Abstract

This research study addresses the complex interaction in between advertising and marketing capabilities, financial performance, and the moderating impact of consumer relationship management (CRM) in Jordanian small and medium enterprises (SMEs) in the service field. Partial Least Squares Structural Equation Modeling (PLS-SEM) analysis was used for this study. The study clearly verifies a significant and favorable relationship in between advertising alignment and financial performance, highlighting the tactical value of customer-centric approaches. It likewise highlights the prominent function of value development in driving monetary success and the positive effect of operational capabilities on financial efficiency. Furthermore, the research study discovers the reliable moderation of CRM in the connections amongst marketing alignment, value development, operational capacities, and financial performance. These searchings for highlight the central role of CRM in improving the effect of marketing abilities on financial end results and offer useful understandings for Jordanian SMEs in the solution sector looking for to optimize financial performance and boost client connections.

IMPACT STATEMENT

This research focused on investigating the impact of marketing strategies on the financial performance of Jordanian small and medium enterprises (SMEs) in the service sector. Partial Least Squares Structural Equation Modelling (PLS-SEM) was used to examine the correlations between marketing orientation, value innovation, operational capabilities and financial performance. The study found strong positive relationships between these factors and emphasised the importance of customer-centric approaches, innovation beyond products and efficient internal processes for the financial success of SMEs. The results of this study contribute to a broader discussion of SME management practises and strategies and emphasise the critical role of customer relationship management (CRM) in improving the impact of marketing, innovation and operational efficiency on financial performance. The findings of this study offer valuable insights not only for Jordanian SMEs seeking improved financial performance but also for understanding similar dynamics in SMEs around the world.

REVIEWING EDITOR:

Introduction

A company’s marketing capacities are characterized as its capacity to design, implement, and measure marketing strategies and campaigns that add value for customers and eventually improve the company’s financial performance. To put it another way, a company’s marketing talents are essential to its financial success because they enable it to successfully position its goods and services in the market and to draw in and keep customers (Tarsakoo & Charoensukmongkol, Citation2020). In the academic literature, this connection between marketing skills and financial performance has been thoroughly researched (Algarni et al., Citation2022; Cassia & Magno, Citation2022; Tolstoy et al., Citation2022). Small and medium-sized businesses (SMEs) employ more than two-thirds of the workforce and make up more than 90% of all firms in Jordan, contributing significantly to the country’s economy (Salameh et al., Citation2022). However, these SMEs encounter a number of difficulties when creating successful marketing plans and solidifying client connections, which may have an effect on their financial performance (Ma et al., Citation2022). For the success and development of Jordanian SMEs, it is crucial to comprehend the relationship between marketing capabilities and financial performance, as well as the moderating function of CRM in this relationship. According to research on the relationship between marketing capabilities and financial performance, businesses are more likely to experience higher financial success if they have stronger marketing capabilities (Tolstoy et al., Citation2022). Companies that are stronger at market sensing, for instance, which entails obtaining and analyzing data regarding consumer preferences and market trends, are better equipped to create and provide goods and services that cater to the wants and preferences of customers. This can then result in greater customer retention, loyalty, and repeat business, all of which help to improve financial success. In a similar vein, businesses with great marketing communication skills—which entail convincing customers of the value of the firm’s goods or services—are better equipped to stand out from rivals and draw in clients (Alshurideh et al., Citation2023). Higher levels of customer acquisition and retention may result from this, which, eventually, may help to improve financial performance. Yet, there are a variety of variables that may influence the relationship between marketing capabilities and financial performance, making it not always clear-cut (Wang et al., Citation2022). CRM is one such element, which entails maintaining and growing client relationships in order to increase customer lifetime value (Hamida et al., Citation2022). In-depth research has been done in the academic literature on the relationship between marketing skills and financial performance, with varying degrees of success. According to several studies, CRM can strengthen the link between marketing effectiveness and financial performance by increasing client loyalty and recurring business (Hanaysha & Al-Shaikh, Citation2022; Liu & Chen, Citation2023). For instance, a study of Indian SMEs revealed that enterprises with higher levels of marketing capabilities and better CRM procedures outperformed those with lower levels of marketing capabilities and subpar CRM practices in terms of financial success. Similarly, a study of Malaysian SMEs discovered a substantial correlation between CRM and financial performance, with the association being stronger for businesses with more advanced marketing skills (Jalil et al., Citation2022). Yet, according to other studies, CRM either does not regulate the association between marketing capabilities and financial performance or its moderating effect is context-dependent. For instance, research of Dutch SMEs revealed that CRM did not modify the association between marketing capabilities and financial success, indicating that the advantages of marketing capabilities may be unrelated to CRM procedures (Hagen et al., Citation2022). Parallel to this, a study of South African SMEs discovered that the degree of industry competition affected how much of a moderating influence CRM had on the link between marketing capabilities and financial performance (Duffett & Cromhout, Citation2022). Small and medium-sized businesses (SMEs) account for more than 90% of all firms in Jordan and employ more than two-thirds of the labor force. SMEs are crucial to the country’s economy. Unfortunately, these SMEs encounter a number of obstacles when creating successful marketing plans and solidifying client connections, which may have an impact on their financial performance. There is broad agreement that organizations with greater marketing capabilities tend to generate stronger financial success. This relationship between marketing capabilities and financial performance has been extensively examined in the academic literature. Yet, in the context of Jordanian SMEs, the moderating impact of customer relationship management (CRM) in this relationship is not well known. CRM, which entails managing and nurturing client connections to enhance customer lifetime value, is essential to the success of SMEs in Jordan. Improved client loyalty and repeat business can ultimately lead to improved financial success thanks to effective CRM techniques. It is unclear, though, how much CRM modifies the connection between marketing prowess and monetary performance in Jordanian SMEs. Given their substantial contribution to the economy of the nation, it is crucial for the development and expansion of Jordanian SMEs to comprehend this relationship. SMEs can compete more effectively in the market and achieve improved financial performance by establishing excellent CRM practices and developing effective marketing capabilities. As a result, more jobs may be created, the economy may grow faster, and the nation as a whole may experience higher wealth. There are a number of obstacles that Jordanian SMEs must overcome in order to improve their marketing strategies and bottom lines. They generally cannot afford to invest in extensive marketing methods, which limits their capacity to reach new customers and keep existing ones. Their potential for development and innovation may also be stunted by a lack of resources. Furthermore, SMEs are under pressure to differentiate and innovate due to intense regional and national market competition. In addition, bureaucratic roadblocks and regional economic uncertainty threaten their solvency. To increase the marketing capacities and financial results of Jordanian SMEs, it is necessary to address these concerns through the implementation of customised marketing strategies, the expansion of access to financing, and the creation of a conducive business climate. Therefore, this study investigates the moderating role of customer relationship management on the relationship between marketing capabilities and financial performance in Jordanian SMEs. As this is the first study conducted in Jordan in this specific area, there is a notable research gap in understanding how marketing capabilities, Customer Relationship Management, and financial performance interact in the Jordanian SME landscape. While the global literature has extensively studied the relationships between marketing capabilities, Customer Relationship Management, and financial performance in various contexts, a significant knowledge gap exists due to the lack of Jordan-specific research. Understanding these dynamics in the Jordanian SME context is critical for both academic and practical reasons, as the local business environment, customer behavior, and cultural factors can significantly influence these relationships (Al-Hawary & AlFassed, Citation2022). In addition, this study pioneers the study of the impact of CRM on Jordanian SMEs and represents a crucial and pioneering endeavour in this field. What is unique about this study is that it is the first research to address the moderating effect of Customer Relationship Management in Jordanian SMEs. The inclusion of managers from different industries operating in Jordan enhances the unique contribution of the study by providing diverse insights into different sectors and bridging the critical gap in understanding the interactions between marketing capabilities, financial performance and Customer Relationship Management dynamics in the diverse landscape of Jordanian SMEs.

