ABSTRACT

Overdose deaths in North America have soared, primarily because of the spread of illegally manufactured fentanyl. This paper uses detailed qualitative and transaction-level data to analyse an early and prominent dark web fentanyl-selling operation. The data record the date, drug, quantity, and selling price for 5,589 transactions comprising 872,659 items sold for a little over $2.8 million through AlphaBay. Findings include that the organisation sustained an impressive sales growth rate of approximately 15% per week, compounded. Increasing order sizes by a factor of ten reduced the price per pill by approximately 25% for Oxycodone and 50% for Xanax. Those steep quantity discounts imply large price markups when selling further down the distribution chain. Such high growth rates and price markups suggest that it might be difficult to constrain supply by shutting down individual organisations, since any remaining organisations may be able to quickly grow to fill unmet demand.

Introduction

Motivation

Internet drug sales, though apparently accounting for a small share of all drug revenues, have the potential to become more important. This raises the question of how they may differ from the familiar traditional, in-person, distribution systems. For example, do they allow for market entry by a different set of offenders via a distinctive business model? And could they promote availability of new forms of drugs, as internet retailers have with legal goods (Brynjolfsson, Citation2006)?

This paper provides a detailed quantitative analysis of a large number of AlphaBay transactions for one prominent organisation that primarily manufactured counterfeit prescription pills containing fentanyl and distributed them by U.S. mail (U.S. Attorney for Utah, Citation2020). The analysis also draws on a substantial set of court documents including internal communications among group members that describe the evolution of the enterprise and the operational challenges it faced.

This complements other studies in the rapidly growing literature on internet drug distribution (e.g. Duxbury & Haynie, Citation2021). Most large-scale, transaction-level data are gathered by scraping websites, and so pertain to marketplaces as a whole, not to a single organisation, and lack the complementary rich qualitative data that we have on organisational practices. Conversely, most detailed studies of individual organisations are qualitative and/or focus on smaller vendors (e.g. Martin et al., Citation2020).

The organisation studied here – as described further in Section 3 – is of particular interest because it contributed to the early rise in manufacturing counterfeit prescription drugs containing fentanyl (Humphreys et al., Citation2022). This rise has proven disastrous due to fentanyl’s high potency, inducement of respiratory muscle stiffness, and other attributes that increase the risk of overdose (Gill et al., Citation2019). Indeed, illegally manufactured fentanyl (IMF) has dominated drug overdose deaths in the United States and Canada for several years now (Hedegaard et al., Citation2021). The high correlation between opioid deaths and independent indicators of IMF supply – e.g. from seizures – underscores the importance of studying IMF supply (Pardo et al., Citation2019).

Given the importance of IMF supply and of this organisation, our focus is on understanding the dynamics of this particular business. We did not impose any specific theoretical frame. Rather, just as a business school might study a prominent legal enterprise, we simply wished to understand how this organisation operated, how profitable it was, and what its vulnerabilities might be. We report finding that are related to three theses:

Organizations selling via internet drug markets can share characteristics with legal firms and differ from organisations that sell drugs in traditional drug markets.

Internet drug traffickers can expand rapidly, e.g. because they are not bound by geography.

Online selling can be profitable by having low costs and the ability to transcend levels of the market.

In addition, we show in unusual detail the pricing decisions, costs, and authority of this online drug-selling business and examine vulnerabilities that the enterprise exhibited. The concluding discussion also explores whether ‘crime paid’ for the individuals involved in this particular organisation (which may have been a relatively successful one, albeit not long-lived).

Prior research on dark web markets

Dark web marketplaces, like legal internet marketplaces such as eBay or Amazon, are virtual markets where vendors and buyers exchange currency for goods, with order fulfilment achieved primarily by contracting with parcel delivery services. However, there are some differences. Dark web marketplaces (often called cryptomarkets) can generally only be accessed via the Tor network which anonymises the user’s IP address, providing anonymity. Dark web transactions are usually conducted using digital currency such as Bitcoin, ensuring anonymous and verifiable transactions. Martin et al. (Citation2019) highlight that dark web marketplaces generally provide vendor and product (type and price) transparency, feedback systems where buyers can rate vendors (and vice versa), marketplace-administered escrow services, and dispute resolution.

The business we are studying sold online through AlphaBay. The original AlphaBay marketplace operated from 2014 to 2017. By 2015 it was considered to be the largest dark web marketplace, with over 200,000 users (Cimpanu, Citation2017). Previous literature on AlphaBay includes an assessment of vendor sizes and associated competition (Paquet-Clouston et al., Citation2018). Christin (Citation2017) provides a detailed description of how AlphaBay operated. Greenberg (Citation2022) provides a vivid account of how AlphaBay was closed down.

The literature drawing on interviews with dark web vendors finds that their motivations can be complex (Martin et al., Citation2020). Vendors who say that they would not sell drugs outside of dark web marketplaces report that it feels safer than selling in person and offers greater profit. While online selling poses some distinctive risks, such as the platform shutting down or being scammed by customers, respondents say that these risks are part of the job and are significantly lower than for offline or in-person transactions (Martin et al., Citation2020).

Much of the current literature agrees that establishing trust among trading partners is a primary concern (Beckert & Wehinger, Citation2013; Gambetta, Citation2009; Sebagh et al., Citation2022), similar to other risky trades (Greif, Citation2006; Hillmann & Aven, Citation2011; Kollock, Citation1994). Some have discussed how the relationships between vendors and buyers affect pricing strategies (Moeller & Sandberg, Citation2019), e.g. a vendor may be able to charge (and buyers be willing to pay) a premium based on their obtaining a good sales rating (Przepiorka et al., Citation2017), or vendors may provide price discounts to reward loyalty and retain customers. We investigate the latter in our data below.

The next section describes the data and methods. Section 3 provides a richer description of the organisation and its operations before Section 4 presents the quantitative results.

Data & methods

Data on online transactions

The transaction data were obtained from the prosecutors of the Shamo case; all were entered into the public record as evidence. The data are in two forms. An interesting but less comprehensive form are screenshots of Shamo’s private seller page that police took when the operation was raided; a confederate who worked for Shamo provided the enforcement agents with that access. They cover 131 transactions that were recent or pending when the organisation was shut down and include details like shipping charges and the commission paid to the AlphaBay marketplace. They also provide some insight into the comprehensiveness of the main transactional data described next.

The second form and primary focus is 5,589 ‘feedback’ observations documenting the sale of 872,659 items sold for a little over $2.8 million through AlphaBay.Footnote1 They represent about two-thirds of the 8,332 ‘finalized’ transactions that Shamo’s Pharma-Master operation conducted on AlphaBay. To clarify the difference, markets like AlphaBay hold the customer’s money until the customer reports the shipment has been received, at which point the market releases the funds to the seller (assuming the customer did not file a complaint of fraud, defective product, etc.). The culture on AlphaBay encouraged customers to report receipts promptly. If they failed to do so within a specified period (e.g. 14 days) then the market would ‘auto finalize’ the transaction. Christin (Citation2017) reports that auto-finalised sales are a modest share of consummated transactions on AlphaBay; for Shamo, it appears that about one-third of transactions were auto-finalised. We have no way to know whether the auto-finalised transactions differed in any systematic way from the feedback observations for which we have data.

