knowledge pools and capabilities is coined a highly risky casino strategy (Balland et al. Citation2019).

The globalist approach, in turn, advocates peripheral regions to get embedded in GVCs or to strategically couple to global lead firms in preexisting GPNs. This strategy is hardly available in emerging industries because they lack clearly defined lead firms and well-established GVC/GPN structures (Gong et al. Citation2022b). Though GPN 2.0 studies have begun to distill the formation process of GPNs instead of taking a GPN as given (Yeung and Coe Citation2015; Yeung Citation2016), they still posit that indigenous coupling is most likely to occur in core regions (Yeung Citation2021b). This approach thus gives peripheral regions little hope that they can quickly reach a leading position in emerging GPNs, since these regions are expected to only be able to realize structural coupling to rather standardized production activities (Yeung Citation2021b).

Toward an Anchoring-based Regional Development Model

Given this dual development challenge, and increasing evidence that unrelated diversification is an empirical reality in various sectors around the world (e.g., Binz and Anadon Citation2018; Carvalho and Vale Citation2018; Baumgartinger-Seiringer et al. Citation2022), it is necessary to further conceptualize a third route of regional development that stands in between the regionalist and globalist perspectives. Our conceptualization draws on the ability of anchor tenants and regional stakeholders to strategically build up critical resources for new-to-the-world industries through regional system-building that heavily draws on mobilizing and anchoring key resources from elsewhere. Furthermore, we will elaborate on the (dynamic) capabilities that are required by both parties to manage these processes in a deliberate way.

Outline of the Third Route—Local System-building and Anchoring Extraregional Resources

Our conceptual approach is first and foremost inspired by the regional studies literature on anchoring, that is, the attraction, harboring, or pegging of external resources (De Propris and Crevoisier Citation2011). Within economic geography, anchoring processes have first been conceptualized from a knowledge-based perspective (Feldman Citation2003; Crevoisier and Jeannerat Citation2009; Jeannerat and Crevoisier Citation2016), which has later been complemented with a systemic perspective (Vale and Carvalho Citation2013; Binz, Truffer, and Coenen Citation2016; Heiberg and Truffer Citation2022). The latter characterizes anchoring-based regional development as an iterative and reflexive process that depends on (1) the mobilization of local and extraregional system resources and (2) their conversion into spatially sticky innovation system structures and resources (Binz, Truffer, and Coenen Citation2016; Boschma et al. Citation2017).

In this literature, the interplay between various regional stakeholders and anchor tenants stands center stage. Anchor tenants are resourceful actors, such as firms, intermediary organizations, or universities, that enter a region from outside and whose presence creates significant spillovers by connecting regional stakeholders to innovation processes happening elsewhere (Feldman Citation2003; Binz, Truffer, and Coenen Citation2016). For example, a company can be a strong anchor tenant, bringing in knowledge, funding, and other strategic resources that are not available in a region. The company can disseminate knowledge in the region by working with local universities and suppliers, and interacting with service providers and government agencies. This literature provides very relevant underpinnings to conceptualize our third route of regional development. At the same time, it has not ventured deeply into conceptualizing the mechanisms and processes that enable system- and resource-building. Moreover, little has been said about what kind of (dynamic) capabilities enable anchor tenants and regional stakeholders to jointly navigate complex resource build-up and anchoring processes.

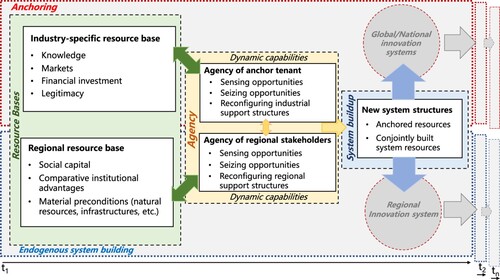

Against this backdrop, the third route to regional development aims at creating an explicit process-oriented understanding of regional development trajectories (Shi and Shi Citation2022). Such a process-oriented perspective is particularly relevant for emerging industries developing in peripheral regions, where relevant resources are not preexisting but have to be proactively built up in dynamic, long-term, and multiscalar system-building processes. outlines the key tenets of our conceptual framework. We posit that anchoring processes move through different cycles of development. Each cycle or development phase starts from a region’s preexisting system resource base (green box in ). We here distinguish analytically between the place-specific and territorially embedded regional resource base (e.g., social capital, comparative institutional advantages, material preconditions) and the industry-specific system resources (knowledge, market access, financial investment, and legitimacy), which typically are developing in and accessible in multiscalar/multilocational industry structures (see also Heiberg, Binz, and Truffer Citation2020; Heiberg and Truffer Citation2022).

Regional stakeholders and anchor tenants may mobilize these resource stocks through strategic and distributed agency aimed at improving the regional and industry-specific support structures and system resources (Garud and Karnøe Citation2003; Boschma et al. Citation2017). At the end of each development cycle, new regional and national/global innovation system structuresFootnote1 will have emerged, and a new stock of innovation system resources will be available to propel the industrial path development process forward. This iterative and nonlinear process requires actors to continually anticipate, probe into, and invest in different future industrial development options. In order to specify the required competencies of anchor tenants and regional stakeholders, we leverage the concept of dynamic capability (DC), which is well established in the business management literature (Teece, Pisano, and Shuen Citation1997; Wang, Klein and Jiang Citation2007), and adapt it to the level of actors in regional contexts (e.g., anchor tenants and regional stakeholders).

Dynamic Capabilities at the Regional Level

DCs contribute to regional development in important ways (Laasonen and Kolehmainen Citation2017; Labory and Bianchi Citation2021; Lassonen Citation2023). DCs enable an organization to integrate, build, and reconfigure internal and external resources to address rapidly changing contexts (Teece, Pisano, and Shuen Citation1997). To develop emerging industries in regions, both firms and nonfirm actors need to develop DCs (Labory and Bianchi Citation2021; Lassonen Citation2023). This concept aligns well with recent calls in economic geography to focus more explicitly on different types of agency in regional industrial path development (Isaksen et al. Citation2019; Grillitsch and Sotarauta Citation2020; Trippl et al. Citation2020; Sotarauta and Grillitsch Citation2023). However, compared to these rather static typologies, the DC literature focuses on the specific processes through which agency gets mobilized (Shi and Shi Citation2022) as well as on how dynamic capabilities contribute to successful innovation and transformation trajectories (Teece, Pisano, and Shuen Citation1997).

Following Teece’s (Citation2007) original work, we argue that three types of DC have to be leveraged both by regional stakeholders and the anchor tenants in order to successfully navigate an anchoring trajectory (orange box in ): sensing, seizing, and reconfiguring. In the original literature (e.g., Teece Citation2007), sensing relates to the discovery and creation of opportunities (or threats) through scanning and monitoring organizational and environmental dynamics, and to the assessment of existing or latent opportunities. Seizing refers to the capability of actors to probe into such future opportunities through experimenting with new, sometimes even disruptive products, processes, services, or institutional arrangements. Finally, reconfiguring relates to actors’ capabilities to continuously reform their tangible and intangible resource base in order to include these new options in their core business.