Literature review

R-A theory

The R-A theory is a disequilibrium-based economic theory of competition that was first presented by Hunt and Morgan (Citation1995). According to Hunt (Citation1997), the theory aims to present a thorough framework for elucidating how neoclassical and evolutionary theories might cooperate rather than compete with one another. Dickson (Citation1996) argues in favor of the disequilibrium approach but criticizes the lack of dynamism in R-A theory. Hunt (Citation1997) changed the endogenous process in the R-A theory to emphasize the function of the learning organization as a result. R-A theory’s epistemology was contested by Deligönül and Cavuşgil (Citation1997), who contended that it could not be distinguished from the perfect competition paradigm. In contrast to the neoclassical conception of the economic system as equilibrium, Hunt and Morgan (Citation1997) countered by emphasising the disequilibrium-provoking conduct of enterprises during the endogenous innovation process. According to Hunt (Citation1997), the R-A theory is an evolutionary, equilibrium-inducing, process theory of competition in which innovation and organizational learning are endogenous, firms and consumers have incomplete information, and entrepreneurship, institutions, and public policy have an impact on economic performance. R-A theory is especially beneficial for marketing and adds to marketing theory (Varadarajan, Citation2023). The three fundamental R-A theory principles that apply to marketing are: (1) the diversity of tastes and preferences across industries, (2) competition as a process that emphasizes competitive advantage, and (3) resources as both tangible and intangible. Diversification is necessary to meet dynamically changing demand, and heterogeneity in tastes and preferences affects a firm’s strategy relative to rivals. In order to create greater performance in light of the firm’s goals and competitive position, resources should be reallocated. Resources produced in marketing interactions include financial, legal, physical, human, organizational, relational, and informational resources, according to Morgan and Hunt. Even though marketing capabilities have been extensively researched, there is little consensus on what constitutes a marketing capability and how to quantify it. There are two categories of marketing capability research: The ability to engage with advertising, price, product attributes, distribution, communication, selling, planning, and plan implementation; and organizational power, responsibility, and ability to connect with customers.

Marketing capabilities

The role of Marketing within the dynamic capability framework is pivotal due to the contribution of Marketing Capabilities in acquiring knowledge about customer needs, competitive products, and distribution channels (Barrales-Molina et al., Citation2014). Marketing capabilities encompass human capital, social capital, and managerial cognition, all of which play a vital role in generating, using, and integrating market knowledge and marketing resources to adapt to market and technological changes (Bruni & Verona, Citation2009). These capabilities are a subset of dynamic capabilities, with a specific emphasis on delivering customer value (Fang & Zou, Citation2009). Market Orientation, a cornerstone of modern marketing, involves identifying, comprehending, and satisfying both stated and latent customer needs (Narver et al., Citation2004). In dynamic environments, proactive market orientation becomes crucial for organizations to gain and sustain a competitive edge (Tsai et al., Citation2008). Market Orientation provides profound insights into customers and competitors, guiding resource allocation (Atuahene-Gima, Citation2005) and supporting capability building and reconfiguration within organizations (Atuahene-Gima, Citation2005; Day, Citation1994). Proactive market orientation, in particular, interacts synergistically with other organizational capabilities, reinforcing their impact. Value Innovation Capability involves systematically generating value innovation initiatives to create significantly improved customer value by reshaping the business model and industry relationships (Alkhawaldeh et al., Citation2023). Value innovation enables organizations to create new market spaces and outcompete rivals by changing the competitive landscape. It often leads to business model transformation, necessitating the realignment and reconfiguration of organizational resources and capabilities. Customer knowledge and value play a central role in this process. Operational Marketing Capabilities refer to integrative organizational processes aimed at leveraging the collective knowledge, abilities, and resources to meet marketing-related business needs. These capabilities empower organizations to organize marketing activities effectively, creating unique customer solutions and attaining competitive advantages. Operational Marketing Capabilities facilitate resource transformation into outputs by orchestrating the marketing mix and other inputs (Day, Citation1994).

