Abstract

As more stakeholders pay increased attention to environmental concerns, the importance and application of green entrepreneurial orientation and green innovation have increased. Moreover, resource acquisition with firm age also plays a major role in giving confidence to invest in green activities. Therefore, the objective of the study is to identify the mediating role of green innovation and moderating role of resource acquisition with firm age between green entrepreneurial orientation and performance of entrepreneurial firms. The data was collected using simple random sampling. We found stimulating findings on the mediating role of green innovation and the moderating influence of resource acquisition with firm age on the relation between green innovation and performance of entrepreneurial firms based on the analysis of 384 enterprises operating in Karachi and Sialkot cities of Pakistan. More interestingly, our practical research implies that businesses that have been established for a longer time gain more compared to younger enterprises depending on green invention innovation and green utility-model innovation. These findings were a major contribution to the resource-based view and green utility-model. Our study adds to knowledge on both green entrepreneurial orientation and green innovation and guides the future researchers as well as practitioners about policies that they need to follow to gain the best out of green practices. Furthermore, we suggested the government authorities to motivate businesses to invest in green practices and guided the future researchers to identify the same influences of longer period, thereby guiding to go for longitudinal studies over the same model.

1. Introduction

Entrepreneurial firms especially in the developing countries are under pressure to safeguard the environment by complying with local government rules, stakeholder expectations, and market demands as a result of the increased focus on global environmental protection (Qazi et al., Citation2020; Sulaiman et al., Citation2023, Citation2023). Enterprises must develop their green capabilities to withstand escalating demand from the public and government (Ameer & Khan, Citation2022; Majali et al., Citation2022) and to consider the sustainability of the society at large (Kraus et al., Citation2020; Satar et al., Citation2023). Entrepreneurs embraced environmental initiatives like developing a firm’s green image, reducing impurities, fostering green innovation, and much more (Guo et al., Citation2020).

Researchers and the public have been paying more and more attention to green entrepreneurial orientation (Domańska et al., Citation2018; Ramayah et al., Citation2019). The practice of green entrepreneurial orientation, also called environmental entrepreneurship, eco-business, or sustainable entrepreneurship, involves innovations for environmental protection (Ahmad et al., Citation2015; Chang, Citation2011). Green entrepreneurial orientation is the entrepreneurial conduct in an enterprise’s green innovation of products, services, and market development to produce profit while considering environmental concerns (Ebrahimi & Mirbargkar, Citation2017; Ta’amnha et al., Citation2023). Thus, innovation is key behind achieving superior performance.

Furthermore, it is obvious that the foundation of entrepreneurship is innovation (Chang et al., Citation2023; Khan et al., Citation2021), and green innovation is the core of green entrepreneurial orientation (Sulaiman et al., Citation2023). Using innovation in processes and products, among other things, green innovation is a sustainable focused strategy that aims for the reduction of environmental damage caused by firms’ activities (Guo et al., Citation2020). Hence, it would be right to claim that green innovation being the improvement of a processes or products is leading to the benefits of the environment (Yousaf, Citation2021).

Green innovation, however, is a contentious green strategy, as a number of scholars contend about green innovation being a costly strategy that can harm performance because it costs a lot to implement (Tariq et al., Citation2019; Truong & Nagy, Citation2021). At the same time another group of scholars contend about green innovation being a green strategy able to support long-term growth of entrepreneurial firms because it gives businesses sustainable competitive advantage (Chang, Citation2011; Fernando et al., Citation2019). Based on the controversial findings it is mandatory to identify the relationship with the addition of mediating and moderating variable.

The body of knowledge on green entrepreneurial orientation is currently developing but is still there a significant room for further research (Tuan, Citation2023). The existing research that have looked into how green innovation affects performance have come up with conflicting results regarding the positive, negative, and insignificant impacts (Asadi et al., Citation2020; Hsu et al., Citation2021; Lin & Cheah, Citation2019; Shahzad et al., Citation2020; Singh et al., Citation2021). Based on the inconclusive findings of the previous studies, two major research gaps have been identified.

First, many researchers have looked at this relationship using data from the survey without considering the age of the firms (Aboelmaged & Hashem, Citation2019; Asad et al., Citation2021). In other words, it is not recommended to consider the young and mature firms equally, therefore, moderating role of resource acquisition with firm age has been added. Second, existing literature on green practices has prioritized large, well-established businesses while paying little attention to the small enterprises. The same is true for more recently new established businesses (Chen et al., Citation2016; Lin & Cheah, Citation2019) and enterprises.

A load of green innovation found in past studies is expected to have a stronger impact on entrepreneurial firms, however, given that their resource bases are comparatively more constrained than those of their large established counterparts (Muangmee et al., Citation2021). Hence, considering the gaps in the existing body of knowledge, we proposed that resource acquisition with firm age must be considered (Wang, Citation2019). Secondly, green innovation as a mediator has hardly been analyzed on the entrepreneurial firms operating in the developing countries.

Hence, initially, we investigated that if green entrepreneurial orientation adds to the performance using the theoretical lens of resource-based view and green utility model. Following the prior literature Likert scaled assessment is used to measure green innovation (Majali et al., Citation2022). Further research is being conducted to determine whether firm age which enhances the resources, risk taking tendency, and experience, which has gone unnoticed in earlier studies, especially for the entrepreneurial firms, substantially moderate the relationship between Green entrepreneurial orientation and performance of entrepreneurial firms, or not.

The current research contributes to several ways to the emerging body of knowledge on green entrepreneurial orientation and performance of entrepreneurial firms (Alvarez-Risco et al., Citation2021). Initially, this study adds entrepreneurial firms, which have received little attention by the prior researchers, to the body of knowledge on green entrepreneurial orientation. According to Asad et al. (Citation2021), SMEs make up 90% of all businesses in the country and contribute significantly to the invention, technology, and new product innovations (Asif et al., Citation2021; Sulaiman & Asad, Citation2023; Ta’amnha et al., Citation2023). This statistic emphasizes the crucial role that entrepreneurial firms play in developing and emerging economies, putting green concepts into action.

Additionally, by studying the various effects of two different forms of green innovations including product and process innovation on performance of entrepreneurial firms, our research deepens our understanding of how green entrepreneurial orientation affects performance through green innovation and moderated by resource acquisition with firm age, which has hardly been studied for the entrepreneurial firms. Affirmation that green innovation does not hold a guaranteed impact for the businesses, yet it underscores the complexity of green entrepreneurial orientation and its effects on businesses. This study advances the body of knowledge by providing a refined knowledge over the relationship between green entrepreneurial orientation and performance of entrepreneurial firms, through green innovation, influenced by firm age, using the theoretical lens of resource-based view and green utility-model, in the economic settings of Pakistan.

2. Literature theory and hypothesis

The concept of green practices is not new (Abbas & Khan, Citation2023). Throughout the world businesses are moving towards sustainability and green practices (Asad et al., Citation2023; Pham et al., Citation2023). However, enterprises in the developing countries are reluctant to follow the same because of the costs associated with the adoption of green practices. The focus of the current research is on the performance of entrepreneurial firms because these firms are more dynamic and are willing to take risky decisions.