When transposing DCs to the regional level, these three types have to be reinterpreted as follows. First, regional stakeholders and anchor tenants have to engage in sensing in order to scout and identify promising development trajectories of the emerging industry. This may require various forms of foresight, visioning, scanning for external windows of opportunity, and identification of strategic alternatives. It also encompasses identifying extraregional networks that can be activated to provide key resources not available in the region itself. Second, seizing at the regional level relates to experimental activities with strategic alternatives while constantly evaluating how likely certain product variants, business models, and institutional support structures are to induce sustained industrial development dynamics. Seizing also includes tapping into exogenous windows of opportunity that open through, for example, national policy shifts, the reshaping of market structures, or technological breakthroughs. Finally, reconfiguring means that if the experimental activities proved successful, substantial investments to support the scaling, maturation, and diversification of the emerging industry and its support structures will be needed. Often, this implies adapting regulative frameworks, making major investments into local labor markets, educational and research infrastructures, as well as measures that facilitate access to global knowledge networks, markets, or investors.

DCs at the regional level are more than just the sum of the capabilities of otherwise isolated actors. Regions typically encompass a broad range of organizations, which have more or less developed stocks of internal DCs (Labory and Bianchi Citation2021). In order to be successful in an anchoring-based development model, mediation, coordination and aggregation of expectations, and resource buildup strategies among the different actors are crucial. In emerging industries, where uncertainties are very high and standards are not yet existent, a coordinated and somewhat strategic approach is particularly important to outcompete other regions with similar ambitions.

A second specification is that we expect the concrete content and forms of DC to vary over the course of an anchoring process as the challenges, resource endowments, and strategic priorities of actors change across different phases of development. In each phase, specific development challenges need to be tackled before being able to move to the next level. The exact delimitation of a development phase depends on the initial state of the resource endowment of the actors, externally provided opportunities for scaling the emerging industry, and the quality of dynamic capabilities in the region. At the completion of every system-building and resource-mobilization cycle (t1, t2, tn in ), inflection points may occur, which offer alternative further development trajectories.

In a most optimistic scenario, the industry formation process will move from one stage to the next in a virtuous cumulative causation pattern (Gong and Binz Citation2023). In general, however, the process may as well stagnate in specific development stages or even dissolve in a vicious cycle, for instance, when the anchor tenant decides to move to another region. We do accordingly not argue that coordinated deployment of DCs guarantees successful anchoring-based industrial development. We rather posit that successful anchoring necessitates a commitment of regional stakeholders and anchor tenants to conjointly and strategically invest in the regional resource base while trying to proactively deal with and leverage external opportunities and resources. This proposes a more proactive perspective on unrelated diversification strategies than a casino strategy that is blindly betting on serendipity (Balland et al. Citation2019). To further illustrate and validate our framework we will now juxtapose it with an emblematic empirical case study, the surprising emergence of the EV-battery industry in Ningde, China.

Case Selection and Research Methods

The case chosen here is the EV lithium-ion battery and related industries in Ningde, China, which provides an instructive example of an industrial path development process that occurred in a highly unlikely regional context. The EV battery industry is a quickly emerging industry that started taking off in the early 2010s. The industry is characterized by a long and complex technological value chain, ranging from upstream supply of raw materials to midstream production of components and cells to downstream EV application and postlife battery management (Gong and Andersen Citation2022). Today, lithium phosphate (LFP) or lithium nickel cobalt manganate aluminate (NCM/NCA) batteries are the main types used in most EVs, but technological competition between different chemistries remains fierce.

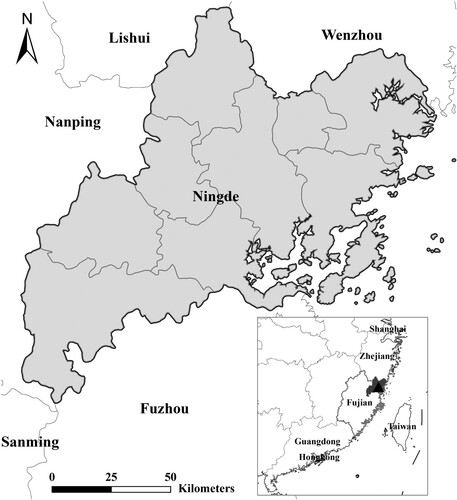

Ningde is a prefecture-level city in Fujian province () and has long been labeled an economic lowland on the southeast coast of China (Xu Citation2020). This was due to its mountainous terrain, poor transportation infrastructure, weak industrial base, and the political constraints imposed by its location on China’s defense front in the Taiwan Strait. Before 2010, Ningde’s gross domestic production (GDP) ranked last among the nine prefecture-level cities in Fujian, and its GDP per capita was far below the provincial and national average (see Appendix 1). For a long time, Ningde specialized in low value-added economic activities such as fishing, tea production, and basic electrical machinery manufacturing. It was thus a typical dual-periphery region, both in terms of geographic location and industrial networks (Glückler, Shearmur, and Martinus Citation2023).

Ningde’s dramatic economic development started in 2008 when the city successfully attracted one of China’s biggest battery producers, ATL, which soon spun off a specialized EV battery manufacturer, CATL. Related upstream (e.g., raw material producers) and downstream (e.g., EV manufacturers, recycling) firms were subsequently attracted to the city, quickly transforming Ningde into a leading global hub for the lithium-ion battery industry. Thanks to the strategic efforts of numerous stakeholders over more than a decade, Ningde is now diversifying into EV-related industries like material and chemical industries or high-end copper and steel production. These industries form close relationships and positive feedback loops among each other and have thus transformed Ningde into a city region with a quickly maturing RIS (regional innovation system) with diversified and complex industrial capabilities.

Fieldwork was conducted in Ningde from January to August 2021, comprising thirty-six in-depth interviews with different actor groups, including enterprises (ET), government agencies (GV), local service companies (LS), local contractors (LC), and education institutions (ED) (Appendix 2). Questions asked included (1) how has the economy been developing in Ningde in the last two decades; (2) what were the key events and actors enabling this process; (3) what were the challenges and lessons learned during this process? In addition, secondary information from various sources was collected and triangulated with site visits to local museums, theme exhibitions, libraries, and government agencies.

For the data analysis, we combined interpretation-focused coding (what interviewees said and why) with presumption-focused coding (theory developing). When the interview transcripts were coded, we grouped together relevant themes into three phases of development. For each phase, we investigated the contextual factors, distributed agency of anchor tenants and local stakeholders, and examined the main system-building processes and changes to the resource bases. Thereafter, we analyzed how such dynamisms were related to the different types of DCs (i.e., sensing, seizing, and reconfiguring) and whether the forms and content of DCs changed over time. For our data coding schemes, we first conducted an open coding by labeling and highlighting activities, actors, and events related to the anchoring process. The outcome of that first step was a list of first-order primary codes, which were closely aligned with information in the transcripts. In the second stage, the primary codes were compared and merged into second-order codes. Finally, we merged the second-order codes into aggregated themes, which we triangulated with insights from secondary literature into a concise case narrative.