Marketing concept-based strategy

In the 1950s and 1960s, as extensively documented in various works (Hunt & Goolsby, Citation1988; Wilkie & Moore, Citation2003; Shaw & Jones, Citation2005; Shaw, Citation2012), there was a significant shift in the field of marketing. This shift transitioned marketing from its earlier focus on understanding marketing systems to a new emphasis on developing a marketing strategy (Acikdilli, et al., Citation2022). This transformation, occurring under the umbrella term ‘marketing management,’ was profoundly influenced by the Aldersonian research tradition. This tradition stressed several key ideas: firms striving for competitive advantages, significant heterogeneity in both demand and supply within industries, and the pivotal role of market segmentation in initiating successful strategies. The term ‘marketing strategy’ was coined and the marketing management technique developed in response to a confluence of events and trends. Specifically, General Electric (GE) pioneered the ‘marketing concept,’ which emphasised three key factors: catering to customers’ wants and needs, encouraging coordinated marketing activities, and placing a premium on revenue growth. Although all of them were important, the focus on the client’s requirements stood out. In his 1953 presidential address to the American Marketing Association, Neil Borden contributed to this transition by stating that a marketing manager’s primary responsibility was to develop a ‘marketing mix.’ Borden’s idea has 12 components, from product design to research and analysis. Combining Alderson’s demand segmentation with Borden’s marketing mix notion, as given by Alfred Oxenfeldt, is key to any effective marketing plan. One definition of this tactic is tailoring one’s marketing plan to a certain group of consumers. The ‘mix’ used by Oxenfeldt comprised things like product quality, advertising budget, and channel selection. These ideas were brought together in ‘Basic Marketing’ by E. Jerome ‘Jerry’ McCarthy, who emphasised the need of putting the needs of the client first. McCarthy argued for breaking down consumer markets into smaller subsets, then tailoring their own marketing strategies to those markets. To help students remember the various parts of the marketing mix, he came up with the memorable ‘4Ps’ (product, pricing, promotion, and location). In the late 1960s, the ‘market-segmentation strategy’ emerged as a result of the influence of McCarthy’s book on the business world. In the present day, this idea has gained widespread acceptance and is regarded as a cornerstone of contemporary marketing (Layton, Citation2002; Myers, Citation1996; Piercy & Morgan, Citation1993; Wind, Citation1978).

Financial performance

Financial performance is a term used to describe how effectively a business generates profits and raises shareholder value over a given time frame. It is critical to the decision-making process of creditors, investors, and other stakeholders because it is one of the fundamental elements of determining the health of a corporation (Gofwan, Citation2022). Financial performance, which is measured by financial and market-based metrics including market share, annual sales, return on sales, and return on assets, is a crucial sign of a company’s success (Chen & Xie, Citation2022). These metrics show how successfully a company can use its resources to produce revenue. Quantitative financial performance yields result that are essential for assessing an organization’s financial success. The ability to assess a firm’s development, efficiency, and effectiveness makes measuring financial performance crucial (DasGupta, Citation2022). Firms can evaluate their financial status, pinpoint areas for development, and set realistic goals for the future using financial performance measurements. Due to the fact that it offers an unbiased assessment of their financial standing over a specific time period, it also helps businesses to compare themselves to other businesses in the same industry (Yoo & Managi, Citation2022). Market share is an important indicator of financial performance since it shows how much of the market a company control. A company’s market share can be used to gauge how competitive it is and how much market domination it currently has. Market share, particularly in markets where they have a smaller market share, can assist businesses in determining possibilities for growth (Saygili et al., Citation2022). Businesses can enhance their financial performance, raise revenue, and gain a competitive edge by expanding their market share. A firm’s entire revenue produced over a given period is reflected in annual sales, another crucial financial success indicator. Businesses can assess their capacity to generate income and monitor their development over time by analyzing annual sales. This measurement is very helpful for spotting patterns and trends in a company’s revenue generating. A financial performance indicator that shows a company’s profitability is return on sales (ROS). According to El Khoury et al. (Citation2023), it is calculated by dividing the company’s net income by its sales revenue. ROS allows for the tracking of a company’s profitability over time and allows for comparison with other companies in the same industry. It can also assist companies in figuring out how to boost earnings through strategies like raising prices or lowering expenses. Return on assets (ROA) is a financial performance indicator that measures a company’s ability to generate profits from its asset base. To get this number, we need to divide the company’s net income by the total value of its assets. The ratio of a company’s profit to its total assets is a strong indicator of management efficiency.