We also do not have data on (1) the organisation’s early sales before opening the AlphaBay account in late 2015 or (2) the organisation’s sales through traditional in-person dealing. (One of Shamo’s co-defendants admitted to brokering the sale of 140,000 of Shamo’s pills to other drug dealers in Utah directly, not via AlphaBay.) Also, one of the organisation’s trademarks was including bonus pills to cultivate customer loyalty. Those bonus pills are not included in the data.

The AlphaBay feedback sales data provide six variables for each observation: Date the transaction was finalised, price ($), quantity/weight (e.g. # of pills), dose per pill (mg), purchaser’s coded name, and the selling name of the drug.

The price recorded in our data set is the ‘item price’ from the AlphaBay webpage. It was often a round number plus postage, e.g. a 2,000 Roxy pill sale that finalised on November 11th, 2016 with a price in our data of $10,007 corresponded to a screenshot showing an item price of $10,007 minus a commission of $265.42 leaving a net total of $9,741.58 with a note indicating that priority mail postage was $7. That suggests that Shamo charged $10,000 (plus $7 postage) but received only $9,741.58, with the AlphaBay market taking a 2.7% commission.

AlphaBay, like most such markets, obfuscates customer identities; e.g. the account name ‘Big_Buyer’ could be coded as ‘B … .r’.Footnote2 That permits aggregation of purchases by the first and last character of the account name, but might occasionally combine purchases made from two accounts. E.g. purchases by ‘Big_Buyer’ and ‘Blue_Brother’ could not be distinguished. Hence, when we analyse repeat purchases below, we technically are observing instances of multiple purchases that had the same coded identity, not necessarily the same purchaser. Likewise, if one physical buyer used two different customer IDs, we could not observe that.

The Shamo organisation listed products under 13 different selling names; however, prosecutors viewed four of these as alternate names for the same product: counterfeit oxycodone pills containing fentanyl, not oxycodone (Trial Brief US v. Shamo p.10). Hence, for most analyses ‘M Box’, ‘Roxy’, and ‘Fentanyl’ were combined with ‘Oxycodone’ into one category called Oxycodone, leaving ten different drugs whose frequencies are described in after removing six instances of ‘canceled’ transactions, as well as some ‘missing’ transactions.

Table 1. Average weekly compound growth rates for sales, transactions, and quantity.

Table 2. Price variation and quantity discounts for Oxycodone and Xanax.

Oxycodone and Xanax account for 92.2% of transactions and 99.2% of sales revenue, so they are the focus. The Appendix describes the data cleaning and elimination of outliers.

Sales trends over time are reported using three metrics: number of transactions, number of pills, and dollar value of sales. Aspects of the organisation’s pricing strategy are assessed both with descriptive statistics and by regressing the log price on log quantity (number of pills) since that log-log relationship has been found to be linear for other drugs (Caulkins, Citation2007).

Qualitative data

We obtained access to and read/viewed all of the court documents related to the prosecution of this case, including the 2,147 page trial transcript, crime scene photos, plea and cooperating agreements of co-conspirators, sentencing memo, and all trial exhibits. Noteworthy among those is the extensive and apparently complete transcript of all Telegram (text) messages sent between the organisation’s head and one of his key staff, between January 27th and November 17th, 2016 (Government Exhibit 14.15), as well as Telegram messages transcripts for shorter periods with other staff. Most is routine banter primarily dealing with problems with individual orders (e.g. a customer complaining).

The trial transcript included some detailed descriptions of relationships and events. The qualitative data are not analysed formally. Nor are they used to test any specific hypothesis, in part because they all pertain to just one organisation. Rather, they provide background information that helps contextualise the quantitative data on sales, pricing, and growth. For example, they provide information about the Shamo organisation’s costs, which can be compared to its revenue from sales transactions.

Description of the shamo operation

This Utah-based organisation operated at least between July 2015 through November 2016, but selling through AlphaBay using the storefront ‘Pharma-Master’ apparently began in December 2015. Online sales grew rapidly until law enforcement shut down the organisation in November 2016, reaching approximately $500,000 in recorded sales per month in the fall of 2016. One indication of the organisation’s size is that prosecutors were able to identify 90 of their customers who were deceased as of the time of sentencing, with confirmation that the cause of death was an overdose in some cases (US vs. Shamo Sentencing memo).Footnote3

The organisation was conceived by Aaron Shamo and Drew Crandall, apparently originally selling various drugs including their own Adderall online (Galofaro & Whitehurst, Citation2019). They began recruiting assistants in mid-2015. Shamo ‘bought out’ Crandall’s one-third stake for $40,000 in November 2015 when Crandall’s girlfriend discovered the activity and urged Crandall to get out. Crandall returned in a customer support function in June of 2016 when he ran short of money, but for the period of greatest interest and greatest sales, the organisation was headed by one person.

Other staff included a pill pressing specialist, customer support staff (one throughout, plus Crandall starting in June 2016), two order-fulfilment workers, a runner, and two ‘executive assistants’ whose duties included purchasing supplies. There was also a close relationship with a broker who apparently was a conduit for traditional wholesale distribution in the region, not via the internet. Approximately 14 more people were paid a piece rate for playing smaller roles such as receiving packages of materials or supplies, e.g. at $200 or $300 per package received.

The organisation experimented with selling many different drugs, but the great bulk of sales were counterfeit ‘Oxycodone’ pills (which contained fentanyl but no Oxycodone) and counterfeit Xanax pills, which apparently did contain Alprazolam. Oxycodone accounted for the majority of pills sold and, because they were more expensive, the great majority of revenues.

The fentanyl was purchased directly from China. Photos included as trial exhibits show at least three separate parcels from Shenzhen and Shanghai with labels indicating the content weighed 0.5 kilograms, and one witness described receiving 30 to 50 packages. Indeed, in June 2016, U.S. Customs agents in Los Angeles discovered a parcel en route from China to Utah that contained fentanyl. Subsequent investigation led to the November arrest of the package recipient, another confederate of Shamo, and ultimately Shamo himself (Trial transcript, prosecutor’s opening statement).

The first recorded AlphaBay sale on December 12th, 2015 was of 10 Valium pills. The first recorded Oxycodone sale was not until February 3rd, 2016. It was the 161st sale overall, coming after 108 Xanax sales, 27 LSD sales, and smaller numbers of Valium, Etizolam, Cialis, and MDMA, but Oxycodone sales grew rapidly thereafter. This suggests that Shamo was not initially knowledgeable about the strength of demand for different drugs; his innovation was the platform, and it was only through trial-and-error that he learned what products could generate the most sales.