Through this process, three phases of Ningde’s anchoring and industrial development process were identified. The first phase (before 2012) featured active business attraction efforts of regional actors that led to the settlement of anchor tenants in Ningde. We accordingly called this phase Attraction and Settling of Anchor Tenant. The second phase (2012–17), which we labeled as Cluster Formation and Multiscalar Resource Mobilization, was characterized by the rapid formation of an EV battery cluster through proactive multiscalar resource mobilization. Finally, the third phase, which we labeled as Smart Diversification and Consolidation of Leadership Position, was characterized by increasing diversification of the region into related industries as well as the consolidation of the anchor tenant’s leadership position in the global EV industry.

Anchoring-based Regional Development in Ningde: A Three-phase Process

In the remainder of this section, we will examine in depth how the EV battery industry took hold in Ningde through a three-phase system resource-mobilization and anchoring process.

Phase 1: Attracting and Settling of Anchor Tenant (before 2012)

Ningde’s industrial development started from a rather humble position. After China’s reform and opening up, its neighboring cities (e.g., Fuzhou and Wenzhou) began to grow fast due to foreign investment and private township entrepreneurship. Ningde, in contrast, remained short of both external investment and local entrepreneurial culture (ET07, ET09, LS34), despite having a harbor with one of China’s best geographic conditions. The municipal government had long tried to develop a harbor economy but failed due to military concerns (close to Taiwan Strait), its hilly topography, and provincial-level planning that prioritized the development of other port cities (e.g., Fuzhou and Xiamen) (GV30).

From 1988 to 1990, Xi Jinping, who became the president of China in 2012, was dispatched to Ningde as the municipal Communist Party of China (CPC) secretary. He compared Ningde to a weak bird and suggested taking advantage of Ningde’s mountain and water resources to fly first (Xi Citation1992). For a long time, enriching the city through manufacturing industries remained an aspirational yet unattainable goal for local cadres and citizens (Jiaocheng CPCC [Chinese People's Political Consultative Conference] Committee Citation2004). It was not until 2009 that the city got connected to the national railway network. In 2010, Xi Jinping visited Ningde again and left an important message to the local cadres: “Now the conditions are in place, […] Ningde should accelerate the pace of economic and social development, initiate a few more big projects and produce a few more ‘golden babies’ (promising industries)” (Xu Citation2020, 259).

Beginning in the early 2000s, although Ningde government officials had no clear idea of which industries could potentially transform the region, they began proactively inviting Ningde-born entrepreneurs who had started promising businesses elsewhere to invest in their hometown (GV03). One of those targets was Robin Zeng, the cofounder of a leading consumer battery manufacturer, ATL. In 1999, Zeng and his colleagues quit TDK (a Japanese company) and established ATL with its major production and R&D center in Dongguan, a major industrial center in the Pearl River Delta. Subsequently, ATL licensed polymer lithium-ion battery patents from US Bell Labs and succeeded in solving the battery bulging problem for mass production, which enabled ATL to become the main supplier for many international smartphone brands such as Apple and Samsung. Due to the smartphone boom in the mid-2000s, ATL grew rapidly and sought a new location to build its third and largest factory.

Ningde’s government officials first contacted Zeng in 2004 and promised an attractive package of policy incentives, including land concessions, corporate tax rebates, assistance in recruiting workers, and improved transportation infrastructure (GV10, GV11). Despite Ningde’s unsatisfactory location and business environment, the low cost of land and the hometown attachment of ATL’s founders finally convinced the company to place its third factory in Ningde (ET21).

In this phase, Ningde’s system-building efforts were largely experimental. Local stakeholders were eager to bring in any promising industry regardless of their relatedness to the local industrial capabilities. They resorted to personal relations and propagating generic place-specific features (e.g., low land cost and deep harbor) to attract any potential anchor tenants willing to come to the region. The targets were single firms, even if they did not seem very promising in the beginning. Some officials admitted that the local government at first did not have strong faith in ATL (GV03, GV07). “At the beginning when this firm (ATL) came, people did not see it as a big deal. For small places like Ningde, no matter what kind of firms, they were welcome as long as they wished to come. The government also did not believe that a battery industry could revolutionize the local economy” (GV07).

In these early days, industry-specific resources, like financial investment, markets, and knowledge, were almost completely mobilized from outside the region. In particular, as the local labor market was underdeveloped, the anchor tenants had to recruit workers nationwide. ATL, for instance, recruited core skilled technicians from its headquarters in Dongguan (ET35). In terms of market, the batteries from ATL were widely applied in domestic and international electronics brands. Financially, in addition to the investments from headquarters (e.g., ATL from TDK Japan), ATL also received substantial amounts of public incentives from the Ningde government. Finally, the legitimacy granted by national top leaders for attracting promising industries also played an important role in channeling the flow of resources into the city.

Despite the city’s humble starting point and initially rather untargeted system-building efforts, early local validation was achieved by 2011 as ATL’s largest factory successfully went into production in Ningde and started providing tangible economic benefits. Between 2007 and 2011, Ningde’s annual growth rate of manufacturing industries’ value added reached more than 20 percent, and manufacturing activities accounted for almost half of Ningde’s GDP in 2011 (Ningde Government Citation2012). Although high expectations for future growth had not yet been induced among local policy makers and other key stakeholders, the newly introduced battery industry was increasingly recognized as a key job provider (GV07).

Phase 2: Cluster Formation and Multiscalar Resource Mobilization (2012–17)

In the 2010s, global concerns about climate change increasingly turned into a key policy theme. In China, this new policy context provided strong legitimacy for developing a domestic EV and battery industry, which was deemed a key strategic industry by the central government. China’s Ministry of Science and Technology and the Ministry of Finance issued the Notice on the Pilot Demonstration and Promotion of Energy-saving and New Energy Vehicles and initiated the Ten Cities, Thousand Vehicles 2009–2012 project to carry out the first large-scale experimentation with EVs in major Chinese cities (Gong and Hansen Citation2023). A large amount of public money was subsequently allocated to subsidizing the purchases of EVs, turning China into the world’s largest EV market in 2015. In the same year, the Ministry of Industry and Information Technology announced a battery whitelist, specifying that only EVs equipped with batteries specified in the whitelist were eligible to receive subsidies. No foreign battery producers were included in the list until 2019, which largely reserved the domestic market for Chinese battery manufacturers (Gong and Hansen Citation2023).