Green entrepreneurial orientation acts as a major resource for the businesses. Green entrepreneurial orientation calls for green practices which may develop competitive advantage for the entrepreneurial firms. Likewise, green entrepreneurial orientation is such a resource which can be considered as value and rare among the competitors, moreover, it is innate as well. Thus, the proposition of resource-based view (Wernerfelt, Citation1984) supports the arguments raised in this research that green entrepreneurial orientation being a competitive resource can help entrepreneurial firms to gain superior performance. Furthermore, to strengthen the theoretical foundations, the support of green utility-model has been used.

The literature over the relationship between green entrepreneurial orientation and performance of entrepreneurial firms is not conclusive and has certain consistentency (Alwakid et al., Citation2020; Duque-Grisales et al., Citation2020; Lotfi et al., Citation2018). Some believe it results in high profitability, while some claimed that it is merely a cost for the small firms. Furthermore, the studies over green entrepreneurial orientation and green innovation have mostly followed the theoretical support of dynamic capabilities (Jiang et al., Citation2018), while important theoretical foundations of green utility-model have been under researched especially in the context of Pakistani entrepreneurial firms. Thus, in order to fulfill the contextual gap in the settings of Pakistan and theoretical gap in the form of inconsistencies in the available literature, it is better to identify the mediator and moderator which is disturbing this relationship (Baron & Kenny, Citation1986; Chmura Kraemer et al., Citation2008).

While reviewing the literature, innovation has been analyzed as a mediator by several researchers because innovation requires resources (Chang, Citation2011; Chen et al., Citation2016; Ebrahimi & Mirbargkar, Citation2017; Khan et al., Citation2021; Majali et al., Citation2022). However, green innovation is relatively under examined in the context of developing countries. Thus, the current research to enrich the body of entrepreneurial research in the developing countries proposes to identify the mediating role of green innovation between green entrepreneurial orientation and performance of entrepreneurial firms (Melay & Kraus, Citation2012).

Likewise, with the increasing age of the enterprises, their experience also increases along with their financial strength, and they become capable of making risky investments and absorbing the shocks. Therefore, considering the important role of age in the performance of entrepreneurial firms and following the prior literature over moderating role of resource acquisition with age over different relationships (Abdi et al., Citation2022; Yin et al., Citation2022), the current research proposes age to have a moderating role over the relationship between green entrepreneurial orientation and performance of entrepreneurial firms.

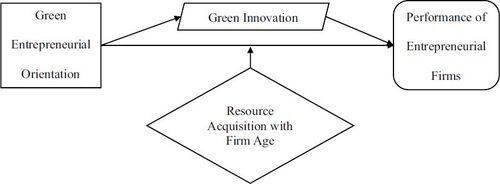

Thus, taking the theoretical support of green utility-model and resource-based view the following framework has been developed in figure .

The theoretical model developed in this study is based on resource-based view and the supporting theory used in the study is green utility-model. The main contribution of the study is that both the existing theories ignore the importance of age which can act as a major influencer, because with the increasing age the resources of the entrepreneurial firms increase, and they become capable of taking risky decisions for investing in green innovation. Based on the above framework, in the next section detailed literature review has been conducted to generate discussion over the hypothesis that has been developed based on the framework drawn above.

2.1. Green entrepreneurial orientation, green innovation, and performance of entrepreneurial firms

There have been a variety of expressions implied to define and view green entrepreneurial orientation, including eco-entrepreneurship and sustainable entrepreneurship (Mrkajic et al., Citation2017; Pratono et al., Citation2019; Shehzad et al., Citation2023). The idea behind these phrases is to increase revenues while reducing the harmful effects of business operations on the environment (GallardoVázquez et al., Citation2023; Rehman et al., Citation2021; Yousaf, Citation2021). Green entrepreneurial orientation in this study is defined as organizational innovation of products or processes for financial gain whilst keeping environmental preservation in view (Santini, Citation2017). Green innovation has been seen as a successful method to save the environment and make money (Lin & Chen, Citation2018; Wang et al., Citation2022), because now it is also considered as a good marketing tool to attract customers (He et al., Citation2023).

Although empirical results are conflicting, green entrepreneurial orientation can cause green innovation which can enable enterprises to achieve the targets in the areas of environmental sustainability and profitability both (Dhrifi et al., Citation2020). In a former study, the researchers concluded that innovation leads to superior performance (Khan et al., Citation2021). However, some researchers claimed that green innovation imposing a somewhat adverse impact on financial performance because they view it as a burden for the firms (Alwakid et al., Citation2020; Lotfi et al., Citation2018; Xie et al., Citation2023).

As the core of green entrepreneurial orientation, green innovation frequently requires a high cost of investment, increasing the financial strain on an enterprise (Duque-Grisales et al., Citation2020). The financial cost and obstacles highlight how challenging green entrepreneurial orientation is for entrepreneurial firms (Zuhaib et al., Citation2022). It is especially burdening for firms owing to their limited resources and expertise, which might limit how effectively they can implement an environmental plan (Ghazali & Zainurrafiqi, Citation2023). Despite these obstacles, this study focused on the fact that green innovation often improves performance of entrepreneurial firms.

Green innovation is capable of boosting economic performance of entrepreneurial firms by utilizing both tangible and intangible resources in addition to physical resources and technology (Damer et al., Citation2021; Fadhel et al., Citation2022; Huang et al., Citation2022). One way that green innovation improves the economy is by reducing costs, boosting productivity, or distinguishing products to help them outperform in the market (Ullah et al., Citation2021, Citation2021; Zameer et al., Citation2022; Zhang et al., Citation2019). Recognizing the physical resources that the enterprises lack and using technology to turn those resources into an advantage will help them perform economically (Suchek et al., Citation2021).

Enterprises might restructure products or production procedures, for instance, to increase resource regulation and decrease costs (materials, etc.), which will increase profitability (Hu et al., Citation2022; Lv et al., Citation2023). Additionally, as recycled resources are less expensive, businesses can increase economic performance by using recyclable materials (Javaid et al., Citation2022). Thus, implementing green innovation can have a positive influence over the performance of entrepreneurial firms.

Likewise, green innovation can also improve a reputation of the enterprise by influencing how they are perceived as being environmentally friendly (Amaleshwari & Jeevitha, Citation2023; Khan et al., Citation2021). According to the concept based on resource, businesses can gain a competitive edge by utilizing both intangible resources and technology in addition to tangible resources (Tu & Wu, Citation2021). Green image of entrepreneurial firms is shaped by green innovation (Srisathan et al., Citation2023) which significantly boosts the market repute of the firms.

Consumers, for instance, have a more favorable opinion of firms with green branding (Qalati et al., Citation2022; Riphah et al., Citation2022). According to market and commerce specialists, firms’ environmental commitment can be a compelling marketing tactic to draw in customers with a strong sense of environmental responsibility (Han, Citation2021; Li et al., Citation2020) which can significantly boost profits. Green innovation improves environmental reputation of the firms, which raises consumers’ perceptions of its dedication to the environment, increase consumer loyalty, which generates profit (Bilal & Sulaiman, Citation2021; Sharma et al., Citation2020; Wang et al., Citation2020).

Based on this research, green innovation refers to both green utility-model (Yin et al., Citation2022). Hence, based on the above discussion, there is no harm in arguing that green entrepreneurial orientation leads to green innovation which boosts performance of entrepreneurial firms. Therefore, the following hypothesis has been proposed:

H1:

Green entrepreneurial orientation has a significant impact over performance of entrepreneurial firms.

H2:

Green entrepreneurial orientation has a significant impact over green innovation.