Customer relationship management

Companies employ customer relationship management (CRM) to boost customer happiness and loyalty (Ledro et al., Citation2022). Data collection, consumer behaviour analysis, and targeted marketing are all components of customer relationship management (CRM) (Ngelyaratan & Soediantono, Citation2022). Businesses that take the time to learn about their customers’ wants and requirements are in a better position to provide their customers with the products and services they need. Businesses can increase sales and profits by utilising this strategy to keep more of their existing customers happy. In industries where customer interaction is high, such as telecommunications, hospitality, and retail, customer relationship management is essential. An integral aspect of customer relationship management is data collection (Alshurideh, Citation2022). Store visits, internet transactions, and social media activity are just a few of the ways that companies amass client information. Information like demographics, spending habits, and personal preferences could fall under this category. By compiling this information, businesses may better understand their customers’ habits and preferences, which in turn can be utilised to improve marketing and customer service (Monod et al., Citation2022). Another crucial CRM feature is analysis. Using data analytics tools, businesses look for patterns in customer actions. This information can be used by companies to better serve their customers, hence boosting loyalty and satisfaction. behind instance, if a business sees that a significant percentage of its customers are abandoning their shopping carts without completing their purchases, it can investigate the reasons behind this behaviour and implement solutions. Customer relationship management also comprises tailoring marketing initiatives to distinct subsets of customers based on collected data, as suggested by Das and Hassan (Citation2022). Businesses can discover groups with similar characteristics, such age, gender, or purchase patterns, by analyzing consumer data. They can then develop niche marketing initiatives that resonate with these groups. This can be accomplished through several means, including social media advertising and email marketing. Businesses must have a customer-centric approach in order to implement effective CRM. This entails placing the consumer at the forefront of all business decisions and creating goods and services that cater to their requirements. CRM-savvy companies can design a cohesive customer experience across all touchpoints, from online buying to in-person interactions. Managing the enormous amount of client data that firms collect is one of the problems of CRM (Del Vecchio et al., Citation2022). Systems must be in place for businesses to handle, store, and analyze this data. Additionally, they must make sure that the manner in which they are gathering data complies with data privacy laws. Making sure that customer interactions are consistent across all channels is another problem for CRM. Whether they are purchasing in-person or online, customers want the same level of service. Systems must be in place for businesses to guarantee that every employee, regardless of position or location, has access to client data (Khan et al., Citation2022). In conclusion, CRM is a potent tactic that companies may employ to forge enduring bonds with their clients. Businesses may increase customer satisfaction and loyalty, which in turn boosts sales and profitability, by gathering and analyzing consumer data, customizing marketing efforts, and providing a seamless customer experience. Yet, to implement effective CRM, companies must have tools in place to handle and analyze client data as well as a customer-centric mindset.

Hypotheses development

The relationship between marketing capabilities and financial performance

The development of organizational capabilities is intricately connected to the understanding of the market’s evolution in which a business operates. This knowledge serves as a foundation for identifying opportunities and identifying gaps in existing capabilities. Proactive Market Orientation (MO) plays a pivotal role in this context, enabling organizations to uncover latent customer needs (Narver et al., Citation2004). Consequently, organizations with varying levels of proactive MO approach customer needs differently, shaping their marketing efforts accordingly. This empowers organizations with superior proactive MO to make more informed decisions regarding resource allocation and capability utilization. For instance, a deep understanding of competitors and latent customer needs, stemming from proactive MO, leads to more effective product development, market positioning, segmentation, and targeting (Narver et al., Citation2004). Moreover, organizations engaged in value innovation strive to create novel value for customers, necessitating the accumulation, configuration, and exploitation of resources. However, the pursuit of value creation can render existing resources and capabilities obsolete. Hence, when a firm embarks on delivering new customer value, it must adapt, evolve, and transform its organizational resource base, including its marketing capabilities. Marketing capabilities are instrumental in executing marketing activities that generate unique customer value (Day, Citation1994). They are crucial for achieving and sustaining competitive advantages and enhancing overall firm performance (Day, Citation1994). For example, a heightened awareness of competitors’ pricing tactics, a facet of marketing capabilities, positively influences a firm’s performance. This implies that superior pricing capabilities enable firms to optimize product or service pricing, thereby enhancing profitability and market effectiveness. Operational marketing capabilities have the potential to serve as a source of competitive advantage due to their value, rarity, difficulty of imitation, and non-substitutability. Therefore, businesses that invest in developing their operational marketing capabilities can increase customer value, profits, and competitiveness. There is a substantial body of research documenting a correlation between a company’s marketing prowess and its bottom line. The ability to attract and keep consumers and create larger revenues are two key factors in a company’s financial performance, and studies have shown that businesses with stronger marketing capabilities have a higher likelihood of success financially (Algarni et al., Citation2022; Cassia and Magno, Citation2022). The term ‘marketing capabilities’ is used to describe a company’s potential to develop, share, and provide value for its clientele. Researching the market, managing the brand, advertising, promoting sales, and setting prices are all part of this (Yoo & Managi, Citation2022). There is a correlation between a company’s marketing prowess and its bottom-line success (Ali et al., Citation2022). Mostafiz et al. (Citation2022) conducted research that showed how companies with better marketing capabilities beat their rivals in terms of revenue growth, profitability, and market share. The R-A theory has not been formally adopted by studies examining the connection between marketing capabilities and performance. However, some studies have utilized the resource-based view (RBV) approach. While RBV recognizes the importance of marketing-specific resources such as brands, customer and distribution relationships in gaining and maintaining a competitive edge, it is limited in explaining the dynamic processes of resource transformation and value creation for customers through managerial guidance (Lutfi et al., Citation2023). In contrast, R-A theory proposes that intangible capabilities can potentially help a firm produce a market offering more efficiently or effectively than its competitors. Two main types of marketing capabilities can be distinguished from previous research (Malhan et al., Citation2022). The first type is concerned with tactical marketing objectives rather than strategic objectives or organizational dynamics, while the second type comprises intangible resources that support marketing performance, not just financial performance (Terry et al., Citation2022). Given the R-A theory’s emphasis on institutional factors and endogenous innovation process, the authors develop hypotheses centered around the second type of capabilities and marketing performance (Lutfi et al., Citation2022). Prior studies have typically used financial measures of performance, despite the benefits of using more comprehensive measures (DasGupta, Citation2022; Gofwan, Citation2022). Therefore, the study justifies the use of two different performance measures, one with respect to the firm’s internal objectives and the other with respect to competitors’ performance. This dual nature of performance is recognized by Hunt and Morgan, and most previous studies have employed direct effect models, which serve as the baseline hypothesis for the authors’ study (Acikdilli et al., Citation2022).