The global sustainability discourse and national policy push for EVs was swiftly seized by ATL’s leaders who were proactively seeking new market opportunities beyond electronic devices. Especially the strong subsidies for EV production and markets led to the birth of CATL in 2011, which spun off from ATL, established its headquarters in Ningde and specialized in high energy-density batteries for EVs. A key event that paved the road for CATL’s success in the EV battery market was the collaboration with BMW Brilliance to provide batteries for its first high-end EV model in 2012 (ET09), marking the first big order of the newly born company. After this successful collaboration, the company’s fame rose rapidly and from 2015 onward, CATL managed to establish close supply relationships with dominant EV makers both in China and overseas. By 2017, CATL not only overtook its Korean and Japanese competitors to become the world's largest EV battery manufacturer but also quickly closed the technology gap with global leaders such as Samsung and Panasonic (ET21).

To keep its fast-growing pace, CATL swiftly expanded its geographic reach and built global pipelines for various resources such as knowledge, finance, market, and raw materials. By 2017, CATL owned one subsidiary, twenty-three holding companies, and eleven affiliates located in China, France, Japan, the US, and Canada. Meanwhile, it strengthened its local roots and connections by establishing and expanding collaborations and partnerships with suppliers and vocational schools in Ningde (CATL Citation2018). Following closely the national subsidy policies for EVs, Ningde officials sensed that EV batteries were an opportunity for the region to capture more value added in high-end manufacturing. As a result, the local government prioritized resource supply (e.g., land) for CATL and developed strategies for building a full-fledged local battery cluster. As an official stated, “We used CATL as a signboard for business attraction and precisely invited nationwide investments from top-three companies along the value chain … if a cluster can be formed, we would be more resilient to market risks. Even if some firms fail, others would still survive” (GV03).

Building such a cluster was initially very challenging for Ningde given its rather poor industrial base—even specific screws needed to be shipped from other regions (GV03). Nevertheless, the existence of CATL compensated for this drawback and led to the continuous inflow of battery-related suppliers. When attracting suppliers, CATL promised to give priority orders to companies that agreed to move to Ningde, as the timely supply of raw materials from a short distance was important to maintain its rapidly expanding battery production and market competitiveness (ET02, ET21).

CATL’s loyalty to Ningde was also partly based on the support it received from the local government. In the early days, when CATL’s batteries were not yet known, the local government helped the firm in setting up business relationships with Fujian-based automobile enterprises (GV03). In addition, the local government used public procurement to facilitate demand for CATL’s batteries. In 2017, it also developed a supportive policy mix for battery-related firms, including favorable land acquisition, transportation, housing, education, and training conditions. A specialized Lithium-ion Battery Industry Development Office was established to coordinate activities related to battery production and innovation. With the joint efforts of the local government and CATL, Ningde successfully attracted thirty-eight companies along the battery value chain (GV03). The growing density of companies and supportive institutions in Ningde increasingly created positive externalities like dense customer-supplier relations or specialized local labor markets. By the end of 2017, more than one thousand highly skilled battery talents with master or doctoral degrees had been attracted to Ningde. The local government and companies even arranged dating activities and matchmaking events between immigrant engineers and local singles to keep these talents settled in Ningde (LC05).

The system-building effort in this phase focused on building up a nationally and internationally well-connected cluster for the emerging battery industry. For CATL, establishing a highly efficient and agile local supply network was pivotal to reaching a global leadership position (ET21). Therefore, CATL worked closely with local suppliers, resulting in strong regional knowledge spillovers. The local government helped facilitating this knowledge exchange, developing a high-skilled labor pool, and building a well-known city brand related to the growing battery industry (GV03, GV10). This interest alignment between regional stakeholders and CATL has crucially supported the formation of a dynamic industrial cluster and related supportive innovation system structures.

In this phase, mobilizing system resources from elsewhere was crucial. In terms of knowledge, in parallel to collaborating with national top universities and attracting research talents nationwide and worldwide (ET08, LS34), CATL also established its first overseas subsidiary in Munich, Germany, and used it to convey technology and market knowledge back into Ningde. CATL and ATL also invested strongly in in-house research and development. They both put increasing pressure on local suppliers to improve their innovation capabilities, so they could supply higher-performance and lower-cost battery materials (ET08). Most engineers and mid-level technicians were still recruited either from extraregional universities or poached from competing companies nationwide (ET06). Only around 20 percent of the blue-collar workers came from Ningde itself, while the rest was recruited from less-developed Western regions in China through labor outsourcing (LS34). CATL also began collaborating with local vocational schools to train more specialized technicians and workers (ED25, LS34). In terms of financing, as the EV industry was strategically prioritized by the central government, CATL could mobilize investments nationwide relatively easily (Bradsher and Forsythe Citation2021). In terms of market, CATL was not only able to attract orders from domestic auto brands, but it was also very successful in building up supply relationships with global brand names such as BMW. In terms of legitimacy, global concerns about the climate crisis as well as the national leadership’s strong push for EV adoption bolstered the confidence of both CATL and regional stakeholders to continue pushing the EV battery path.

By 2017, Ningde developed a frontrunner image in the global EV battery industry, and the value added of the battery industry reached $ 2.27 billion, accounting for 21percent of Ningde’s industrial output (Ningde Government Citation2018). Yet, the anchoring process also encountered some challenges. As many other cities were increasingly offering incentives to attract CATL, the firm reportedly threatened to leave Ningde in order to bargain for even better local support conditions (GV01, GV03, ED33). Regional stakeholders were also cautious about betting on a single horse, as the future prospect of CATL’s main technological pathway (NMC lithium-ion batteries) was highly uncertain (GV01, GV10). Regional stakeholders thus felt an urgent need to reconfigure the regional support structures and diversify the local economic structure with additional growth engines.

Phase 3: Smart Diversification and Consolidation of Leadership Position (2018–)

In 2020, China made a pledge to peak CO2 emissions by 2030 and to achieve carbon neutrality by 2060. Globally, the Dieselgate scandal, as well as the increasingly stringent regulations to phase out internal combustion engines created further legitimacy for electric cars and a global market boom for EVs. As a result, new players and incumbent automobile manufacturers entered the EV market, and many governments strived to attract EV industries as a new growth engine for local economies.

In 2018, CATL was listed on the Shenzhen stock exchange and directly became the most valuable unicorn in China. In particular, its stock shares were largely controlled by large national state-owned capitals (Bradsher and Forsythe Citation2021), which further strengthened the market’s faith in the company. In addition to consolidating its leading position domestically, it also identified further opportunities in the global EV market and started to induce strategic partnerships with additional global original equipment manufacturers like Tesla, BMW, and Daimler. In the last few years, it invested strongly in in-house innovation capabilities with its R&D expenditure reaching 6–7 percent of CATL’s annual revenues (Zeng Citation2022). In parallel, it collaborated with China’s top universities and built several provincial and national research centers (ET08). While maintaining its strength in EV batteries, CATL also invested in expanding its business to new areas covering businesses from raw materials to battery recycling, electric vessels, battery swapping, and energy storage. Externally, CATL established joint ventures with automobile manufacturers and built several gigafactories in China and abroad. By 2022, CATL was leading the global battery innovation race and announced several technological breakthroughs in product and process innovation (sodium-ion batteries, cell-to-pack technologies, etc.). In addition, the company managed to hold the world sales leader title for six consecutive years, and today one-third of electric cars sold worldwide is equipped with batteries from CATL (Zeng Citation2022).