H3:

Green innovation has a significant impact over the performance of entrepreneurial firms.

H4:

Green innovation mediates between green entrepreneurial orientation and performance of entrepreneurial firms.

2.2. Green entrepreneurial orientation, resource acquisition with age, and performance of SMEs

This study argues on the relationship between green entrepreneurial orientation and performance of entrepreneurial firms being significantly affected by the firm’s age, because of the inconsistencies found in the literature of green entrepreneurial orientation and performance. Existing research has found that a firm’s age has a significant moderating role to change the direction of the relationships (Abdi et al., Citation2022), as the findings over the relationship between green entrepreneurial orientation and performance are inconsistent. Scholars contend about age of the firm to have a detrimental effect on innovation (Eldridge et al., Citation2021), whereas some contend that firm age has a favorable effect on innovation (Chatterjee et al., Citation2021). Researchers have concluded that there is no significant correlation and an inverted U-shaped relationship of firm age with innovation activity (Fan & Wang, Citation2021; Ramadani et al., Citation2019). Thus, it also calls to examine the impact of firm over, because it has also certain controversies over its impact on performance.

Former businesses do, in fact, frequently have established external contacts that might provide approach towards assets essential for fostering innovation (Eldridge et al., Citation2021). A firm’s innovation also requires prior relevant experience and expertise (Mokhtarzadeh et al., Citation2020). To put it another way, cumulative experience, and information from previous trials, including successes and failures, can result in future innovative breakthroughs (Fan & Wang, Citation2021). Because experience with knowledge is necessary to develop green innovation, older organizations are therefore more likely to have been benefited from green entrepreneurial orientation compared to younger ones (Huang et al., Citation2022).

Furthermore, older entrepreneurial firms have more established methods for entrepreneurial strategies, which are crucial for facilitating green entrepreneurial activities (Gimenez-Fernandez et al., Citation2020); in contrast, younger firms frequently lack knowledge of these routines or organizational norms. As a result, we hypothesis that older organizations have resources (such as connections with the outside world and previously accumulated information) that encourage the application of green innovation which consequently improves the performance of entrepreneurial firms. Hence, there is no harm in proposing the moderating role of resource acquisition with firm age over the relationship between green entrepreneurial orientation and performance of entrepreneurial firms. Thus, the hypothesis is proposed as follows:

H5:

Resource acquisition with Firm age moderates the relationship between green entrepreneurial orientation and performance of entrepreneurial firms.

3. Research methodology

The purpose of the study is to identify the mediating role of green innovation and moderating role of resource acquisition with firm age between green entrepreneurial orientation and performance of entrepreneurial firms. Data for this study was gathered from the entrepreneurial firms operating in Sialkot and Karachi cities of Pakistan. These two cities reflect various geographic locations, ecological states, and economic developmental levels. Furthermore, these two cities constitute maximum number of SMEs in the country and have greatest share in the SME contribution in GDP of the country. Entrepreneurial firms were chosen from a diverse variety of industry areas, including, leather, sports goods, surgical instruments, and beauty instruments. Respondents in the sample entrepreneurial firms are Owners and managers. Consent was obtained through emails and phone calls. These respondents received questionnaires. Initially, the perspective respondents list was taken from the Chamber of commerce and industry Sialkot and Chamber of commerce and industry Karachi. Out of that list 1000 respondents were chosen using SPSS random sample selection technique. Then the questionnaires were sent to the respondents and a filter question explaining that is the firm entrepreneurial or not was used to proceed only with entrepreneurial firms. The respondents were asked about the flexibility of their firm in innovation and proactiveness. Those who responded in yes were taken for the final data analysis. The same strategy was adopted by previous researchers (Asad et al., Citation2023). To help the respondents understand our goals, a description of this survey was included with each questionnaire. Follow-up calls were made two weeks later to remind them, thank them for their involvement, and address any issues they faced while answering the questions. To maintain the anonymity of the survey, respondents forwarded the completed form straight to us, without their identity.

The measuring items were examined by the academic experts in the field of entrepreneurship. Out of 500 distributed questionnaires a total 384 valid questionnaires were returned that were complete and usable. In this study, businesses had an average tenure of 5 years, while there are 30 employees on average at each firm. Each item was evaluated using a seven-point Likert scale, with a range of 1 (strongly disagree) to 7 (strongly agree).

Five items for green entrepreneurial orientation and three items for green innovation measurement were adopted from Majali et al. (Citation2022). Five items for performance of entrepreneurial firms’ measurement were adopted from Asif et al. (Citation2021). Furthermore, SMEs demographics especially resource acquisition with age having moderating role is followed from Abdi et al. (Citation2022). The description of items is explained in Table .

Table 1. Description of items

For the descriptive analysis of variables SPSS 24 has been used. For evaluating the direct mediating and moderating hypotheses SMART PLS 3 has been used (Hair et al., Citation2013). The method has been used as the same analysis technique has been applied by the prior researchers conducting research in the sector (Hammami et al., Citation2021; Qalati et al., Citation2022).

4. Analysis and findings

To analyze the hypothesis of the study structural equation modelling has been applied using Smart PLS-3. Even though PLS is a non-parametric test, yet to ensure the generalizability of the findings descriptive and normality of the data was analyzed. In the descriptive mean and standard deviation are calculated only. To confirm normality of the collected data skewness and Kurtosis are calculated. The threshold values for Skewness are less than 3 and for kurtosis less than 8 (Hair et al., Citation2010).

From the above table the calculated data is normally distributed, and the findings can be generalized as the data is free from any kind of bias. Afterwards, the first step in structural equation modeling is to ensure the reliability and validity which are the two main criteria used in PLS-SEM analysis to evaluate the outer model (Joseph et al., Citation2013). The first step in evaluation of outer model is evaluating item loadings, followed by Cronbach’s alpha, composite reliability, and Average Variance Extracted (AVE). The threshold level for item loading is higher than 0.70 and the same for Cronbach’s alpha and composite reliability is 0.7, while the threshold for AVE is greater than 0.5 (Carmines & Zeller, Citation1979; Claes & Larcker, Citation1981; Hair et al., Citation2013). The evaluated values for the abovementioned tests are mentioned in Table .

Table 2. Descriptive analysis

The evaluated values in Table confirm that the items used in the instrument hold sufficient loadings and should be kept in the model. Furthermore, from the calculated values of Cronbach’s alpha, composite reliability, and AVE the instrument is reliable and valid. Another measure which is necessary to identify is to confirm that the items used to evaluate one construct are discriminated against from the items used to measure another construct. Therefore, discriminant validity is calculated which shows the capacity of scale to measure the only construct, it is supposed to measure. According to Fornell Larcker Criterion, the square root of AVE of a given construct is larger than its correlation with any other construct (Henseler et al., Citation2015). The evaluated values for the discriminant validity are mentioned in Table .

Table 3. Item loadings reliability and validity

Table confirmed that the items used to measure one construct are significantly different from the items used to measure the other construct. After ensuring that the outer model is reliable and valid, the inner model has been analyzed. Initially, only independent, mediating, and dependent variables were introduced in the model and their direct relationships were analyzed. The findings are mentioned in Table .