Shamo was very concerned with providing good customer service. He and several of his staff had prior experience working in customer service at eBay, and during his trial many of his staff explicitly described their role and activities as performing ‘customer service’. This included a particular focus on maintaining positive customer feedback on the AlphaBay site. A common strategy for promoting customer satisfaction was sending extra (free) pills. Early on they also sent free samples (charging only $7 for shipping) to people offering to write reviews; that was described as an ‘investment’ (in reputation).

The impression we had reading through Shamo’s text messages was often of ‘bros’ having fun, intermingling chat about hitting the gym and picking up women with doing business. To give a feel for the informality, Box 1 quotes an early discussion about creating the posts (offers) for what they call ‘candy’, which appears to be attempts to inject drugs into actual candy, as opposed to pressed pills. What is striking is how casual is the basis for the determination of prices, doses, products, and quality control. Note in the last two lines how close the two came to misunderstanding what the Xanax potency should be by a factor of 2.5. The prosecutors referred to this as developing the product through a dangerous ‘trial and error’ process (Trial transcript, page 2017).

Once they had discovered that counterfeit Oxycodone pills would be their key product, sales grew very quickly, as is discussed below. Thereafter, the texts reminded us of a stereotypical highly-profitable, fast-growing start-up. Indeed, Shamo and at least four co-conspirators had past experience working at eBay. Operations seem a bit ragged at times, but that is perhaps reflective of the speed of growth. On the whole, there is little to suggest that law enforcement pressure disrupted operations before the final raid, although on August 25th Shamo does text ‘once I get another shipping department in another state I’ll feel a lot better’.

Box 1: excerpt from a discussion on February 21st – February 23rd, 2016.

Results

Results based on 131 screenshots

Share of transactions that appear in main data set

The court documents included screenshots of 131 transactions appearing on Shamo’s private seller account just before the operation was closed down. Of the 131, 27 were listed as ‘processing’, 55 as ‘shipped’, and 49 as ‘finalised’; only the 49 finalised transactions could appear in our main data set.

The court documents suggest that our main data set of 5,589 feedback observations account for 67% of the 8,332 AlphaBay transactions conducted by Shamo’s Pharma-Master account. However, only 28 of the 49 (57%) finalised transactions shown on the screenshots contained customer comments.

Also, we could only locate 12 of those 28 in our data set. Hence, our primary data set included only 24% of the 49 finalised transactions observed in the private seller account screenshots (covering 19% of sales revenue and 34% of the pills).

The rate of sales recorded in the private seller account is also suggestive of the share of Shamo’s transactions that are captured in our main data. Of the 131 screenshots, 99 came from the eight days before the operation was shut down, i.e. between November 17th and November 23rd.Footnote5 They covered 165,300 pills with a total sales value of $371,430, or an average of $53,061 per day. By contrast, our primary data records $782,767 in sales for the month of October, or an average of $25,250 per day. Even recognising that the organisation may have been continuing to grow between October and November, this suggests that our primary data set covers perhaps one-quarter to one-half of the organisation’s sales.

AlphaBay market commission

The 131 transactions recorded with screenshots include the commission AlphaBay charged Shamo. Overall, Shamo paid $18,710.69 in commissions on sales whose item prices totalled $704,292, or 2.66%. Commissions were 2.93–2.98% of the item price for the 17 transactions with sales dates before October 21st, and – with a few exceptions – were between 2.48–2.56% for the 100 sales dated after November 13th, so commissions seemed to fall between October and November. These are consistent with the previously understood estimate that AlphaBay charged commissions of 2–4% (US vs Cazes, Citation2017).

Results concerning payroll and other costs

The court documents do not contain complete financial records, but some nuggets from texts and co-conspirators’ plea agreements are suggestive (Government Exhibits 23.00 through 23.07). Most full-time staff were ‘salaried’, being paid for their time rather than having an equity stake in the profits. After the organisation had grown, that meant ‘payroll’ costs were low. The two packaging specialists were each paid $7,000 per month. The customer support person and runner appear to have been paid even less (on the order of $1,600 per month, some in the form of Amazon gift cards). Given known revenues from AlphaBay sales of $2.8 M, plus other sales, those salaries appear to have accounted for less than 5% of gross revenues.

Two people were paid piece-rate at $1 per pill (at least at some points, though perhaps not throughout), and so earned far more than did other employees and agents. One was a pill-pressing specialist. The early text messages show that it was challenging to figure out the right recipe and technique for getting the pressed pills to look authentic. It is not clear why once that technical problem was solved, the person doing the pressing continued to be paid so well. The $2.8 M in known AlphaBay sales revenue comes from selling 0.85 M pills (plus some additional bonus free pills added to win customer loyalty). If the $1 per pill were paid throughout, that would account for about 30% of gross revenue. Consistent with that, the government seized $805,990 and 32.811 BitcoinsFootnote6 from the pill presser vs. only $19,520 from the two order fulfilment specialists combined. (The pill presser was sentenced to five years.)

The second key player who was paid piece rate was a confederate who connected Shamo to drug dealers in Utah (i.e., a separate distribution channel outside of the AlphaBay sales). Perhaps because those activities did not leave a digital trace, they are less clearly described, but the US DOJ Press release (2021) states that he ‘was paid approximately one dollar per pill for this service and that he distributed approximately 140,000 pills’ and was sentenced to 10 years. It is not clear how much Shamo was paid for pills distributed this way, but the price per Oxy pill for bulk sales via AlphaBay was roughly $4–$5.50 per pill, so this middleman might have been capturing 20–25% of Shamo’s revenues from those sales.

Other known costs were quite minor. Postage of $7–$9 per sale for 5,600 internet sales would have come to about 1.6% of the revenues from those sales, and as already mentioned, the AlphaBay market’s commission appears to have been about 2.5% of gross revenues.

Another activity that occupied Shamo’s time, and created associated expenses, was converting the Bitcoins earned from online sales into cash. It is not clear why he preferred holding cash instead of Bitcoins, but law enforcement seized $2.4 M in cash (as well as approximately 513 Bitcoins) when they shut down the operation. That cash was mostly just stuffed into dresser drawers and duffle bags; it had not yet been laundered.

The enterprise was in fact hugely profitable for its head, Aaron Shamo, and also generated large income for two specialists. For all other participants, their earnings were somewhere between low and modest.

Results pertaining to online sales data

Growth rates

Shamo shipped to customers throughout the nation and by Fall of 2016 was selling about 300,000 pills per month. That rapid growth rate is worth characterising in some detail not only because organisations’ growth rates are interesting in their own right, but also as an indirect indicator of the resilience of market supply. A market can be resilient even when constituent organisations are not, if when a member organisation is dismantled, the remaining organisations can quickly grow to take its place and/or a new enterprise can substitute for the one that was removed.