For regional stakeholders, the issue of how to reduce the overdependency on CATL and the battery industry became a key concern in this phase. Even though Ningde is a peripheral city, “Our ambition is to develop Ningde into a Headquarter Economy, which features the concentration of intelligent, high value-added and low pollution activities” (GV03). Thus, a key priority for Ningde during this phase was attracting new anchor tenants in related, promising industries. A key success story was the arrival of SAIC, a major state-owned automotive company headquartered in Shanghai. In 2017, SAIC decided to build a new EV manufacturing base in Fujian province. The Ningde government quickly set up a specialized SAIC Program Office to compete for the SAIC project with tailored policy incentives. Ningde’s CPC secretary and Robin Zeng visited provincial leaders and the SAIC Group president several times to express strong interest in the project. The proximity to CATL plants and the strong commitment of regional stakeholders convinced SAIC to establish an EV export base in Ningde. Together with SAIC, the local government invested $3 billion in new infrastructure, including highway connections, railway lines, and port infrastructure. With this, more than thirty-one of SAIC’s main suppliers also came to settle in Ningde, forming a new EV industry cluster.

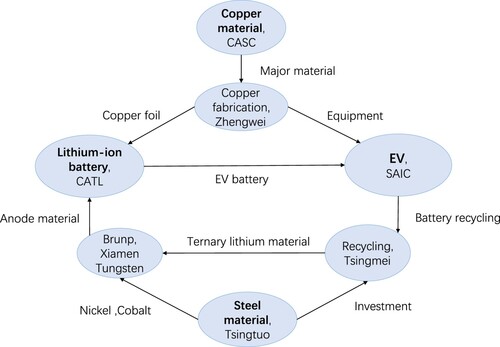

Largely in parallel, a high-end copper industry emerged in the region with the arrival of China Aluminum Southeast Copper (CASC) and Zhengwei Group in 2018, which began to supply high-quality copper products to CATL and SAIC. Tsingtuo,Footnote2 which is one of the largest steel companies in China, started to build local supplier connections by establishing a joint venture with GEM, one of China’s leading recyclers, to specialize in battery raw materials. By 2020, Ningde had diversified its economic structure by establishing four interrelated industries: (EV) batteries, EVs, steel, and copper production. These industries closely interact with each other (), and by 2020 jointly achieved an output accounting for 64.6 percent of Ningde’s industrial value added (GV03).

The dynamics of system-building in this phase qualitatively shifted to creating a strategic buildup of diversified regional support structures and cross-industry system resource bases. Local stakeholders continued to mobilize extraregional system resources, especially through now well-established innovation networks and market pipelines to other parts of the world. In terms of knowledge, firms in Ningde jointly built up one state key laboratory, nine provincial key laboratories, and forty-five provincial engineering and technology research centers. The number of state-level high-tech firms doubled between 2015 and 2020. To respond to the shortage of regional workers, the government established a new vocational education group. Most local lead firms collaborated with the included local vocational colleges and sponsored tailored courses (ED25, ED32). Workers were also trained on the job in Ningde-based factories as inflows of talent from other regions of China continued (ET29).

Meanwhile, the local government also quickly improved its institutional capacities in facilitating industrial development (GV01, GV03). The experiences gained through serving the battery industry and the SAIC project were institutionalized through a Special Project Office in Ningde’s Development and Reform Commission, which aims to further coordinate big investment projects in the city (GV23). Other regional stakeholders and intermediaries also strived to create a more efficient and business-friendly environment. Overall, Ningde has managed to build a more diversified and institutionally thicker innovation system that benefits the newly introduced, higher-value-added industries.

However, some key challenges still remain. As an official stated, “Now the problem is no longer that we are unable to attract new firms, but that we have no land to host them” (GV03).

Similarly, relying on extraregional and mobile labor is increasingly costly to many firms, as trained workers are often drawn to lead firms’ high salaries, which makes the local competition for skilled labor even fiercer. Meanwhile, the vast investment in infrastructure has caused a huge financial burden on the local government, which has delayed some return of taxes that were promised when attracting firms (ET29). Nevertheless, most interviewees firmly believe that Ningde is on the right track to a prosperous future.

Discussion

We will now abstract and synthesize key insights from our case study into a more general model of how peripheral regions can beat the casino through an anchoring-based regional development strategy. First, we will synthesize how the relevant system-building and resource-mobilization dynamics evolved through the three development phases. Second, we will explicate how the dynamic capabilities of anchor tenants and regional stakeholders propelled the anchoring process forward.

System-building and Resource Dynamics throughout the Three Development Phases

The first phase is characterized by the attraction and retention of external anchor tenant(s). In Ningde, the local government played a key role both in proactively brokering initial connections with extraregional firms and establishing attractive conditions for their move to Ningde. ATL’s decision to locate in Ningde was linked to a complex mix of generic, place-specific resources, attractive policy incentives by the local government, and a certain home bias (Nilsen Citation2017; Fredin, Miörner, and Jogmark Citation2019) by its founders. Local stakeholders were eager to bring in promising industries, and ATL worked closely with them to establish early supplier networks. This first phase was successfully concluded when the battery industry in the region reached some local validation through the first commercial successes in terms of tax revenues and employment opportunities. This achievement marked the first inflection point in the regional development trajectory, where the lack of a tangible success story or the bankruptcy of ATL would have led to a quick dissolution or reversal of the new development path.

In the second phase, the focus of the anchor tenant and regional stakeholders shifted to establishing an (inter)nationally highly networked cluster for the battery industry. This process was strongly based on mobilizing extraregional system resources to improve the patchy regional resource base. ATL and later CATL showed a strong motivation to connect their extraregional networks with local networks, to shorten distances to suppliers, and to establish codependencies with local firms. Regional stakeholders, in turn, actively built up support structures for the anchor tenant and its suppliers and facilitated exchanges with extraregional suppliers, markets, workers, and educational institutions. The growing regional cluster increasingly created nontraded interdependencies in its internal networks, customer-supplier relations, and specialized labor markets. These regional dynamics were largely interdependent with the mobilization of system resources from elsewhere, for example, by inducing labor mobility from other parts of China, mobilizing financial investment from major national investors, or developing R&D centers in leading car manufacturing regions overseas.