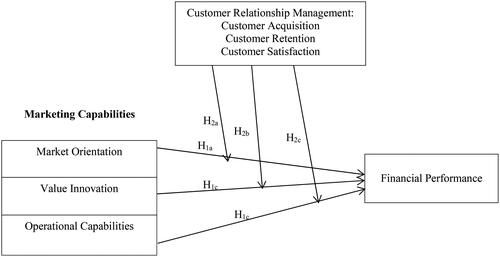

H1: There is significant positive relationship between marketing capabilities and financial performance

H1a: There is significant positive relationship between marketing orientation and financial performance

H1b: There is significant positive relationship between value innovation and financial performance

H1c: There is significant positive relationship between operational capabilities and financial performance

The moderating role of customer relationship management

In order to build and keep loyal customers, businesses must employ a customer relationship management (CRM) strategy. Marketing that focuses on the consumer includes initiatives including customer acquisition, retention, and loyalty programmes (Das & Hassan, Citation2022). In order to generate sales and profits, a company needs strong marketing capabilities that allow it to produce and deliver value to its consumers. However, a company’s level of customer relationship management adoption may affect the efficacy of its marketing skills (Monod et al., Citation2022). Several research (Cao et al., Citation2022; Saygili et al., Citation2022) have examined the impact of CRM as a moderator between marketing capabilities and financial performance. Research in this area looks at the relationship between a company’s level of customer relationship management and its financial performance, and how the latter can be improved through the use of the former. The level of customer relationship management acts as a moderator between marketing capabilities and financial performance, suggesting that this link can either strengthen or weaken. Several studies have investigated CRM’s potential moderating effect on the correlation between marketing efficacy and financial results. Luo and Huang, for example, revealed that CRM significantly moderates the connection between marketing capabilities and financial performance. The research showed that companies with advanced CRM strategies were better able to capitalise on their marketing efforts, leading to better financial results. In particular, businesses who prioritised their customers over everything else in their marketing strategy and fostered close ties with their clientele saw greater success in their efforts to generate revenue. Also, Wu et al. (Citation2023) discovered that, for Chinese businesses, CRM moderates the connection between marketing capabilities and financial performance. Companies with advanced marketing capacities and CRM were shown to have the best financial results. The research also showed that companies with a strong customer-centric strategy to CRM were able to outperform their competitors financially more so than those without such an approach. Wang et al. looked at how customer relationship management (CRM) affected the connection between marketing skills and financial performance for Chinese small and medium-sized businesses (SMEs). The association between marketing talents and financial performance was shown to be significantly moderated by customer relationship management. The study concluded that businesses who excelled financially also had excellent marketing capabilities and implemented efficient CRM practises. These research’ results imply that customer relationship management (CRM) significantly moderates the connection between marketing capabilities and financial results. When businesses use efficient CRM practises, they are better able to use their marketing resources to drive growth and profit. Specifically, businesses who put their customers first through a customer-centric marketing strategy and maintain positive relationships with their clientele are more likely to succeed financially. Therefore, businesses who want to boost their bottom lines should think about implementing efficient CRM practises to strengthen their marketing departments. Several studies have examined the impact of CRM as a moderator between marketing capabilities and financial performance. According to the results of these analyses, customer relationship management (CRM) significantly moderates the connection between marketing capabilities and financial performance. When businesses use efficient CRM practises, they are better able to use their marketing resources to drive growth and profit. Specifically, businesses who put their customers first through a customer-centric marketing strategy and maintain positive relationships with their clientele are more likely to succeed financially. Therefore, businesses who want to boost their bottom lines should think about implementing efficient CRM practises to strengthen their marketing departments.

H2: Customer relationship management moderate the relationship between marketing capabilities and financial performance

H2a: Customer relationship management moderate the relationship between marketing orientation and financial performance

H2b: Customer relationship management moderate the relationship between value innovation and financial performance

H2c: Customer relationship management moderate the relationship between operational capabilities and financial performance

Theoretical framework

Based on the Resource-Advantage (R-A) theory and the Resource-Based View (RBV) of the firm, theoretic frameworks are used to explain how Customer Relationship Management (CRM) modifies the relationship between marketing capabilities and financial performance. According to the R-A hypothesis, businesses can gain a competitive advantage by efficiently using their assets and competencies to better satisfy the needs of their clients than those of their rivals. One definition of a company’s marketing prowess is its potential to identify, create, and implement strategies for reaching a specific demographic of consumers. A company’s marketing prowess can be impacted by a number of internal and external factors, including the availability of resources and the quality of the company’s marketing team, among others. The RBV of a company emphasises the value of its assets and competencies in developing sustainable competitive advantages. According to this theory, a company’s assets and abilities can only provide it with a competitive advantage if they meet specific criteria, like being valued, uncommon, difficult to replicate, and tough to replace. In the context of this study, CRM can be viewed as a helpful tool that helps companies to get to know their customers better, learn more about their needs and preferences, and modify their marketing strategies accordingly. research framework illustrates the relationships between and sequencing of the effects of the various study components. The diagram specifically shows that CRM moderates the relationship between marketing skills and financial performance. This suggests that the degree to which a company implements CRM will determine how marketing capabilities affect its financial performance. In simpler terms, the influence of marketing capabilities on financial performance is more pronounced in firms with higher levels of CRM compared to those with lower levels of CRM. Support for this theoretical framework can be found in the works of Hunt and Morgan (Citation1995) and Hunt and Morgan (Citation1997), which delve into the intricacies of marketing theory and its practical applications in understanding how firms can achieve competitive advantages by effectively managing customer relationships and deploying marketing capabilities.