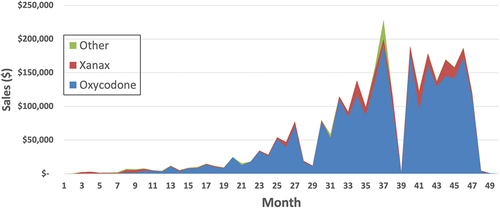

plots weekly sales revenue by drug type. The graph shows two interruptions (around weeks 28 and 39), which suggests distinguishing three growth periods: Weeks 1–27, weeks 29–38, and weeks 40–46. (The decline after week 46 can be traced to the arrests of members of the organization.Footnote7) displays the mean weekly compound growth rates for sales, transactions, and quantity over the three separate periods and overall.

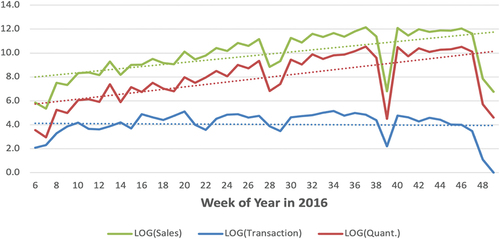

Growth rates varied somewhat, and the numbers of transactions grew less quickly than did sales revenues or quantities sold because transaction sizes grew over time. The enterprise only started to sell very large quantities (>1,000 pills) in the second half of the year with even larger quantities (>5,000) occurring within the last 2–3 months of its operation. The upshot though is that both quantity sold and revenues derived from sales grew by about 15% per week compounded, for the entire period, with higher growth for the first 36 weeks and lower growth in the final six weeks before the organisation was dismantled.

plots the log of the dollar value of sales, the number of transactions, and the quantity per week just for Oxycodone to show the steadiness of sales growth. With a logged vertical axis, steady percentage growth manifests as a straight line. It shows that growth was quite steady, except for the previously mentioned interruptions around Weeks 28 and 39.

Sales interruptions and resilience

As noted, the organisation experienced two slowdowns in recorded sales: one in July (week 28, roughly July 7th − 15th) and a second in September (week 39, roughly September 17th − 23rd). Late May (week 22, roughly May 19th − 31st) saw a reduction in the number of transactions but less impact on sales. The text message stream sheds some light on their causes and, hence, what these interruptions do or do not say about the resilience of the organisation.

On July 13th Shamo wrote ‘ … there’s some changes in [sic] making I wanna fill you in on, can we shoot for tomorrow? [to meet]’ which apparently, they did. Then on the 15th the associate texts ‘Still cancelling any Utah/sl county orders yeah?’ and there were no texts between July 18th and 22nd, which is unusual. The nature of the July operational change is unclear, but there is no indication that it relates to any arrest or other enforcement activity. (There is a July 26th message mentioning getting a new pill press machine up and running but that appears to be after the July interruption.)

On August 23rd (p.237) an associate asks ‘Someone wanted to know when you were going on vacation in September’ to which Shamo replies ‘Yea I’ll be gone 2 weeks then. Should be 10–21st’. There are few texts during those days, and some explicitly mention Shamo being on vacation. For example, on September 15th, ‘Yo. I know you’re on vacay. [But] Can you ask … ’ with a special request. Based on [US v. Shamo Trial Transcript p.84], it appears that Shamo took many trips to Las Vegas as well as cruises, but it may be that the online store was only set to vacation mode for this longer September vacation.

In sum, both interruptions were due to planned, internal actions, not external shocks. Continuity of business is important for internet businesses, both legal and illegal. (See Greenberg (Citation2022) for descriptions of how hard AlphaBay and other such markets worked to prevent interruptions to service.) Hence, any interruption hints at the degree to which Shamo’s organisation was small, informal, and/or lacking in contingency plans, but at the same time, the interruptions do not imply fragility or vulnerability to external forces.

With regard to resilience, we also note a ‘dog not barking’, namely that there is no evidence that Shamo was inordinately dependent on one or a few key customers, let alone that loss of such a customer ever appreciably harmed aggregate sales. Shamo’s two largest customers accounted for just 11.8% and 5.2% of recorded sales, respectively.

The literature argues that the technology of online drug trading collapses hierarchical drug distribution networks in favour of decentralised networks where many buyers are connected with many vendors (Duxbury & Haynie, Citation2018). With these data, we cannot comment on the overall network structure, but this one seller had 710 customers and was not particularly dependent on any of them.

Results pertaining to online pricing

Deciding what price to charge is ‘one of the more basic, yet critical decisions facing a business’ (Morris, Citation1987, p. 79). Four aspects of prices are examined here: (1) For any given transaction size (e.g. a 100-pill sale), how much do prices vary over time? In the context of the fentanyl market, 11 months, particularly in 2015, was a long enough time that we hypothesized that prices would decline. (2) For any given transaction size and time, how dispersed are prices? Traditional drug markets have shown high dispersion of prices (e.g. Reuter & Caulkins, Citation2004). (3) How large are price discounts for those purchasing large quantities? Traditional markets have consistently shown large price discounts for quantity. (4) Do repeat customers get discounts based on their record of past purchases?

Price variation over time

Retail sales in conventional place-based drug markets are characterised by conventional round unit pricing (e.g. $10 for a so-called ‘dime bag’ in New York City) and indeterminate quantities (Kleiman, Citation1992). The pure quantity in the bag varies over time and across transactions. When drugs become scarce the pure quantity in a bag shrinks, increasing the effective price per pure gram. With pills it is in theory possible to adjust the content; however, no correspondence suggests that Shamo ever considered doing so; his goal was to provide a consistent product over time.

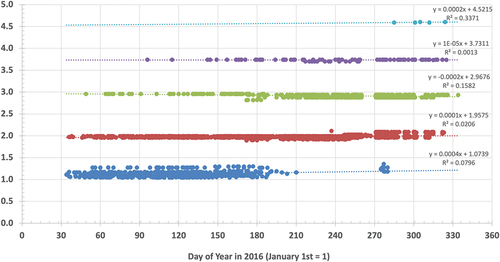

By contrast, this organisation’s transaction quantities were usually for round lot sizes. Of the 5,573 transactions, 5,082 or 91.2% were for either 1, 10, 100, or 1,000 pills. Others were for 5, 50, 500, or 2,000 pills. Superficially the prices seemed to be for odd dollar values, but the Appendix suggests they may have been mostly round dollar amounts plus charges for postage. plots the log of the price charged for 1, 10, 100, 1,000, and 10,000 Oxycodone pill sales. The flatness of the trendlines shows that average prices for any given transaction size were fairly stable over time.

also shows growth over time in transaction size. The organisation started selling Oxycodone in February of 2016 in lot sizes of 1 (blue), 10 (red), and occasionally 100 (green) pills but rarely sold individual pills after August. Court documents reveal that the organisation was concerned about the workload of packaging staff at that time (US. v. Shamo Trial Transcript p.9). Conversely, 1,000 pill transactions were rare until the second half of the year, and the few 10,000 pill transactions occurred towards the end of the organisation’s existence.

The corresponding graph for Xanax (not shown) is similar, with some minor differences. For example, there was greater variety in Xanax prices, particularly for the 10-pill quantities.