A second key inflection point was reached when a stable regional cluster was created for the EV battery industry, which increasingly provided spatially sticky and globally unique system resources for local actors. Once Ningde had developed a frontrunner image in the global EV battery industry, it could step up its ambition to attract external suppliers, service providers, and talent eager to profit from the local momentum. At the end of the second development stage, this momentum could however still have been disrupted relatively easily, for example, with CATL being attracted to another region, national support policies for EVs changing, sudden shifts in the industry’s dominant technological trajectory, or if regional stakeholders had proven unable to keep up with CATL’s quickly expanding and changing support needs.

The third phase was focused on diversifying the regional development trajectory in order to increase the region’s long-term economic resilience. The observed developments started resembling a conventional smart specialization trajectory aimed at developing a portfolio of interrelated high-complexity industries. Regional actor networks and extraregional linkages had to be transformed yet again in ways that accommodated new industries entering the region, further increasing the value added that was retained in the region.

In this phase, managing the strategic directionality of multiple coevolving industries thus moved center stage. Regional stakeholders managed to build up an increasingly diversified and mature RIS structure fit for this task, which offered innovation support structures for various related industrial activities (Zhu, Guo, and He Citation2021). Yet, potential inflection points persist also in this last phase. They relate, for example, to the lack of space and auxiliary infrastructures for further industrial expansion and diversification, potential major shifts in the EV (battery) industry’s dominant designs, or increasing competition from other regions developing similar industrial paths ().

Table 1 System-building, Resource Formation, and Key Inflection Points over the Three Development Phases of the Emerging EV Battery Industry in Ningde

Dynamic Capabilities Driving the Anchoring-based Regional Development Process

Based on the above elaborations, the key development challenges and DCs that anchor tenants and regional stakeholders had to develop and employ to propel the development process forward can be further specified (). The DCs in are directly derived from our empirical case, but formulated in generic terms to allow for deeper scrutiny and validation in future empirical work.

Table 2 Key Development Challenges and Dynamic Capabilities in Anchoring-based Regional Development

The key development challenge in the first phase is managing the high levels of uncertainty that exist when trying to develop and locate an emerging industry. As the anchor tenant’s activities are both new to the region and to the world, no template exists on how a supportive regional environment could best be created. Anchor tenants and regional stakeholders thus both have to engage in experimentation and interactive learning about what business/institutional models work and how their diffusion may best be supported. In this context, both actor types need particularly sophisticated sensing capabilities. Anchor tenants need to proactively and continuously scope for promising business opportunities and look for regions that offer promising support structures for tackling them. In the specific case of ATL, its founders were proactively exploring new applications for lithium-ion batteries beyond the consumer electronics market and identified Ningde as a promising location for further experimentation due to the attractive conditions provided by regional stakeholders. ATL then managed to seize the opportunities provided by Ningde (cheap land and labor, tax benefits, etc.) through establishing a local factory and reconfiguring its internal and external organizational structures in ways to create joint system resources with regional stakeholders.

At the level of regional stakeholders, key DCs in this first phase revolved around developing capabilities for proactively searching for promising anchor tenants from outside the region (sensing). Most peripheral regions struggle with developing these capabilities as searching for anchor tenants depends on the buildup of considerable social capital and extraregional networks, which takes time and money, often with uncertain success. To seize the opportunities of an anchor tenant moving into the region, regional stakeholders furthermore needed to employ a multidimensional approach for creating an attractive initial environment, including financial, infrastructural, and personal incentives. Finally, as shown in the empirical case, Ningde’s rather generic regional support structures in this first phase needed to be actively reconfigured to provide the most attractive fit to the anchor tenant’s needs.

In this first phase, coordination between anchor tenant regional stakeholders was still happening on a rather ad hoc basis, driven by both actors’ self-interest. Since the peripheral region was in a rather disadvantaged position, the interrelationship between the anchor tenant and regional stakeholders could be described as unidirectional dependence. At the same time, both actors also quickly realized that developing an aligned strategy could be a crucial success factor. Once ATL achieved economic success, this insight was locally validated, and the development dynamics and key DCs could structurally shift to a next level.

The key development challenge in the second phase is developing (and constantly adapting) a comprehensive, industry-specific system resource portfolio that caters to the anchor tenant’s needs. To do so, extending local value chain linkages and upscaling relevant RIS structures have to go hand in hand with identifying, mobilizing, and anchoring extraregional system resources that are lacking in the region.

The anchor tenant needs to be able to sense opportunities for deepened regional collaboration as well as for windows of opportunity that provide interesting business opportunities beyond the home region. In the case of Ningde, CATL successfully anticipated the emergence of national support policies for domestic EV producers, which provided a window of opportunity for quick business expansion. Once such opportunities are sensed, seizing them by creating new strategic partnerships locally and with actors far away to mobilize a full system resource portfolio is of key importance. This means that rapid learning capabilities in complex multilocational value chains have to be combined with a constant reconfiguration of internal, regional, and (inter-)national collaboration structures. CATL proved particularly skillful in swiftly expanding its local collaboration networks and filling lacking regional resource stocks with external collaborations when the domestic EV market opportunity emerged.

Also, other regional stakeholders need to develop sensing capabilities for shifts in the emerging industry’s core technologies, markets, or business models, and for anticipating exogenous opportunities. The key dynamic capability in this phase is however about seizing exogenous opportunities by quickly adapting local innovation support structures and extraregional collaborations in ways that a full system resource portfolio gets mobilized. This implies reconfiguring the industry-specific and regional innovation system structures, for example, by consolidating the local labor market or developing adequate educational infrastructures. As illustrated in our empirical case, gaps in the regional resource stocks also have to be filled by inducing and supporting movements of labor, knowledge, or financial investment from elsewhere, or improving critical trade infrastructures to guarantee market access.

In this second phase, facilitating dense and trustful interaction between the anchor tenants and regional stakeholders and creating a joint vision and codependent relationships are thus of crucial importance. If the anchor tenants come out of this phase as a global leader and the region as a core hub in the focal industry, the development dynamics and key DCs can yet again structurally shift to a next level.

In the third phase, the main development challenge relates to consolidating the anchor tenant’s global leadership position while branching into related industries in order to diversify the regional economy. The DCs to be employed by anchor tenants and regional stakeholders thus yet again shift qualitatively and increase in complexity. In this phase, being able to identify strategic opportunities locally and abroad (sensing), strengthening their own R&D capabilities, and experimenting in national and international markets (seizing) is still important. Yet, the anchor tenant also increasingly requires capabilities to continuously and strategically reconfigure the acquired resource bases in order to maintain a global leadership position. This includes managing an increasingly variegated portfolio of products and services developing a sophisticated global innovation network, while also strengthening regional and national innovation system structures.