Methodology

This study adopts a cross-sectional research design. The target population for this study are small and medium-sized enterprises (SMEs) in the service industry in Jordan. The sample size for this study was determined using G*Power software based on the minimum sample size required for PLS-SEM analysis. The sample size calculated based on a significance level of 0.05, a power of 0.80, and an effect size of 0.15. The minimum required sample size for this study are 200 managers of the Jordanian firms that are operating in various industries. The respondents were selected using a purposive sampling technique based on the availability of data and willingness to participate in the study. Data collected using a self-administered questionnaire. The questionnaire was designed based on the constructs of marketing capabilities, financial performance, and CRM. The marketing capabilities construct consist of three sub-constructs, namely product innovation, customer value creation, and marketing communication effectiveness. The CRM construct measured using the dimensions of customer acquisition, customer retention, and customer satisfaction. The items were evaluated using a ten-point Likert scale with a range from (1) ‘Strongly Disagree’ to (10) ‘Strongly Agree’. The data collection was start from September to December, 2022.

Research instrument

Questionnaires were used in this study to collect data and analyse it in order to evaluate the hypotheses. The study measured marketing orientation, value innovation, and operational performance using a total of twenty items that were derived from Kachouie et al. (Citation2018), Hunt and Madhavaram (Citation2020). Additionally, a total of nine items were utilised to gauge client acquisition, retention, and satisfaction. These items were derived from Wirtz (Citation2020), Homburg and Wielgos (Citation2022). Finally, financial performance was measured using a total of five items that were obtained from sources like Yapanto et al. (Citation2021).

Common method bias

In order to find a solution to the CMV issue, we assured participants that their answers would be kept confidential and that there was no such thing as a ‘wrong’ answer. This research employed Harman’s one-factor test to discover CMV, which involves eliminating one factor from each construct and checking to see if the remaining factors explain more than 50% of the variance. Less than the 50% criterion, or 38.612% of the variance, was explained by CMV, according to data. Additionally, Kock (Citation2015) suggested that if all variance inflation factors (VIFs) from a collinearity test are equal to or less than 5, then the model is considered to be free of common method bias. Therefore, no common method bias was detected in this study, as all the structural components of the model had VIFs lower than 3.3. Specifically, revealed that product innovation (1.857), customer value creation (2.856), marketing communication effectiveness (2.110), and customer relation management (2.819) all had VIFs below the threshold, indicating the absence of CMV.

Table 1. Common method bias result.

Table 2. Variance inflation factors results.

Multivariate normality

The presence of multivariate normality in the data was assessed in this study using the Web Power web tool (source: https://webpower.psychstat.org/wiki/tools/index). The tool calculated the multivariate skewness and kurtosis coefficients for Mardia, and the resulting p-value was found to be .000, which is less than the significance level of .05. This indicates the presence of multivariate non-normality in the data.

Data analysis method

A causal modelling method called Partial Least Squares (PLS-SEM) maximises the variance explained by latent components. PLS: PLS-SEM was used to analyse the gathered data. PLS-SEM is an analytical method that works well for looking at intricate correlations between variables in a research model, especially in cases where the data is non-normal and the sample size is small. Investigating moderating effects in the study model is another useful application of PLS-SEM. Furthermore, PLS-SEM can be more flexible and effective when analysing complex interactions in bigger samples. Evaluating the validity and reliability of the research model’s constructs is the first stage in the data analysis process. This entails evaluating the constructs’ discriminant, convergent, and internal consistency. The Cronbach’s alpha coefficient was used to evaluate the constructs’ internal consistency, and the composite reliability (CR) and average variance extracted (AVE) coefficients were used to evaluate the constructs’ convergent validity. Cross-loadings and the Fornell-Larcker criterion were used to evaluate discriminant validity. The study hypotheses were put to the test in the second phase of data analysis. Regression analysis is used to look at the relationship between marketing capabilities and financial performance. Using the interaction term technique, the moderating influence of CRM on the connection between marketing capabilities and financial performance was investigated. The study adheres to ethical principles, such as informed consent, confidentiality, and anonymity. Participants were informed about the purpose of the study, the benefits and risks of participation, and their right to withdraw at any time. The data collected were kept confidential, and only the researchers have access to it. The data collected was anonymized to ensure that participants’ identities are protected.

Results and discussion

Validity and reliability

Cronbach’s alpha, a conservative measure of internal consistency reliability, was used to ensure the trustworthiness of all items. All variables scored above 0.75, indicating strong reliability. Composite reliability, as suggested by Hair and Alamer (Citation2022), was also measured, with a minimum threshold of 0.7 required for composite dependability. Our study’s composite reliability values exceeded 0.80 for all variables, as seen in . Dijkstra-Hensele’s rho values for each variable were above 0.70, ensuring convergent validity with all AVE values being greater than 0.50. Multicollinearity was also checked through the examination of variance inflation factors (VIFs), which showed no significant concerns as all VIF values for each variable were less than 3.3 (see ).

Table 3. Validity and reliability.

In order to ensure that the study’s components are distinct from each other, discriminant validity was tested using multiple methods. Firstly, all loading values, as presented in , were higher than 0.5 and greater than the corresponding cross-loading values, indicating that each component is clearly defined and separate from the others. Secondly, the Fornell and Lacker criterion was used to assess the discriminant validity by comparing the square root of average variance extracted (AVE) from each component to the correlation between constructs (see ). The results showed that the square root of AVE for each component was higher than its correlation with other components, which confirmed the discriminant validity. Lastly, the Heterotrait-Monotrait ratio (HTMT) method was used to estimate the discriminant validity of the construct (see ). The results of both the Fornell-Lacker and HTMT analyses found strong relationships between the components, further confirming the discriminant validity of the study’s components.