Price variation & quantity discounts

describes Oxycodone and Xanax prices for standard numbers of pills sold. For larger transactions (meaning, 100 pills or more), the coefficient of variation in Shamo’s prices (i.e. the standard deviation divided by the mean) was around 0.1, indicating only modest variation in prices over time or across transactions.Footnote8

Recall that Shamo sold counterfeit Oxycodone pills that were essentially the same, but advertised on AlphaBay under several different names, so some price dispersion could relate to how the pills were described. Consider purchases of 10 pills during the period from June through October,Footnote9 since there are many such observations and they are small enough to have been purchased by users, not just dealers (see ). Formally, a t-test will reject the null hypothesis of equal means at the p = 0.05 level for all pairs of labels, but practically speaking the average prices for ‘Roxy – Oxycodone’ were about the same price regardless of whether the label specifically mentioned the word ‘Fentanyl’ ($94.32 vs. $95.02), whereas prices were 7–8% lower when the same pills were labelled ‘M Box 30 – Oxycodone’. Qualitatively similar results were obtained for all data when regressing the log price on the log number of pills for quantities up to 1,000 pills, with dummy variables for the label.

Table 3. Prices for 10 counterfeit Oxycodone pills by label, June – August 2016.

The discounts reported in the final column of indicate the reduction in average price per pill relative to transactions that were one-tenth as large. For example, the price per pill was 46.2% lower when purchasing 100 Xanax pills instead of 10 Xanax pills.

Increasing the size of an order by a factor of ten reduced the price per pill by about 25% for Oxycodone and by about 50% for Xanax. A plot of log average price vs. log number of pills (not shown) is almost a straight line, suggesting a fairly constant rate of quantity discounts across three orders of magnitude in transaction size. Such regularity in quantity discounts across market levels has been observed before, although the magnitude of the discounts for Xanax are larger than has typically been reported in the past for cocaine or heroin. See, e.g. Caulkins and Padman (Citation1993), Caulkins (Citation2007), and Caulkins and Reuter (Citation2006).

Price discounts for returning customers?

The literature has examined whether customers are loyal to or otherwise favour certain vendors (e.g. Décary-Hétu & Quessy-Doré, Citation2017). looks at another aspect of loyalty, from the seller’s side, by exploring whether Shamo provided discounts to returning customers. For sales of 1, 10, and 100 pills a returning customer was defined as one who had at least one previous purchase. Very few people bought 1,000 pills without at least one prior, smaller purchase, so the last line of the table uses a different cut-point. For 1,000 pill purchases we contrasted prices paid by customers with 3 or more previous purchases (‘returning’) and those with 2 or fewer (‘new’).

Table 4. Prices paid by first-time vs. Returning customers.

Overall, the data do not support the hypothesis that returning customers receive discounts. Some of the differences are statistically significant, but the magnitudes of the differences are small and the average prices for returning customers are as apt to be larger as smaller than prices paid by new customers.

Discussion and conclusions

Limitations

Four important limitations bear mention. First, we are unsure what proportion of the organisation’s sales are represented in our data. A lower-than-expected proportion of the transactions documented in seller-side screenshots appeared in our main data set which was derived from the public side of AlphaBay. Additionally, the amount of money that was seized from the organisation exceeds the profits based on the analysed sales, and court documents show that there were also significant offline sales. Hence, the provided data may only represent approximately half or even as little as one-quarter of all the organisation’s transactions.

Second, the data come from public records related to a court case. Although all data are either copied from electronic media (e.g. sales data, transcripts of messages exchanged between members of the organisation) or were evidence subject to rebuttal and/or submitted under oath, the fact that the prosecution was seeking convictions may induce some bias.

Third, the organisation analysed may have been atypical. Most online vendors are small and ephemeral; see Paquet-Clouston et al. (Citation2018). By comparison, even though it only lasted a little more than a year, Shamo’s operation was one of the larger and more enduring. It should perhaps be considered an example of a relatively successful online vendor. We discuss this below.

Fourth, there may have been changes in market conditions since 2016, e.g. it appears that fentanyl now generally enters the U.S. from Mexico, not direct from China (U.S. Commission on Combating Synthetic Opioid Trafficking, Citation2021).

Summary of specific findings

Although the details vary by substance and period, by any reasonable standard, the organisation’s recorded sales grew very quickly over the time covered by these data. If drug trafficking organisations (DTOs) generally can grow that quickly, then it might be very difficult for law enforcement to shut down organisations quickly enough to prevent their peers from expanding to fill their place.

Also, this particular organisation was not dependent on a few large customers. It had 710 customers on AlphaBay and was not particularly dependent on any one of them. Thus, it was fairly resilient to law enforcement efforts against its customers.

These data show the organisation suffered several slowdowns in recorded sales, each lasting a week or longer. Circumstantial evidence suggests that the causes were internal and unexceptional like the principal deciding to take a vacation. There is no suggestion that these interruptions were driven by enforcement actions or that they cost Shamo customers.

This organisation offered roughly 25% and 50% discounts on Oxycodone and Xanax for each ten-fold increase in the amount purchased. In a standard log-linear model of quantity discounts that translates into quantity discount coefficients of −0.125 and −0.3, respectively. That puts the Oxycodone discounts in line with what Moeller et al. (Citation2021) estimate for online cocaine and cannabis markets in Sweden, and perhaps a shade smaller than what Munksgaard and Tzanetakis (Citation2022) report for other drugs on the major dark web markets of 2018. However, Shamo’s quantity discounts on Xanax appear to be unusually large.

These data offered a rare opportunity to assess whether frequent buyers enjoy discounts since most transaction-level data on illegal drug prices do not identify the customers. Within these data, there was no evidence of discounts for repeat buyers.

There was also no meaningful difference in prices of counterfeit oxycodone tablets whether they were sold under the labels ‘Roxy – Oxycodone’ vs ‘Fentanyl – Roxy – Oxycodone’. Perhaps people buying online assume that what is sold as Oxycodone is really a counterfeit pill containing fentanyl even if the presence of fentanyl is not acknowledged by the seller. Another hypothesis is that customers did not care – at least back in 2016 – whether an opioid contains fentanyl. It is hard to say, but these data should be of interest to those who wonder about users’ perspectives on fentanyl in opioid markets (e.g. Mars et al., Citation2019).

The data also reveal broad consistency in pricing over time and across customers. During a period in which the fentanyl market was expanding rapidly and prices were probably decliningFootnote10 this enterprise charged similar prices to all customers buying a given quantity over almost a whole year.

Insights on illegal markets, organizations, and earnings

We close by discussing three issues: (1) the extent to which this drug-selling organisation was like legitimate firms, (2) differences between this organisation and typical in-person DTOs, and (3) whether ‘crime paid’ for these individuals. We note again that this is just one DTO and a relatively successful one, albeit not long-lived.