For regional stakeholders, the main DCs also shift toward reconfiguring the regional and (inter-)national support structures in ways that enable them to support a more diversified set of local industries and sectors. As our case study has shown, this includes identifying additional anchor tenants from related industries to be attracted to the region from a future-oriented perspective (sensing). Once new anchor tenants have been attracted, seizing the opportunities they bring happens by creating new system resources for their specific needs. More sophisticated system intermediation is needed in this phase. In our empirical case, this is shown by the establishment of a Special Project Office in the local Development and Reform Commission, which essentially institutionalized the DCs needed to support industrial diversification in the core of Ningde’s local administration.

In this third phase, the codependence between anchor tenant and regional stakeholders diminishes gradually, as both actor’s attention shifts to managing interactions with a broader set of related industries. While strategic coordination will go on, this third phase comes to a successful end when the anchor tenant achieves a dominant position in the quickly maturing global industry, and the region manages to build up a diversified and thick RIS structure, which enables further smart diversification along classical regionalist models. While both outcomes have not yet completely been achieved in Ningde, the region has arguably come quite far in transforming its economic fabric away from its initial peripheral status.

A key overarching result that emerges from is that, even though all three types of DC are crucial in each phase of this development model, the most critical DCs required by the anchor tenant and regional stakeholders shifted from sensing (first phase), to seizing (second phase) to reconfiguring (third phase). The concrete forms of DCs also changed over time as the anchoring priorities shifted from embedding a single firm to cultivating a successful single industry to attracting and managing multiple regional industries. Having actors present who are able to navigate this long-term process with flexibly adaptable strategies is a key success condition. While these insights are influenced by many context-specific factors of our case study, we posit the phase model and types of DCs deployed over time offer inspiration for comparative case studies and a cumulative theorization of the general mechanisms that enable third route industry development trajectories.

Conclusions

This article proposes a third route for industrial development in peripheral regions that complements the established regionalist and globalist perspectives in economic geography. It focuses on the processes that enable peripheral regions to leapfrog into newly emerging industrial paths. This process perspective examines closely how anchor tenants and regional stakeholders can conjointly build up a portfolio of supportive system resources endogenously and by anchoring them from elsewhere. Our model aligns with the burgeoning literature on distributed agency in industrial path development (for recent progress, see Sotarauta and Grillitsch Citation2023), by further arguing that developing dynamic capabilities is a key success factor for engaging in anchoring-based regional development. Our case study illustrated that if these capabilities are skillfully developed and leveraged, anchoring-based regional development can be approached in a strategic, rather than a purely luck-based casino approach.

While we believe the characteristics of identified phases and the corresponding dynamic capabilities needed for successful anchoring are of general relevance, we are also conscious that our single case will not be able to cover all relevant mechanisms and development trajectories that enable successful leapfrogging. First and foremost, some of the elements assessed in our case study are clearly context-specific. For instance, Ningde’s strong political relations with national leaders drew particularly strong political attention and legitimacy to the region. These sorts of government-business guanxi ties matter a lot for regional economic development in China (Yu and Gibbs Citation2020; Huang and Yu Citation2021) but may be less relevant in other contexts. Second, the national EV strategy gave Ningde a strong push at the right stage of development. Other smaller countries will have less leverage in providing emerging industries with initial niche markets. Third, in Ningde’s case, the different development phases are rather seamlessly connected to each other, while in many other peripheral regions, the process may not go as smoothly due to, for instance, the quick dissolution of an exogenous window of opportunity, changes in technological trajectories, or the leaving of anchor tenants.

Given these considerations, our claim is thus not that other peripheral regions should aim to follow the exact development model of the EV battery case in Ningde, but rather to use the analytical framework sketched here to more systematically think about the general strategies and dynamics capabilities needed to beat the casino. Adding comparative case studies set in other sectoral and regional contexts will be of crucial importance to a deeper and more comprehensive theorization of the third route’s key success and failure conditions. Once a deepened understanding is achieved, the anchoring-based approach may provide peripheral regions with a more hopeful option for achieving a quick transformation of their economic structure than the approaches proposed by EEG scholars and GPN theorists (Dawley Citation2014; Carvalho and Vale Citation2018; Fredin, Miörner, and Jogmark Citation2019).

Research seeking to further theorize anchoring-based regional development could focus on the following three areas. First, future research could complement our strong focus on regional stakeholders and a select anchor tenant with a deepened exploration of the role of nonlocal actors and contextual developments in other world regions, and their influence on anchoring-based development processes. Second, the questions of how actors can develop dynamic capabilities in the first place and what enables them to translate those capabilities into coordinated action (and what roles intermediaries play in this process) would also be worthy of deeper investigation. Elucidating the most effective forms of system intermediation and coordination and what actor types are particularly well positioned to induce them—also beyond the specific context of China—would be of paramount importance. Finally, exploring how generic leapfrogging potentials differ between types of sectors or regions and deriving context-specific policy recommendations would be highly important.

Acknowledgments

The corresponding author Zhen Yu acknowledges the support from the National Natural Science Foundation of China, Grant 42301188. Huiwen Gong acknowledges financial support from Marie-Curie Standard Individual Fellowship, Grant 8946063. We are grateful to Jim Murphy and three anonymous reviewers for their constructive comments on earlier versions of this article.

Correction Statement

This article has been corrected with minor changes. These changes do not impact the academic content of the article.

Notes

1 Incorporating all sorts of knowledge-exploration (innovation) and knowledge-exploitation (production) activities.

2 It was attracted to Ningde already in 2008 but remained largely isolated from battery-related activities.

References

- Balland, P. A., Boschma, R., Crespo, J., and Rigby, D. L. 2019. Smart specialization policy in the European Union: Relatedness, knowledge complexity and regional diversification. Regional Studies 53 (9): 1252–68. doi:10.1080/00343404.2018.1437900.

- Baumgartinger-Seiringer, S., Doloreux, D., Shearmur, R., and Trippl, M. 2022. When history does not matter? The rise of Quebec's wine industry. Geoforum 128 (January): 115–24. doi:10.1016/j.geoforum.2021.12.013.

- Bathelt, H., Malmberg, A., and Maskell, P. 2004. Clusters and knowledge: Local buzz, global pipelines and the process of knowledge creation. Progress in Human Geography 28 (1): 31–56. doi:10.1191/0309132504ph469oa.

- Binz, C., and Anadon, L. D. 2018. Unrelated diversification in latecomer contexts: Emergence of the Chinese solar photovoltaics industry. Environmental Innovation and Societal Transitions 28 (September): 14–34. doi:10.1016/j.eist.2018.03.005.

- Binz, C., and Gong, H. 2022. Legitimation dynamics in industrial path development: New-to-the-world versus new-to-the-region industries. Regional Studies 56 (4): 605–18. doi:10.1080/00343404.2020.1861238.

- Binz, C., Truffer, B., and Coenen, L. 2016. Path creation as a process of resource alignment and anchoring: Industry formation for on-site water recycling in Beijing. Economic Geography 92 (2): 172–200. doi:10.1080/00130095.2015.1103177.