Table 4. Discriminant validity

The findings from Table confirmed that green entrepreneurial orientation significantly influences performance of entrepreneurial firms (β = 0.315, t = 2.212, p = 0.014). Likewise, green entrepreneurial orientation also significantly influences green innovation (β = 0.588, t = 5.110, p = 0.000). Similarly green innovation significantly influences performance of entrepreneurial firms (β = 0.469, t = 3.186, p = 0.001). The calculated values confirmed that all the direct relationships are significant. Afterwards the mediating role of green innovation has been analyzed for which the findings are mentioned in Table .

Table 5. Direct effects

Mediating is analyzed using the indirect effects method of PLS-SEM. The findings confirmed that the mediating role of green innovation is significant and positive (β = 0.240, t = 2.307, p = 0.011) as shown in table . The positive role is analyzed by analyzing the increased value of r2 after introducing mediator in the model. Afterwards the moderating variable which was resource acquisition with firm age has been introduced in the model and initially, the direct effect of the age is analyzed. Afterwards, interaction term has been introduced in the model to check the moderating effect of resource acquisition with firm Age between green entrepreneurial orientation and performance of entrepreneurial firms. The findings of the direct effect as well as the moderating effect of resource acquisition with firm age are mentioned in Table .

Table 6. Mediating Effect

Table 7. Moderating effect

The evaluated value for the direct effect of resource acquisition with firm age is significant which confirms that age of entrepreneurial firms influences the performance of entrepreneurial firms (β = 0.546, t = 4.351, p = 0.000). Similarly, when the interaction term was introduced, the moderating effect was also proven to be significant (β = 0.408, t = 2.395, p = 0.008). Furthermore, from the abovementioned table the entire model is significant.

To further confirm the findings, effect size has been measured to confirm the importance of intervening variables. Effect size is calculated by evaluating the model with presence and absence of the variable in the model and changes in the r2 is analyzed (Hair et al., Citation2010). Using the formula given by Chin et al. (Citation2003) effect size has been evaluated. If the calculated value of the f2 is 0.02 it shows small effect, however, 0.15 shows a moderate effect, while above 0.35 shows large effect (Chin et al., Citation2003). The findings for the effects size of mediator and moderator are mentioned in Table .

Table 8. Effect Size

As per the values calculated in the model above, mediator has almost a large effect, but it falls in the range of medium effect. However, moderator is showing large effect as the calculated value is above 0.35. Finally, to check the predictive relevance of the model. Blindfolding technique has been applied using construct cross validated redundancy using Stone-Geisser’s Q2 test (Hair et al., Citation2010). If the calculated value of Q2 falls below zero, then the model lacks predictive relevance.

The calculated value of Stone-Geisser’s Q2 as mentioned in table confirms that the model holds significant predictive relevance, and it can be used over any similar kind of settings.

Table 9. Construct cross Validated Redundancy

5. Discussions, implications, limitations, recommendations, and conclusions

Our study uses the data from 384 entrepreneurial firms from leather, sports goods, surgical instruments, and beauty instruments operating in Sialkot and Karachi cities of Pakistan to examine the effect of green entrepreneurial orientation on the performance of entrepreneurial firms and if this link varies because of age of the enterprise. The objective of the study was to identify the mediating role of green innovation and moderating role of resource acquisition with firm age, both the main objectives which were the contribution of the study have been fulfilled.

The findings confirmed the influence of green utility-model to confirm the mediating role of green innovation. We found significant evidence through the collected data that supports the claim that green innovation mediates and enhances performance of entrepreneurial firms. It is due to reduced application requirements, lower costs, a faster application process, and a shorter period of legal protection are characteristics of utility-model innovation (Guo et al., Citation2020; Zameer et al., Citation2022; Zhang et al., Citation2019). In other words, the speedier commercialization of technology, shorter lifecycle of the products which calls for the innovation on continuous bases and the increasing consumer knowledge for the green products calls for green innovation which plays a crucial function. The findings of this research imply towards impact that green utility-model has on performance of entrepreneurial firms which is confirmed for young as well as old enterprises, but the influence is magnified over the old firms, as the moderating role of resource acquisition with firm age is established. This also confirms that with the increase in experience of the entrepreneurs their capability to invest in risky projects mostly gives them advantageous outcomes. This is in line with the prior studies which claim the age holds a significant moderating role (Abdi et al., Citation2022; Yin et al., Citation2022; Ullah et al., Citation2021). Resource acquisition with firm age as a moderator has shown to have a significant impact because the age of the firm improves experience as well as the financial strength, which helps in taking right decisions and make the firms capable of doing right investments.

5.1. Implications of the study

Numerous theoretical and managerial advancements are made through our research. By distinguishing between several categories of green innovation, this research first adds to the body of knowledge on green entrepreneurial orientation as well as the performance of entrepreneurial firms.

5.2. Theoretical implications

Our research on mediating role of green invention by using the theoretical lens of green utility-model adds to the body of knowledge regarding the relationship between green entrepreneurial orientation and performance of entrepreneurial firms. Performance of entrepreneurial firms is significantly impacted by green innovation in the context of this research. While earlier studies have concentrated on green entrepreneurial orientation, we illustrate why it is crucial for future research to consider the diversity and complications of businesses’ green entrepreneurial initiatives.

The empirical results indicate that green entrepreneurial orientation is advantageous for entrepreneurial firms. Younger businesses, however, hardly earn profit from green innovation, yet their future becomes bright because of increasing trends of the consumers towards green activities. We also hypothesized that, given the theoretical justifications for the steady accumulation of resources such as experience, knowledge, and resources, age can also play a significant part for large enterprises. Thus, conformance of the moderating role of resource acquisition with firm age holds another significant theoretical contribution in the RBV which highlight only about the resources, however, in this study, resource acquisition with firm age has been catered as moderator which has proven significant by analysis of collected data.

Finally, we close the study gap found in the existing literature on green entrepreneurial orientation, which prioritizes large firms and mostly ignores small and medium entrepreneurial firms in case it relates to environmental strategy. This study deepens the concept of the relationship between environmentally friendly innovations and the performance of entrepreneurial firms. The results from our study confirm that environmentally friendly innovations encourage businesses to pursue environmentally friendly innovation commonly termed as green innovation.

5.3. Managerial implications

Our research has management implications as well. For instance, businesses are faced with the task of going “green” as the public’s awareness of environmental protection grows. Economic growth can be increased through green innovation, which is the core of green entrepreneurial orientation. Businesses may use a variety of creative techniques to combat constraints from the local government and stakeholders (e.g., customers). Policymakers of younger enterprises may be concerned about various sorts of investment in environment-related activities, beyond green technologies, given the general belief that entrepreneurial firms have scarcity of resources. Taking energy-saving equipment, for instance, our research revealed that green ideas might assist entrepreneurial firms. Green technologies are particularly risky because they are accompanied by investment uncertainty, but cost saving and increasing consumer trends towards green and environmentally friendly products can prove beneficial for entrepreneurial firms. To put it another way, green innovations present difficulties only for young firms since they lack the experience and resources needed to create green innovations. Hence, Failures in green R&D experiments could cause significant losses for young entrepreneurial firms.

5.4. Limitations and recommendations

Despite the importance of research theoretically as well as practically, the study has its limitations. First, we restrict our attention to enterprises only in two major cities which are considered as hub of firms in Pakistan, however, a detailed comparison over various cultural settings can further enhance the concept. Regulations pertaining to the environment may vary from area to area. Therefore, additional research in a wider empirical setting is required. Secondly, the study used primary method of data collection based on self-perception of the respondents, even though several measures were taken to avoid any kind of personal biasness of the respondents, however, in any primary study it is impossible to eliminate this issue, hence in future the researchers are guided to conduct qualitative study or to use secondary data to analyze the same model.