(1) There is considerable interest in the literature as to whether organised crime groups can usefully be thought of as firms, either in the general sense of a business enterprise or the more specialised Coase-Williamson sense which focuses on asking which functions are performed internally vs. being purchased from outside suppliers (Williamson, Citation1975). For example, Lusthaus et al. (Citation2022) offer an insightful analysis of the extent to which the Gozi malware group is or is not a firm.

Relative to any Fortune 500 corporation, Shamo’s enterprise, like most criminal enterprises, was small, informal, relatively short-lived, and did not file formal incorporation documents (Reuter, Citation1983). Nonetheless, Shamo’s enterprise was firm-like in that it was a profit-making entity that regularly produced and sold products to customers. Staff had specialised roles, and there was a separation of ownership from workers. Shamo bought out his initial partner for a negotiated sum and then as sole owner retained all profits generated by the enterprise.

The operation encompassed manufacturing (pressing pills) as well as order fulfilment and customer support. Marketing was limited because of the need to maintain a low profile, but Shamo’s team put thought into creating appealing photographs of its wares and how to ‘package’ the key product (e.g. initially the fentanyl was to be sold within gummy candies but later shifted to pressed pills). Finance was primitive, but that is understandable because the main challenge was what to do with excess cash, not how to obtain the capital necessary for expansion.

At least three of the key staff appeared to be full-time and salaried (paid by the month), although at least two people who worked regularly were paid piece rates ($1 per pill to the presser and the local wholesale connection). Four others (a runner, two who served as executive assistants, and the former partner who returned in a customer support role) appeared to work full-time, but it is not clear whether they were salaried or paid less formally. About fourteen others were paid by the activity and were not full-time workers (e.g. being paid a certain amount to receive a package).

Thus, not every activity committed in the furtherance of Shamo’s enterprise was performed by in-house workers; some was contracted out to what were essentially gig workers. But other functions were performed in-house by full-time employees. Legal firms often do the same.

There were ways in which Shamo’s enterprise was different or more than just a profit-making firm. Many of those involved were friends, and some socialised frequently. So just as street gangs offer members more than income, Shamo’s enterprise was not all business. Nonetheless, it seems fair to describe Shamo’s enterprise as an (illegal) firm and to liken it to other start-ups that sell both locally (through the broker) and via direct-to-consumer sales on the internet. The primary distinction beyond illegality is the degree of profitability, not something more fundamental or structural.

(2) The differences with typical in-person drug-selling enterprises are in some ways striking but one needs to acknowledge that in-person drug-selling enterprises can vary a great deal. Shamo recruited from his own circle of friends and acquaintances, many of whom had experience working at eBay. None had major prior criminal convictions or connections to drug distribution, though most/all had histories of drug use.

Shamo was undeniably charismatic but in other respects does not appear to us to have been the consummate entrepreneur. He left the bulk of his profits in cash where it was easy for law enforcement to seize (i.e. failed to manage against foreseeable risks). His deal with the staffer who developed the pill pressing method can be seen as unreasonably generous once the process was established; $1 per pill was close to 25% of revenues (i.e. Shamo overlooked opportunities to reduce a key component of his cost structure). At the same time, he paid other key staff relatively poorly, did not increase their pay commensurate with their workload, and was sometimes slow in paying some staff (i.e. failed to invest in the loyalty of staff who later cooperated with law enforcement against him).

(3) One strand of the criminal justice literature asks: ‘Does crime pay?’ and, in particular, are criminals’ net earnings fair compensation for the risks they suffer? Overall the literature suggests that typical street crime (e.g. burglaries and robberies) and retail drug selling may not, but high-level drug trafficking can (Desroches, Citation2005; Wilson & Abrahamse, Citation1992).

Except for the middleman selling directly to Utah dealers, Shamo and his staff faced little physical risk of violence, but what about the balancing of monetary compensation and prison time? We offer here admittedly very speculative calculations.

The recorded AlphaBay sales of $2.8 M were not the organisation’s total revenue. There were online sales that were not part of the price data set we analysed as well as in-person sales via the middleman to local dealers. For the sake of argument, let us consider the hypothetical that the organisation had $5 M in gross revenues. That revenue came at the price of one life sentence (for Shamo) and a total of about 30 years sentenced for co-conspirators. If Shamo actually serves 25 years and the others serve half their sentences that would work out to $5 M/(25 + 15) = $125,000 in revenue per year served. However, the government seized $2.4 M in cash and 513 Bitcoins that were worth about $500,000 at the time.Footnote11 So the conspirators might only have been able to spend and enjoy more like ($5 M – $2.9 M)/(25 + 15) = $52,500 per year served, or even less after deducting expenses for postage, AlphaBay commission, materials purchased, etc.

Another calculus compares years spent ‘living the highlife’ to years in prison.Footnote12 Although the first online sale dates to December 2015, large revenues were not realised until February 2016, or about 9 months before the organisation was shut down. So Shamo got about ¾ of a year of high-living in exchange for perhaps 25 years in prison. The pill presser joined later, so only got 4–5 months of that lifestyle for a 5-year sentence. The packaging staff had a comfortable but less extravagant income (equivalent of $84,000 per year tax-free) for the better part of a year in exchange for 3-year sentences. Arguably, crime did not pay very well for these individuals, but if they had managed to sell for 11 years, not 11 months before getting shut down, that calculus might look different.

Acknowledgments

We thank the HIDTA Narconomics project for giving us access to the investigators and prosecutors involved in this case, and Michael Gadd for providing the sales transaction data.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Funding

Notes

1. The vast majority of these ‘items’ are pills, but for some drugs not analysed here (e.g. LSD) the physical form may not literally have been a pill or tablet.

2. Duxbury and Haynie (Citation2021) took advantage of the fact that Silk Road 3.1 perhaps uniquely amongst major cryptomarkets identified the full user name, allowing them to track individual sellers and buyers.

3. Regarding the nature, if any, of a connection between the organisation and these deaths, the prosecutor’s sentencing memo states: ‘Due to the risk of unfair prejudice at trial, the United States agreed to not present evidence to the jury that more than ninety of the defendant’s customers had died from subsequent overdoses. While it is true in many instances that the defendant’s pills did not directly cause his customers’ deaths, in those instances the defendant’s pills fed his customers’ addictions until death ultimately took them. And it will never be fully known what percentage of the defendant’s customers knew the defendant substituted Fentanyl for oxycodone in his fake oxycodone pills. Similarly, the true number of the defendant’s victims cannot be calculated. When the defendant sold Fentanyl-laced fake oxycodone pills in bulk to redistributors, the end user of those pills cannot be found by investigators. The decedents listed below were largely users, not profit-seeking redistributors. As a memorial to those died, and to make a clear record of this central aspect to the nature and circumstances of the defendant’s crimes, the defendant’s now-deceased customers who were not mentioned at trial are discussed one-by-one below’.

4. Presumably for the lieutenant, mcg = microgram and mgs = milligrams.

5. The others included sales from as far back as October 12th. It is not clear what determined which transactions showed up in the private seller interface and which the investigators took screen shots of.