- Binz, C., and Truffer, B. 2017. Global Innovation Systems—A conceptual framework for innovation dynamics in transnational contexts. Research Policy 46 (7): 1284–98. doi:10.1016/j.respol.2017.05.012.

- Boschma, R. 1997. New industries and windows of locational opportunity: A long-term analysis of Belgium (Neue Industrien und das “Windows of Locational Opportunity”-Konzept. Eine Langfrist-Analyse Belgiens). Erdkunde 51 (1): 12–22. doi:10.3112/erdkunde.1997.01.02.

- Boschma, R. 2017. Relatedness as driver of regional diversification: A research agenda. Regional Studies 51 (3): 351–64. doi:10.1080/00343404.2016.1254767.

- Boschma, R. 2021. Designing Smart Specialization Policy: Relatedness, unrelatedness, or what? Papers in Evolutionary Economic Geography 21.28. Utrecht, the Netherlands: Utrecht University.

- Boschma, R. 2022. Global value chains from an evolutionary economic geography perspective: A research agenda. Area Development and Policy 7 (2):123–46. doi:10.1080/23792949.2022.2040371.

- Boschma, R., Coenen, L., Frenken, K., and Truffer, B. 2017. Towards a theory of regional diversification: Combining insights from evolutionary economic geography and transition studies. Regional Studies 51 (1): 31–45. doi:10.1080/00343404.2016.1258460.

- Bradsher, K., and Forstyhe, M. 2021. Why a Chinese company dominates electric car batteries. New York Times, December 22, 2021. https://www.nytimes.com/2021/12/22/business/china-catl-electric-car-batteries.htm.

- Breul, M., Hulke, C., and Kalvelage, L. 2021. Path formation and reformation: Studying the variegated consequences of path creation for regional development. Economic Geography 97 (3): 213–34. doi:10.1080/00130095.2021.1922277.

- Carvalho, L., and Vale, M. 2018. Biotech by bricolage? Agency, institutional relatedness and new path development in peripheral regions. Cambridge Journal of Regions, Economy and Society 11 (2): 275–95.

- CATL. 2018. CATL Initial Public Offering Prospectus. China Securities Regulatory Commission. https://www.catl.com/uploads/1/file/public/202010/20201014141001_911lreeufo.pdf.

- Coe, N. M., and Yeung, H. W-c. 2015. Global production networks: Theorizing economic development in an interconnected world. Oxford: Oxford University Press.

- Crevoisier, O., and Jeannerat, H. 2009. Territorial knowledge dynamics: From the proximity paradigm to multi-location milieus. European Planning Studies 17 (8): 1223–41. doi:10.1080/09654310902978231.

- Dawley, S. 2014. Creating new paths? Offshore wind, policy activism, and peripheral region development. Economic Geography 90 (1): 91–112. doi:10.1111/ecge.12028.

- Dawley, S., MacKinnon, D., and Pollock, R. 2019. Creating strategic couplings in global production networks: Regional institutions and lead firm investment in the Humber region, UK. Journal of Economic Geography 19 (4): 853–72. doi:10.1093/jeg/lbz004.

- De Propris, L., and Crevoisier, O. 2011. From regional anchors to anchoring. In Handbook of regional innovation and growth, ed. P. Cooke, B. Asheim, R. Boschma, R. Martin, D. Schwartz, and F. Tödtling, 167–77. Cheltenham, UK: Edward Elgar Publishing.

- Doloreux, D., and Dionne, S. 2008. Is regional innovation system development possible in peripheral regions? Some evidence from the case of La Pocatie`re, Canada. Entrepreneurship and Regional Development 20 (3): 259–83. doi:10.1080/08985620701795525.

- Eder, J. 2019. Innovation in the periphery: A critical survey and research agenda. International Regional Science Review 42 (2): 119–46. doi:10.1177/0160017618764279.

- Feldman, M. 2003. The locational dynamics of the US biotech industry: Knowledge externalities and the anchor hypothesis. Industry and Innovation 10 (3): 311–29. doi:10.1080/1366271032000141661.

- Fitjar, R. D., and Rodríguez-Pose, A. 2011. Innovating in the periphery: Firms, values and innovation in Southwest Norway. European Planning Studies 19 (4): 555–74. doi:10.1080/09654313.2011.548467.

- Fredin, S., Miörner, J., and Jogmark, M. 2019. Developing and sustaining new regional industrial paths: Investigating the role of ‘outsiders’ and factors shaping long-term trajectories. Industry and Innovation 26 (7): 795–819. doi:10.1080/13662716.2018.1535429.

- Frenken, K., Van Oort, F., and Verburg, T. 2007. Related variety, unrelated variety and regional economic growth. Regional Studies 41 (5): 685–97. doi:10.1080/00343400601120296.

- Fu, W., and Lim, K. F. 2022. The constitutive role of state structures in strategic coupling: On the formation and evolution of Sino-German production networks in Jieyang, China. Economic Geography 98 (1): 25–48. doi:10.1080/00130095.2021.1985995.

- Glückler J, Shearmur, R., and Martinus, K. 2023. Liability or opportunity? Reconceptualizing the periphery and its role in innovation. Journal of Economic Geography 23 (1): 231–49. doi:10.1093/jeg/lbac028.

- Garud, R., and Karnøe, P. 2003. Bricolage versus breakthrough: Distributed and embedded agency in technology entrepreneurship. Research Policy 32 (2): 277300. doi:10.1016/S0048-7333(02)00100-2.

- Gong, H., and Andersen, A. D. 2022. The role of natural resources in accelerating net-zero transitions: Insights from EV lithium-ion battery technological innovation system in China. Working Paper 20221001. Oslo, Norway: Centre for Technology, Innovation and Culture, University of Oslo. https://www.sv.uio.no/tik/InnoWP/tik_working_paper_20221001.pdf.

- Gong, H., and Binz, C. 2023. Cumulative causation in regional industrial path development—A conceptual framework and case study in the videogame industry of Hamburg and Shanghai. Geoforum 141 (May): art. 103729.

- Gong, H., and Hansen, T. 2023. The rise of China's new energy vehicle lithium-ion battery industry: The coevolution of battery technological innovation systems and policies. Environmental Innovation and Societal Transitions 46 (March): art. 100689. doi:10.1016/j.eist.2022.100689.

- Gong, H., Binz, C., Hassink, R., and Trippl, M. 2022a. Emerging industries: Institutions, legitimacy and system building. Regional Studies 56 (4): 523–35. doi:10.1080/00343404.2022.2033199.

- Gong, H., Hassink, R., Foster, C., Hess, M., and Garretsen, H. 2022b. Globalisation in reverse? Reconfiguring the geographies of value chains and production networks. Cambridge Journal of Regions, Economy and Society 15 (2): 165–81.

- Grillitsch, M., and Sotarauta, M. 2020. Trinity of change agency, regional development paths and opportunity spaces. Progress in Human Geography 44 (4): 704–23. doi:10.1177/0309132519853870.