Additionally, we measure a firms’ green entrepreneurial activities using green innovation. Green innovation can acknowledge an organization’s efforts to safeguard the environment. When a firm, however, employs other types of green entrepreneurial tactics, such as maintaining fuel-conserving buildings, utilizing eco-friendly substances, and much more, it might not be a good measurement, but can have momentous impacts over the outcome of the green practices. Future research may consider a green innovation measurement that incorporates a vast range of green innovative activity. Additionally, through the empirical data we found that green invention innovation improves the performance of entrepreneurial firms.

Entrepreneurial firms may also gain from green utility-model innovation along with green invention innovation in various contextual settings. Green utility innovation that has more affordable benefits to the entrepreneurial firms. Therefore, a future study may investigate the implications of green innovation’s qualities, and it should be further explored how they affect performance. Future studies may also examine whether entrepreneurial firms and their large, established competitors differ in how much they can gain from green innovation. Large, well-established firms have resource advantages, therefore their preferences for green innovation and how it affects performance may differ from those of entrepreneurial firms.

6. Conclusions

Based on the above discussion, it is obvious that adoption of green entrepreneurial orientation is beneficial for the entrepreneurial firms, as it enhances their performance. Based on the perspective of RBV, this research confirms the positive impact of green entrepreneurial orientation over performance and enrich the theory by identifying the mediating role of green innovation using the theoretical support of green utility model. Furthermore, the confirmation of the moderating role of resource acquisition with firm age is another important finding which highlights the importance of experience and financial strength, which entrepreneurial firms gain with the passage of time.

Brief Profile of Muzaffar Asad.docx

Download MS Word (13.9 KB)Disclosure statement

No potential conflict of interest was reported by the author(s).

Supplemental material

Supplemental data for this article can be accessed online at https://doi.org/10.1080/23311975.2023.2291850

Additional information

Notes on contributors

Muzaffar Asad

Muzaffar Asad is currently working as Assistant Professor at College of Commerce and Business Administration Dhofar University, Oman, as well as Professor of Entrepreneurship, Global Visiting Faculty, at Technology De Monterry, Mexico. Before joining DU he has served as Associate Professor at Foundation University, Capital University of Science and Technology, and University of Central Punjab. He has completed his doctorate from Malaysia in entrepreneurship. He has a vast experience of teaching and training at various universities at national as well as international level. He is the certified trainer of IBA Karachi, Punjab Education Endowment Fund (PEEF), Akhuwat Institute of Social Entrepreneurship and Management (AISEM), and International Islamic University Islamabad (IIUI). He is also the Member of Editorial Board of Chinese Management Review, Sage Open, Journal of Business (European Journal), and Several Journals for Emerald and Springer.

References

- Abbas, J., & Khan, S. M. (2023). Green knowledge management and organizational green culture: An interaction for organizational green innovation and green performance. Journal of Knowledge Management, 27(7), 1852–17. https://doi.org/10.1108/JKM-03-2022-0156

- Abdi, Y., Li, X., & Càmara-Turull, X. (2022). Exploring the impact of sustainability (ESG) disclosure on firm value and financial performance (FP) in airline industry: The moderating role of size and age. Environment Development and Sustainability, 24(4), 5052–5079. https://doi.org/10.1007/s10668-021-01649-w

- Aboelmaged, M., & Hashem, G. (2019). Absorptive capacity and green innovation adoption in SMEs: The mediating effects of sustainable organisational capabilities. Journal of Cleaner Production, 220, 853–863. https://doi.org/10.1016/j.jclepro.2019.02.150

- Ahmad, N. H., Halim, H. A., Ramayah, T., & Rahman, S. A. (2015). Green entrepreneurship inclination among generation Y: The road towards a green economy. Problems and Perspectives in Management, 13(2), 211–218.

- Alvarez-Risco, A., Mlodzianowska, S., García-Ibarra, V., Rosen, M. A., & Del-Aguila-Arcentales, S. (2021). Factors affecting green entrepreneurship intentions in business university students in COVID-19 pandemic times: Case of Ecuador. Sustainability, 13(11), 1–16. https://doi.org/10.3390/su13116447

- Alwakid, W., Aparicio, S., & Urbano, D. (2020). Cultural antecedents of green entrepreneurship in Saudi Arabia: An institutional approach. Sustainability, 12(9), 3673. https://doi.org/10.3390/su12093673

- Amaleshwari, U., & Jeevitha, R. (2023). Entrepreneurial orientation and circular business practices: A conceptual framework. Journal of Management & Public Policy, 14(2), 16–26. https://doi.org/10.47914/jmpp.2023.v14i2.003

- Ameer, F., & Khan, N. R. (2022). Green entrepreneurial orientation and corporate environmental performance: A systematic literature review. European Management Journal. https://doi.org/10.1016/j.emj.2022.04.003

- Asad, M., Asif, M. U., Sulaiman, M. A., Satar, M. S., & Alarifi, G. (2023). Open innovation: The missing nexus between entrepreneurial orientation, total quality management, and performance of SMEs. Journal of Innovation and Entrepreneurship, 12(79), 1–13. https://doi.org/10.1186/s13731-023-00335-7

- Asad, M., Kashif, M., Sheikh, U. A., Asif, M. U., George, S., & Khan, G. U. (2021). Synergetic effect of safety culture and safety climate on safety performance in SMEs: Does transformation leadership have a moderating role. International Journal of Occupational Safety and Ergonomics, 28(3), 1–7. https://doi.org/10.1080/10803548.2021.1942657

- Asad, M., Majali, T., Aledeinat, M., & Almajali, D. A. (2023). Green entrepreneurial orientation for enhancing SMEs financial and environmental performance: Synergetic moderation of green technology dynamism and knowledge transfer and integration. Cogent Business & Management, 10(3), 1–20. https://doi.org/10.1080/23311975.2023.2278842

- Asadi, S., Pourhashemi, S. O., Nilashi, M., Abdullah, R., Samad, S., Yadegaridehkordi, E., Aljojo, N. Razali, N. S. (2020). Investigating influence of green innovation on sustainability performance: A case on Malaysian hotel industry. Journal of Cleaner Production, 258, 120860. https://doi.org/10.1016/j.jclepro.2020.120860

- Asif, M. U., Asad, M., Kashif, M., & Haq, A. U. (2021). Knowledge exploitation and knowledge exploration for sustainable performance of SMEs. 2021 Third International Sustainability and Resilience Conference: Climate Change (pp. 29–34). Sakheer: IEEE. https://doi.org/10.1109/IEEECONF53624.2021.9668135

- Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality & Social Psychology, 51(6), 1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173

- Bilal, Z. O., & Sulaiman, M. A. (2021). Factors persuading customers to adopt islamic banks and windows of commercial banks services in sultanate of Oman. Review of International Geographical Education(rigeo), 11(4), 651–660. https://doi.org/10.33403/rigeo.800679.

- Carmines, E. G., & Zeller, R. A. (1979). Reliability and validity assessment. Sage publications.