6. In 2016 a Bitcoin was worth about $1,000; see https://www.statmuse.com/money/ask/bitcoin+price+2016

7. The last day of week 46 was November 20th, 2016. Shamo was arrested on November 22nd, 2016. Starting on November 18th, 2016, law enforcement intercepted packages from the courier which were never mailed to customers.

8. Coefficients of variation around 0.1 are typical for commodities such as gasoline (Bergeaud & Raimbault, Citation2020) or wholesale milk prices (Wolf, Citation2010).

9. That date range is useful because the MBox30 label was not used until June, and overall prices were relatively stable until September 1st. Prices of all three forms increased in September, with further increases for F-RO (around October 1st), RO (September 27th), and MBox30 (November 7th).

10. Direct measures of fentanyl price trends are scarce, but the data from the United States Commission on Combating Synthetic Opioid Trafficking (Citation2021, Appendix B) show that the pure weight of fentanyl in small bags was increasing, and it is common for changes in the price per pure gram of illegal drugs to come about by changes in the pure amount in a bag, not a change in the purchase price of a standard bag.

11. The proper phrasing is that the government seized ‘approximately 513.15 Bitcoin, along with cryptocurrency that was created based on forks within the Bitcoin block chain including 512.93 Bitcoin Cash (BCH) and 513.15 Bitcoin Gold (BTG)’. The Bitcoins appreciated in value thereafter. The government sold them for $5.36 M, but that was more than they were worth in November 2016.

12. The text streams and various court exhibits document that Shamo and some friends were travelling and partying extensively. The prosecutor’s closing argument quotes Shamo as saying: ‘With money comes greed. I’m not going to lie. Money’s cool. With money comes a lifestyle. If you drive a BMW, you can’t go back to a Toyota’.

13. Half of Alprazolam item prices ended in $9 (86 of 169), and Alprazolam was the only drug with a price ending in $9.00. Interestingly, the one transaction with a price ending in $4.50 was also for Alprazolam. We are unsure why it appears that the postage charge may have been different for that one drug.

References

- Beckert, J., & Wehinger, F. (2013). In the shadow: Illegal markets and Economic Sociology. Socio-Economic Review, 11(1), 5–30. https://doi.org/10.1093/ser/mws020

- Bergeaud, A., & Raimbault, J. (2020). An empirical analysis of the spatial variability of fuel prices in the United States. Transportation Research Part A: Policy and Practice, 132, 131–143. https://doi.org/10.1016/j.tra.2019.10.016

- Brynjolfsson, E. and Yu Jeffrey, H. and Smith, M. D. (2006). From niches to riches: Anatomy of the Long Tail. Sloan Management Review, 47(4), 67–71. Summer Available at SSRN https://ssrn.com/abstract=918142

- Caulkins, J. P. (2007). Price and Purity analysis for Illicit drugs: Data and conceptual issues. Drug and Alcohol Dependence, 90, S61–S68. https://doi.org/10.1016/j.drugalcdep.2006.08.014

- Caulkins, J., & Padman, P. (1993). Quantity discounts and quality premia for Illicit drugs. Journal of the American Statistical Association, 88(423), 748–757. https://doi.org/10.1080/01621459.1993.10476335

- Caulkins, J. P., & Reuter, P. (2006). Illicit drug markets and economic irregularities. Socio-Economic Planning Sciences, 40, 1–14.

- Christin, N. (2017). An EU-focused analysis of drug supply on the AlphaBay marketplace. EMCDDA commissioned paper. Downloaded from https://www.drugsandalcohol.ie/28855/1/An%20EU-focused%20analysis%20of%20drug%20supply%20on%20the%20AlphaBay%20marketplace.pdf.

- Cimpanu, C. (2017, July 14). AlphaBay dark web market taken down after law enforcement raids. Bleeping Computer. https://www.bleepingcomputer.com/news/security/alphabay-dark-web-market-taken-down-after-law-enforcement-raids/.

- Décary-Hétu, D., & Quessy-Doré, O. (2017). Are repeat buyers in cryptomarkets loyal customers? Repeat business between dyads of cryptomarket vendors and users. American Behavioral Scientist, 61(11), 1341–1357. https://doi.org/10.1177/0002764217734265

- Desroches, F. J. (2005). The crime that pays: Drug trafficking and organized crime in Canada. Canadian Scholars’ Press.

- Duxbury, S. W., & Haynie, D. L. (2018). The network structure of opioid distribution on a darknet cryptomarket. Journal of Quantitative Criminology, 34(4), 921–941. https://doi.org/10.1007/s10940-017-9359-4

- Duxbury, S. W., & Haynie, D. L. (2021). Network embeddedness in illegal online markets: Endogenous sources of prices and profit in anonymous criminal drug trade. Socio-Economic Review, 21(1), 25–50. https://doi.org/10.1093/ser/mwab027

- Galofaro, C., & Whitehurst, L. (2019). The rise and fall of an Eagle Scout’s deadly fentanyl empire. AP News, September 15th. Downloaded on Febuary 9th, 2023 from https://apnews.com/article/health-salt-lake-city-us-news-ap-top-news-ut-state-wire-ce51cf7c958643629bce76764f71058d.

- Gambetta, D. (2009). Codes of the underworld: How criminals communicate. Princeton University Press.

- Gill, H., Kelly, E., & Henderson, G. (2019). How the complex pharmacology of the fentanyls contributes to their lethality. Addiction, 114(9), 1524. https://doi.org/10.1111/add.14614

- Greenberg, A. (2022). Tracers in the dark: The global hunt for the crimelords of cryptocurrency. New York: Doubleday.

- Greif, A. (2006). Institutions and the path to the Modern Economy: Lessons from Medieval trade. Cambridge University Press.

- Hedegaard, H., Miniño, A., Spencer, M., & Warner, M. (2021). Drug overdose deaths in the United States, 1999–2020. NCHS Data Brief, No. 428. Natl Cent Health Stat.

- Hillmann, H., & Aven, B. L. (2011). Fragmented networks and entrepreneurship in late imperial Russia. American Journal of Sociology, 117(2), 484–538. https://doi.org/10.1086/661772

- Humphreys, K., Shover, C. L., Andrews, C. M., Bohnert, A. S., Brandeau, M. L., Caulkins, J. P., Chen, J. H., Cuéllar, M. F., Hurd, Y. L., Juurlink, D. N., Koh, H. K., Krebs, E. E., Lembke, A., Mackey, S. C., Larrimore Ouellette, L., Suffoletto, B., & Timko, C. (2022). Responding to the opioid crisis in North America and beyond: Recommendations of the Stanford–lancet commission. The Lancet, 399(10324), 555–604. https://doi.org/10.1016/S0140-6736(21)02252-2

- Kleiman, M. (1992). Against excess: Drug Policy for Results. BasicBooks.