Table 4. Measurement model and findings.

Table 5. Fornell-Larcker criterion.

Table 6. Heterotrait–Monotrait ratio.

The results presented in and indicate a significant and positive relationship between marketing orientation and financial performance in Jordanian SMEs. The results indicate that a mere 1% increase in marketing orientation is associated with a significant 21.1% increase in financial performance. Therefore, we accept H1a. This result is consistent with previous research by Levine and Zahradnik (Citation2012) and Wilson and Perepelkin (Citation2022). In addition, the results showed that value innovation and the financial performance of Jordanian SMEs have a significance and positive relationship. This implied that a 1% increase in value innovation would leads to a 15.2% increase in financial performance. Hence, we accept H1b. This result is consistent with the studies of Cheah et al. (Citation2021). Moreover, the result showed that operational capabilities has a positive and significant effect on financial performance in Jordanian SMEs. The result indicated that 1% increase operational capabilities is associated with a significant 39.1% increase in financial performance. Consequently, we accept H1c. Finally, the results indicated that Customer Relation Management positively and significantly moderated the effect of marketing orientation, value innovation, and operational capabilities on financial performance of Jordanian SMEs.

Table 7. Result of path analysis.

Discussion

The study’s conclusions show that among Jordanian small and medium-sized enterprises (SMEs), marketing orientation and financial performance have a strong and favourable correlation. The first hypothesis (H1a) that proposed such a link is supported by this result. First and foremost, the fact that there is a clear and positive correlation between financial performance and marketing orientation in Jordanian SMEs highlights the critical role that marketing strategies play in these companies’ success. SMEs make up a sizable share of Jordan’s economy, and the country’s capacity to grow economically and create jobs depends on them. This research implies that by concentrating on their marketing techniques, SMEs in Jordan may be able to attain better financial results. A customer-centric strategy, market research, and a thorough comprehension of the wants and needs of customers are all included in marketing orientation. The positive connection implies that there is a higher likelihood of improved financial performance for SMEs that make the investment to comprehend their target market and match their offerings accordingly. Increased revenue, devoted customers, and general profitability could result from this. This outcome also underscores how crucial strategic marketing strategy and implementation are for Jordanian SMEs. It suggests that SMEs should actively engage with their consumers, adjust to shifting market conditions, and actively look for development prospects rather than solely depending on product quality or cost competitiveness. Marketing orientation is a comprehensive strategy to comprehending and catering to clients, encompassing more than just advertising and marketing.

Acceptance of hypothesis H1b is confirmed by the study’s results, which offer strong evidence of a noteworthy and positive association between value innovation and the financial success of Jordanian SMEs. Significant ramifications for SMEs’ competitiveness and strategic orientation in Jordan’s business environment result from this discovery. A strategy idea known as ‘value innovation’ focuses on creating distinctive and differentiating value for customers, frequently through fusing together aspects that were previously considered to be incompatible. The study’s positive correlation indicates that small and medium-sized enterprises (SMEs) in Jordan that allocate resources towards value innovation are more likely to witness enhanced financial performance. This discovery has several important ramifications, one of which is that innovation should not be restricted to product creation. Value innovation encompasses not only new products or services but also innovations in business models, processes, supply chain management, and customer experiences. The idea that value may be created in a variety of ways outside of typical product innovation is consistent with this larger view of innovation. This outcome also emphasises how crucial differentiation is in a market that is competitive. Value innovation is a way for Jordanian SMEs to differentiate themselves from rivals and increase their market share, customer loyalty, and profitability. Value innovation can help SMEs better fulfil the changing needs of their clientele and break into previously untapped market areas.

Strong evidence for the acceptance of hypothesis H1c is provided by the study’s findings, which show a significant and positive association between operational capabilities and the financial performance of Jordanian small and medium-sized enterprises (SMEs). Significant ramifications for the competitiveness and strategic management of SMEs operating in Jordan result from this discovery. An organization’s internal procedures, assets, and productivity are all included in its operational capabilities. This positive link implies that there is a greater likelihood of improved financial success for Jordanian SMEs who invest in enhancing their operational capabilities. This outcome is consistent with the more general knowledge that financial success and competitive advantage can be fueled by operational excellence. One of the main ramifications of this discovery is that Jordanian SMEs should view operational efficacy and efficiency as strategic requirements. In addition to cutting expenses and raising productivity, SMEs can better meet market demands by streamlining their internal operations and making better use of their resources. Better financial results, such as increased profit margins and overall profitability, may follow from this. Furthermore, the positive correlation emphasises how crucial it is for SMEs to be flexible and always improving. In today’s fast-paced business environment, the ability to streamline operations, minimize wastage, and quickly adapt to changing circumstances can be a significant source of resilience and competitive advantage. The significance of the relationship between operational capabilities and financial performance extends beyond Jordanian SMEs and has relevance for SMEs globally. Efficient and effective operations are fundamental to the success of businesses regardless of their size or industry. Therefore, SMEs in other regions and contexts can also benefit from the lessons drawn from this study.