- Chang, C.-H. (2011). The influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. Journal of Business Ethics, 104(3), 361–370. https://doi.org/10.1007/s10551-011-0914-x

- Chang, Y.-Y., Lin, Y.-M., Chang, T.-W., & Chang, C.-Y. (2023). Sustainable corporate entrepreneurship performance and social capital: A multi-level analysis. Review of Managerial Science. https://doi.org/10.1007/s11846-023-00690-5

- Chatterjee, S., Chaudhuri, R., & Vrontis, D. (2021). Does data-driven culture impact innovation and performance of a firm? An empirical examination. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03887-z

- Chen, Y.-S., Chang, T.-W., Lin, C.-Y., Lai, P.-Y., & Wang, K.-H. (2016). The influence of proactive green innovation and reactive green innovation on green product development performance: The mediation role of green creativity. Sustainability, 8(10), 1–12. https://doi.org/10.3390/su8100966

- Chin, W. W., Marcolin, B. L., & Newsted, P. R. (2003). A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Information System Research, 14(2), 189–217 . https://doi.org/10.1287/isre.14.2.189.16018

- Chmura Kraemer, H., Kiernan, M., Essex, M., & Kupfer, D. J. (2008). How and why criteria defining moderators and mediators differ between the Baron & Kenny and MacArthur approaches. Health Psychology, 27(S2). https://doi.org/10.1037/0278-6133.27.2Suppl.S101

- Claes, F., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. https://doi.org/10.1177/002224378101800104

- Damer, N., Al-Znaimat, A. H., Asad, M., & Almansour, A. Z. (2021). Analysis of motivational factors that influence usage of computer assisted audit techniques (CAATs) auditors in Jordan. Academy of Strategic Management Journal, 20(Special Issue 2), 1–13. https://doi.org/10.5296/ijafr.v10i2.16692

- Dhrifi, A., Jaziri, R., & Alnahdi, S. (2020). Does foreign direct investment and environmental degradation matter for poverty? Evidence from developing countries. Structural Change and Economic Dynamics, 52, 13–21. https://doi.org/10.1016/j.strueco.2019.09.008

- Domańska, A., Żukowska, B., & Zajkowski, R. (2018). Green entrepreneurship as a connector among social, environmental and economic pillars of sustainable development. Why some countries are more agile? Problemy Ekorozwoju/Problems of Sustainable Development, 13(2), 67–76.

- Duque-Grisales, E., Aguilera-Caracuel, J., Guerrero-Villegas, J., & García-Sánchez, E. (2020). Does green innovation affect the financial performance of Multilatinas? The moderating role of ISO 14001 and R&D investment. Business Strategy and the Environment, 29(8), 3286–3302. https://doi.org/10.1002/bse.2572

- Ebrahimi, P., & Mirbargkar, S. M. (2017). Green entrepreneurship and green innovation for SME development in market turbulence. Eurasian Business Review, 7(2), 203–228. https://doi.org/10.1007/s40821-017-0073-9

- Eldridge, D., Nisar, T. M., & Torchia, M. (2021). What impact does equity crowdfunding have on SME innovation and growth? An empirical study. Small Business Economics, 56(1), 105–120. https://doi.org/10.1007/s11187-019-00210-4

- Fadhel, H. A., Aljalahma, A., Almuhanadi, M., Asad, M., & Sheikh, U. (2022). Management of higher education institutions in the GCC countries during the emergence of COVID-19: A review of opportunities, challenges, and a way forward. The International Journal of Learning in Higher Education, 29(1), 83–97. https://doi.org/10.18848/2327-7955/CGP/v29i01/83-97

- Fan, S., & Wang, C. (2021). Firm age, ultimate ownership, and R&D investments. International Review of Economics & Finance, 76, 1245–1264. https://doi.org/10.1016/j.iref.2019.11.012

- Fernando, Y., Jabbour, C. J., & Wah, W.-X. (2019). Pursuing green growth in technology firms through the connections between environmental innovation and sustainable business performance: Does service capability matter? Resources, Conservation & Recycling, 141, 8–20. https://doi.org/10.1016/j.resconrec.2018.09.031

- GallardoVázquez, D., HerradorAlcaide, T. C., & Sánchezdomínguez, J. D. (2023). Developing a measurement scale of corporate socially responsible entrepreneurship in sustainable management. Review of Managerial Science, 1–50. https://doi.org/10.1007/s11846-023-00658-5

- Ghazali, G., & Zainurrafiqi, Z. (2023). The effect of green entrepreneur orientation on network resource acquisition and small and medium enterprises’ business performance with knowledge transfer and integration and green technology dynamism as moderator variables. Indonesian Interdisciplinary Journal of Sharia Economics (IIJSE), 6(1), 136–153. https://doi.org/10.31538/iijse.v6i1.2723

- Gimenez-Fernandez, E. M., Sandulli, F. D., & Bogers, M. (2020). Unpacking liabilities of newness and smallness in innovative start-ups: Investigating the differences in innovation performance between new and older small firms. Research Policy, 49(10), 104049. https://doi.org/10.1016/j.respol.2020.104049

- Guo, Y., Wang, L., & Chen, Y. (2020). Green entrepreneurial orientation and green innovation: The mediating effect of supply chain learning. SAGE Open, 10(1), 215824401989879. https://doi.org/10.1177/2158244019898798

- Hair, J. F., Black, B., Babin, B., & Anderson, R. E. (2010). Multivariate data analysis. Pearson Education International.

- Hair, J. F., Ringle, C. M., & Sarstedt, M. (2013). Editorial-partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Planning, 46(1), 1–12. https://doi.org/10.1016/j.lrp.2013.01.001

- Hammami, S. M., Ahmed, F., Johny, J., & Sulaiman, M. A. (2021). Impact of knowledge capabilities on organisational performance in the private sector in Oman: An SEM approach using path analysis. International Journal of Knowledge Management, 17(1), 15–18. https://doi.org/10.4018/IJKM.2021010102

- Han, H. (2021). Consumer behavior and environmental sustainability in tourism and hospitality: A review of theories, concepts, and latest research. Journal of Sustainable Tourism, 29(7), 2021–1042. https://doi.org/10.1080/09669582.2021.1903019

- He, Q., Ribeiro-Navarrete, S., & Botella-Carrubi, D. (2023). A matter of motivation: The impact of enterprise digital transformation on green innovation. Review of Managerial Science. https://doi.org/10.1007/s11846-023-00665-6

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. https://doi.org/10.1007/s11747-014-0403-8

- Hsu, C.-C., Quang-Thanh, N., Chien, F., Li, L., & Mohsin, M. (2021). Evaluating green innovation and performance of financial development: Mediating concerns of environmental regulation. Environmental Science and Pollution Research, 28(40), 57386–57397. https://doi.org/10.1007/s11356-021-14499-w

- Hu, D., Jiao, J., Tang, Y., Xu, Y., & Zha, J. (2022). How global value chain participation affects green technology innovation processes: A moderated mediation model. Technology in Society, 68, 101916. https://doi.org/10.1016/j.techsoc.2022.101916

- Huang, W., Chau, K. Y., Kit, I. Y., Nureen, N., Irfan, M., & Dilanchiev, A. (2022). Relating sustainable business development practices and information management in promoting digital green innovation: Evidence from China. Frontiers in Psychology, 13, 930138. https://doi.org/10.3389/fpsyg.2022.930138

- Javaid, M., Singh, R. P., & Suman, R. (2022). Sustainability 4.0 and its applications in the field of manufacturing. Internet of Things and Cyber-Physical Systems, 2, 82–90. https://doi.org/10.1016/j.iotcps.2022.06.001

- Jiang, W., Chai, H., Shao, J., & Feng, T. (2018). Green entrepreneurial orientation for enhancing firm performance: A dynamic capability perspective. Journal of Cleaner Production, 198, 1311–1323. https://doi.org/10.1016/j.jclepro.2018.07.104

- Joseph, F., Hair, J., Hult, G. T., Ringle, C., & Sarstedt, M. (2013). A primer on partial least squares structural equation modeling (PLS-SEM). SAGE Publications.