- Kollock, P. (1994). The emergence of exchange structures: An experimental study of uncertainty, commitment, and trust. American Journal of Sociology, 100(2), 313–345. https://doi.org/10.1086/230539

- Lusthaus, J., Van Oss, J., & Amann, P. (2022). The Gozi group: A criminal firm in cyberspace? European Journal of Criminology, 14773708221077615. https://doi.org/10.21428/cb6ab371.e1600be7

- Mars, S. G., Rosenblum, D., & Ciccarone, D. (2019). Illicit fentanyls in the opioid street market: Desired or imposed? Addiction, 114(5), 774–780. https://doi.org/10.1111/add.14474

- Martin, J., Cunliffe, J., & Munksgaard, R. (2019). Cryptomarkets: A Research Companion. Emerald Group.

- Martin, J., Munksgaard, R., Coomber, R., Demant, J., & Barratt, M. J. (2020). Selling drugs on darkweb cryptomarkets: Differentiated pathways, risks and rewards. The British Journal of Criminology, 60(3), 559–578. https://doi.org/10.1093/bjc/azz075

- Moeller, K., Munksgaard, R., & Demant, J. (2021). Illicit drug prices and quantity discounts: A comparison between a cryptomarket, social media, and police data. International Journal of Drug Policy, 91, 102969. https://doi.org/10.1016/j.drugpo.2020.102969

- Moeller, K., & Sandberg, S. (2019). Putting a price on drugs: An economic sociological study of price formation in illegal drug markets. Criminology, 57(2), 289–313. https://doi.org/10.1111/1745-9125.12202

- Morris, M. H. (1987). Separate prices as a marketing tool. Industrial Marketing Management, 16(2), 79–86. https://doi.org/10.1016/0019-8501(87)90012-5

- Munksgaard, R., & Tzanetakis, M. (2022). Uncertainty and risk: A framework for understanding pricing in online drug markets. International Journal of Drug Policy, 101, 103535. https://doi.org/10.1016/j.drugpo.2021.103535

- Paquet-Clouston, M., Décary-Hétu, D., & Morselli, C. (2018). Assessing market competition and vendors’ size and scope on AlphaBay. International Journal of Drug Policy, 54, 87–98. https://doi.org/10.1016/j.drugpo.2018.01.003

- Pardo, B., Taylor, J., Caulkins, J. P., Kilmer, B., Reuter, P., & Stein, B. D. (2019). The future of fentanyl and other Synthetic opioids. RAND.

- Przepiorka, W., Norbutas, L., & Corten, R. (2017). Order without law: Reputation promotes cooperation in a cryptomarkets for illegal drugs. European Sociological Review, 33(6), 752–764. https://doi.org/10.1093/esr/jcx072

- Reuter, P. (1983). Disorganized crime: The economics of the visible hand. MIT press.

- Reuter, P., & Caulkins, J. P. (2004). Illegal ‘lemons’: price dispersion in cocaine and heroin markets. Bulletin on Narcotics, 56(1–2), 141–165.

- Sebagh, L., Lusthaus, J., Gallo, E., Varese, F., & Sirur, S. (2022). Cooperation and distrust in extra-legal networks: A research note on the experimental study of marketplace disruption. Global Crime, 23(3), 259–283. https://doi.org/10.1080/17440572.2022.2031152

- U.S. Attorney for Utah. (2020). Shamo sentenced to life in prison after conviction for organizing, directing drug trafficking organization. Press Release. Downloaded on October 30 , 2022 from https://www.justice.gov/usao-ut/pr/shamo-sentenced-life-prison-after-conviction-organizing-directing-drug-trafficking.

- US Commission on Combating Synthetic Opioid Trafficking. (2021) . Commission on Combating Synthetic opioid trafficking. Rand Corporation.

- US vs Cazes. (2017). Eastern California dist. Ct. July 19, 2017. Verified Complaint for Forfeiture in REM. https://www.justice.gov/opa/press-release/file/982821/download.

- Williamson, O. E. (1975). University of Illinois at Urbana-Champaign’s Academy for Entrepreneurial Leadership Historical Research Reference in Entrepreneurship. New York: Free Press.

- Wilson, J. Q., & Abrahamse, A. (1992). Does crime pay? Justice Quarterly, 9(3), 359–377. https://doi.org/10.1080/07418829200091431

- Wolf, C. A. (2010). Understanding the milk-to-feed price ratio as a proxy for dairy farm profitability. Journal of Dairy Science, 93(10), 4942–4948. https://doi.org/10.3168/jds.2009-2998

APPENDIX

Elimination of Outliers

All but 14 of the Oxycodone transactions list a dose of 30.0 mg and all but 6 of the Xanax transactions list a dose of 3.0 mg, so those 20 anomalous transactions were dropped.

We dropped four Xanax observations whose listed prices and numbers of pills did not match. In particular, one sale listed 1,000 pills being sold for $124.50, which is a typical price for 100 pills. Three 10-pill sales listed prices typical of sales of 100 pills ($94 and $139) or 1,000 pills ($520.88).

Similarly, we dropped 8 Oxycodone observations whose listed prices and numbers of pills did not match. In particular, five sales listed 10 pills as being sold for $757.5 – $907, which is a typical price for 100 pills, and one sale at a price of $2,007.5, which is a typical price for 250 pills. One 1,000-pill sale listed a price of$857.5 which is typical of sales of 100 pills and one 5,000-pill sale listed a price of $3,257.5 which is typical of sales of 500 pills.

Possible Role of Postage in Item Pricing

Prices in our data are mostly not round dollar amounts, but that may be because of shipping costs. The 131 screenshots list priority mail postage charges of $0, $7.50, $8.00, and (for Alprazolam) $9.00. In each case, the corresponding list prices ended in $0, $7.50, $8.00, or $9.00, respectively. The comping of postage was limited to large transactions, with a minimum of $2,000 and all but two being for $3,500 or more.

shows that the majority of prices in our data for medium- and high-value purchases were a multiple of $10 plus one of those known postage amounts or plus $7 or $7.75, which we conjecture could have been postage charges earlier in the year (all screenshots are from late fall). A few of the 131 screenshots indicate the customer bought two batches. Those list the postage as half the usual amount, so the 3rd line of notes which prices were even multiples of $10 plus exactly half of a known or suspected postage charge.Footnote13 Those three conditions (price a multiple of $10 or that plus a postage amount or half the postage amount) account for 86% of medium- and 95% of high-value purchase prices.

Table A1. Postage amounts in medium- and high-value transactions.

Of the remaining high-value purchases, 21 were Fentanyl – Roxy Oxycodone observations with prices of $866.75 or $906.75, which may have had postage of $6.75, and 20 were Roxy – Oxycodone observations with prices of $863 or $903. Just six had prices that seemed not plausible to be a round number plus postage ($520.88, $861.58, $861.67, $862.88, two for $1,006.99).

The same general pattern was observed with prices ranging from $93.50 up to $498, but with more different endings (e.g. 65 ending in $2.75; 35 ending in $5.75).

Parallel analysis was not possible for small transactions because the pre-postage price would be less likely to be a multiple of $10.