- Khan, A. A., Asad, M., Khan, G. U., Asif, M. U., & Aftab, U. (2021). Sequential mediation of innovativeness and competitive advantage between resources for business model innovation and SMEs performance. 2021 International Conference on Decision Aid Sciences and Application (DASA) (pp. 724–728). Sakheer: IEEE. https://doi.org/10.1109/DASA53625.2021.9682269

- Khan, P. A., Johl, S. K., & Johl, S. K. (2021). Does adoption of ISO 56002-2019 and green innovation reporting enhance the firm sustainable development goal performance? An emerging paradigm. Business Strategy and the Environment, 30(7), 2922–2936. https://doi.org/10.1002/bse.2779

- Kraus, S., Rehman, S. U., & García, F. J. (2020). Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technological Forecasting & Social Change, 160, 120262. https://doi.org/10.1016/j.techfore.2020.120262

- Li, Z., Liao, G., & Albitar, K. (2020). Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. Business Strategy and the Environment, 29(3), 1045–1055. https://doi.org/10.1002/bse.2416

- Lin, W.-L., & Cheah, J.-H. (2019). Does firm size matter? Evidence on the impact of the green innovation strategy on corporate financial performance in the automotive sector. Journal of Cleaner Production, 229, 974–988. https://doi.org/10.1016/j.jclepro.2019.04.214

- Lin, Y.-H., & Chen, H.-C. (2018). Critical factors for enhancing green service innovation: Linking green relationship quality and green entrepreneurial orientation. Journal of Hospitality & Tourism Technology, 9(2), 188–203. https://doi.org/10.1108/JHTT-02-2017-0014

- Lotfi, M., Yousefi, A., & Jafari, S. (2018). The effect of emerging green market on green entrepreneurship and sustainable development in knowledge-based companies. Sustainability, 10(7), 2308. https://doi.org/10.3390/su10072308

- Lv, C., Fan, J., & Lee, C.-C. (2023). Can green credit policies improve corporate green production efficiency? Journal of Cleaner Production, 397, 136573. https://doi.org/10.1016/j.jclepro.2023.136573

- Majali, T., Alkaraki, M., Asad, M., Aladwan, N., & Aledeinat, M. (2022). Green transformational leadership, green entrepreneurial orientation and performance of SMEs: The mediating role of green product innovation. Journal of Open Innovation: Technology, Market, and Complexity, 8(191), 1–14. https://doi.org/10.3390/joitmc8040191

- Melay, I., & Kraus, S. (2012). Green entrepreneurship: Definitions of related concepts. International Journal of Strategic Management, 12(2), 1–6.

- Mokhtarzadeh, N. G., Mahdiraji, H. A., Jafarpanah, I., Jafari-Sadeghi, V., & Cardinali, S. (2020). Investigating the impact of networking capability on firm innovation performance: Using the resource-action-performance framework. Journal of Intellectual Capital, 21(6), 1009–1034. https://doi.org/10.1108/JIC-01-2020-0005

- Mrkajic, B., Murtinu, S., & Scalera, V. G. (2017). Is green the new gold? Venture capital and green entrepreneurship. Small Business Economics, 52(4), 929–950. https://doi.org/10.1007/s11187-017-9943-x

- Muangmee, C., Dacko-Pikiewicz, Z., Meekaewkunchorn, N., Kassakorn, N., & Khalid, B. (2021). Green entrepreneurial orientation and green innovation in small and medium-sized enterprises (SMEs). Social Sciences, 10(4), 1–15. https://doi.org/10.3390/socsci10040136

- Pham, N. T., Jabbour, C. J., Vo-Thanh, T., Huynh, T. L., & Santos, C. (2023). Greening hotels: Does motivating hotel employees promote in-role green performance? The role of culture. Journal of Sustainable Tourism, 31(4), 951–970. https://doi.org/10.1080/09669582.2020.1863972

- Pratono, A. H., Darmasetiawan, N. K., Yudiarso, A., & Jeong, B. G. (2019). Achieving sustainable competitive advantage through green entrepreneurial orientation and market orientation: The role of inter-organizational learning. The Bottom Line, 32(1), 2–15. https://doi.org/10.1108/BL-10-2018-0045

- Qalati, S. A., Ostic, D., Sulaiman, M. A., Gopang, A. A., & Khan, A. (2022). Social media and SMEs’ performance in developing countries: Effects of technological-organizational-environmental factors on the adoption of social media. SAGE Open, 12(2), 1–13. https://doi.org/10.1177/21582440221094594

- Qalati, S. A., Qureshi, N., Ostic, D., & Sulaiman, M. A. (2022). An extension of the theory of planned behavior to understand factors influencing Pakistani households’ energy-saving intentions and behavior: A mediated–moderated model. Energy Efficiency, 15(6), 1–21. https://doi.org/10.1007/s12053-022-10050-z

- Qazi, W., Qureshi, J. A., Raza, S. A., Khan, K. A., & Qureshi, M. A. (2020). Impact of personality traits and university green entrepreneurial support on students’ green entrepreneurial intentions: The moderating role of environmental values. Journal of Applied Research in Higher Education, 13(4), 1154–1180. https://doi.org/10.1108/JARHE-05-2020-0130

- Ramadani, V., Hisrich, R. D., Abazi-Alili, H., Dana, L.-P., Panthi, L., & Abazi-Bexheti, L. (2019). Product innovation and firm performance in transition economies: A multi-stage estimation approach. Technological Forecasting & Social Change, 140, 271–280. https://doi.org/10.1016/j.techfore.2018.12.010

- Ramayah, T., Rahman, S. A., & Taghizadeh, S. K. (2019). Modelling green entrepreneurial intention among university students using the entrepreneurial event and cultural values theory. International Journal of Entrepreneurial Venturing, 11(4), 394–412. https://doi.org/10.1504/IJEV.2019.101629

- Rehman, S. U., Kraus, S., Shah, S. A., Khanin, D., & Mahto, R. V. (2021). Analyzing the relationship between green innovation and environmental performance in large manufacturing firms. Technological Forecasting & Social Change, 163, 120481. https://doi.org/10.1016/j.techfore.2020.120481

- Riphah, H. Z., Ali, S., Danish, M., & Sulaiman, M. A. (2022). Factors affecting consumers intentions to purchase dairy products in Pakistan: A cognitive affective-attitude approach. Journal of International Food & Agribusiness Marketing, 1–26. https://doi.org/10.1080/08974438.2022.2125919

- Santini, C. (2017). Ecopreneurship and ecopreneurs: Limits, trends and characteristics. Sustainability, 9(4), 492. https://doi.org/10.3390/su9040492

- Satar, M. S., Alarifi, G., Alkhoraif, A. A., & Asad, M. (2023). Influence of perceptual and demographic factors on the likelihood of becoming social entrepreneurs in Saudi Arabia, Bahrain, and United Arab Emirates – an empirical analysis. Cogent Business & Management, 10(3), 1–21. https://doi.org/10.1080/23311975.2023.2253577

- Shahzad, M., Qu, Y., Zafar, A. U., Rehman, S. U., & Islam, T. (2020). Exploring the influence of knowledge management process on corporate sustainable performance through green innovation. Journal of Knowledge Management, 24(9), 2079–2106. https://doi.org/10.1108/JKM-11-2019-0624

- Sharma, T., Chen, J., & Liu, W. Y. (2020). Eco-innovation in hospitality research (1998-2018): A systematic review. International Journal of Contemporary Hospitality Management, 32(2), 913–933. https://doi.org/10.1108/IJCHM-01-2019-0002

- Shehzad, M. U., Zhang, J., Latif, K. F., Jamil, K., & Waseel, A. H. (2023). Do green entrepreneurial orientation and green knowledge management matter in the pursuit of ambidextrous green innovation: A moderated mediation model. Journal of Cleaner Production, 388, 135971. https://doi.org/10.1016/j.jclepro.2023.135971

- Singh, S. K., Giudice, M. D., Jabbour, C. J., Latan, H., & Sohal, A. S. (2021). Stakeholder pressure, green innovation, and performance in small and medium-sized enterprises: The role of green dynamic capabilities. Business Strategy and the Environment, 31(1), 500–514. https://doi.org/10.1002/bse.2906

- Srisathan, W. A., Ketkaew, C., Phonthanukitithaworn, C., & Naruetharadhol, P. (2023). Driving policy support for open eco-innovation enterprises in Thailand: A probit regression model. Journal of Open Innovation: Technology, Market, and Complexity, 9(3), 100084. https://doi.org/10.1016/j.joitmc.2023.100084

- Suchek, N., Fernandes, C. I., Kraus, S., Filser, M., & Sjögrén, H. (2021). Innovation and the circular economy: A systematic literature review. Business Strategy and the Environment, 30(8), 3686–3702. https://doi.org/10.1002/bse.2834

- Sulaiman, M. A., & Asad, M. (2023). Organizational learning, innovation, organizational structure and performance: Evidence from Oman. ISPIM Conference Proceedings (pp. 1–17). Ljubljana: ISPIM.

- Sulaiman, M. A., Asad, M., Ismail, M. Y., & Shabbir, M. S. (2023). Catalyst role of university green entrepreneurial support promoting green entrepreneurial inclinations among youth: Empirical evidence from Oman. International Journal of Professional Business Review, 8(8), e02723–e02723. https://doi.org/10.26668/businessreview/2023.v8i8.2723

- Sulaiman, M. A., Asad, M., Shabbir, M. S., & Ismail, M. Y. (2023). Support factors and green entrepreneurial inclinations for sustainable competencies: Empirical evidence from Oman. International Journal of Professional Business Review, 8(8), e02724–e02724. https://doi.org/10.26668/businessreview/2023.v8i8.2724

- Ta’amnha, M. A., Magableh, I. K., Asad, M., & Al-Qudah, S. (2023). Open innovation: The missing link between synergetic effect of entrepreneurial orientation and knowledge management over product innovation performance. Journal of Open Innovation: Technology, Market, and Complexity, 9(4), 1–9. https://doi.org/10.1016/j.joitmc.2023.100147

- Tariq, A., Badir, Y., & Chonglerttham, S. (2019). Green innovation and performance: Moderation analyses from Thailand. European Journal of Innovation Management, 22(3), 446–467. https://doi.org/10.1108/EJIM-07-2018-0148

- Truong, Y., & Nagy, B. G. (2021). Nascent ventures’ green initiatives and angel investor judgments of legitimacy and funding. Small Business Economics, 57(4), 1801–1818. https://doi.org/10.1007/s11187-020-00373-5

- Tu, Y., & Wu, W. (2021). How does green innovation improve enterprises’ competitive advantage? The role of organizational learning. Sustainable Production and Consumption, 26, 504–516. https://doi.org/10.1016/j.spc.2020.12.031

- Tuan, L. T. (2023). Fostering green product innovation through green entrepreneurial orientation: The roles of employee green creativity, green role identity, and organizational transactive memory system. Business Strategy and the Environmant, 32(1), 639–653. https://doi.org/10.1002/bse.3165

- Ullah, Z., Otero, S. Á., Sulaiman, M. A., Sial, M. S., Ahmad, N., Scholz, M., & Omhand, K. (2021). Achieving organizational social sustainability through electronic performance appraisal systems: The moderating influence of transformational leadership. Sustainability, 13(10), 1–14. https://doi.org/10.3390/su13105611

- Ullah, Z., Sulaiman, M. A., Ali, S. B., Ahmad, N., Scholz, M., & Han, H. (2021). The effect of work safety on organizational social sustainability improvement in the healthcare sector: The case of a public sector hospital in Pakistan. International Journal of Environmental Research and Public Health, 18(12), 1–18. https://doi.org/10.3390/ijerph18126672

- Wang, C.-H. (2019). How organizational green culture influences green performance and competitive advantage: The mediating role of green innovation. Journal of Manufacturing Technology Management, 30(4), 666–683. https://doi.org/10.1108/JMTM-09-2018-0314

- Wang, C., Zhang, X.-E., & Teng, X. (2022). How to convert green entrepreneurial orientation into green innovation: The role of knowledge creation process and green absorptive capacity. Business Strategy and the Environment, 32(4), 1260–1273. https://doi.org/10.1002/bse.3187

- Wang, X., Zhao, Y., & Hou, L. (2020). How does green innovation affect supplier-customer relationships? A study on customer and relationship contingencies. Industrial Marketing Management, 90, 170–180. https://doi.org/10.1016/j.indmarman.2020.07.008

- Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171–180. https://doi.org/10.1002/smj.4250050207

- Xie, Z. Q., Sulaiman, M. A., & Qureshi, N. A. (2023). Understanding factors influencing healthcare workers’ intention towards the COVID-19 vaccine. PLoS One, 18(7), e0286794. https://doi.org/10.1371/journal.pone.0286794

- Yin, C., Salmador, M. P., Li, D., & Lloria, M. B. (2022). Green entrepreneurship and SME performance: The moderating effect of firm age. International Entrepreneurship & Management Journal, 18(1), 255–275. https://doi.org/10.1007/s11365-021-00757-3

- Yousaf, Z. (2021). Go for green: Green innovation through green dynamic capabilities: Accessing the mediating role of green practices and green value co-creation. Environmental Science and Pollution Research, 28(39), 54863–54875. https://doi.org/10.1007/s11356-021-14343-1

- Zameer, H., Wang, Y., Yasmeen, H., & Mubarak, S. (2022). Green innovation as a mediator in the impact of business analytics and environmental orientation on green competitive advantage. Management Decision, 60(2), 488–507. https://doi.org/10.1108/MD-01-2020-0065

- Zhang, D., Rong, Z., & Ji, Q. (2019). Green innovation and firm performance: Evidence from listed companies in China. Resources, Conservation & Recycling, 144, 48–55. https://doi.org/10.1016/j.resconrec.2019.01.023

- Zuhaib, Z., Wenyuan, L., Sulaiman, M. A., Siddiqu, K. A., & Qalati, S. A. (2022). Social entrepreneurship orientation and enterprise fortune: An intermediary role of social performance. Frontiers in Psychology, 12, 1–17. https://doi.org/10.3389/fpsyg.2021.755080