The culmination of the study’s findings is the recognition that Customer Relationship Management (CRM) plays a vital and positive moderating role in the relationship between marketing orientation, value innovation, operational capabilities, and the financial performance of Jordanian Small and Medium Enterprises (SMEs). This result underscores the critical importance of effective CRM strategies in maximizing the impact of these key factors on SME financial performance. CRM encompasses a wide range of practices and technologies aimed at managing and nurturing customer relationships. The moderation effect observed in this study suggests that CRM not only independently influences financial performance but also amplifies the positive effects of marketing orientation, value innovation, and operational capabilities on SMEs’ financial outcomes. CRM helps SMEs in Jordan to better use their operational strengths, value innovation, and marketing orientation to improve financial performance. Prioritising CRM allows SMEs to maximise customer value and service by leveraging customer insights, matching products and services to customer needs, and streamlining operations. Good CRM procedures assist SMEs in creating and sustaining enduring, solid client connections. In today’s cutthroat business environment, keeping and gaining new customers is crucial. CRM may give SMEs the methods and resources they need to stand out from the competition and maintain a competitive edge. The moderation effect highlights the importance of a holistic approach to business management. SMEs should not view marketing, innovation, operational efficiency, and CRM as isolated components but as interconnected facets of a comprehensive strategy for success. Integration across these areas can result in synergistic benefits for financial performance. The positive moderation effect suggests that CRM can help SMEs adapt to changing market conditions and evolving customer preferences. A dynamic CRM strategy that incorporates customer feedback and adapts accordingly can lead to improved financial performance in the face of uncertainty.

Conclusion

This study delved into the intricate relationship between marketing capabilities and financial performance, with a specific focus on the moderating role of Customer Relationship Management (CRM) within the context of Jordanian Small and Medium Enterprises (SMEs) in the service industry. The research findings have yielded significant insights, affirming the acceptance of hypotheses H1a, H1b, and H1c, and providing compelling evidence of CRM’s positive and significant moderating impact on the financial performance of these SMEs. The findings clearly showed that among Jordanian SMEs in the service sector, marketing orientation and financial performance had a substantial and favourable link. This research emphasises how crucial market research, client-centric strategies, and a thorough grasp of customer needs are to SMEs’ financial success. Accepting H1a signifies our agreement that Jordanian SMEs in the service sector can perform financially better when they strategically prioritise marketing orientation. The results of our study also demonstrated a strong and favourable correlation between value innovation and Jordanian SMEs’ financial performance. Value innovation has become a key factor in driving financial success. It entails developing distinctive value propositions for customers. This finding, which supports H1b, highlights how SMEs can enhance their financial results by actively looking for novel ways to satisfy the demands and expectations of their customers. The study demonstrated that operational capabilities have a positive and significant effect on the financial performance of Jordanian SMEs in the service industry. The significance of effective internal procedures, effective resource management, and operational excellence in propelling financial prosperity is emphasised by this. By agreeing to H1c, we recognise the vital part that improving operational capabilities plays in raising these SMEs’ financial success. The beneficial and strong moderating influence of CRM on the links between marketing orientation, value innovation, operational capabilities, and financial performance within Jordanian SMEs is one of the study’s most noteworthy findings. This result highlights that effective CRM practices not only independently influence financial performance but also enhance and amplify the positive impact of marketing capabilities. This underscores the vital role of building and maintaining strong customer relationships in maximizing financial outcomes. this study contributes to our understanding of the dynamics within Jordanian SMEs operating in the service industry by affirming the critical role of marketing capabilities and the significant influence of value innovation and operational capabilities on financial performance. Moreover, the study underscores the transformative power of Customer Relationship Management as a moderator, emphasizing its potential to magnify the positive effects of marketing, innovation, and operational efficiency. These findings offer valuable guidance for Jordanian SMEs in the service sector, encouraging them to prioritize marketing orientation, value innovation, and operational excellence while recognizing the pivotal role of CRM in enhancing financial performance. This research also provides a foundation for future studies exploring similar relationships in different industries and regions, contributing to the ongoing advancement of SME management practices and strategies.

Limitations and recommendation for future studies

Although this study produced some intriguing results, there are some limitations that should be taken into account when evaluating the data. First off, the study’s focus on Jordanian businesses means that its conclusions might not apply in other situations. The study also uses cross-sectional data, which restricts the use of causal inferences. Lastly, other potential moderating variables were left out of the research because the study only takes CRM’s moderating impact into account. To improve the generalizability of the findings, future studies should try to repeat the study in different settings. A longitudinal research strategy should be used in future studies to evaluate the causal links between the variables across time. Future research should take into account additional moderators such company culture, leadership, and technology adoption. Usage of alternative performance metrics: To better understand the relationship between marketing skills and financial performance, future studies should take into account employing alternative performance measures like market share and customer happiness. To better understand the underlying mechanisms driving the relationship between marketing capabilities, CRM, and financial performance, future studies may supplement the quantitative data with qualitative research techniques like focus groups and interviews.

Managerial implication

Regarding the positive and significant correlation between marketing communication effectiveness, customer value creation, product innovation, and financial performance, the study reveals a number of key management implications for Jordanian businesses. First, businesses ought to spend money on initiatives that increase the efficiency of their marketing communications. With better customer communication of their value proposition, businesses are able to increase customer retention, boost sales, and ultimately improve their financial performance. Second, firms should concentrate on delivering value to their clients through cutting-edge goods and services. The research demonstrates that product innovation significantly improves financial performance. As a result, businesses should invest in research and development to produce new products that cater to the changing demands and tastes of their clients. Thirdly, businesses need to guarantee the efficacy of their customer relationship management (CRM) initiatives. By establishing and maintaining strong relationships with customers, learning about their needs and preferences, and using this knowledge to create and deliver products and services that meet those needs, effective CRM activities can strengthen the positive relationship between marketing capabilities and financial performance. Furthermore, the study’s conclusion that customer relationship management (CRM) positively modifies the association between the success of marketing communications and financial performance in Jordanian businesses has significant managerial ramifications. First, Jordanian businesses ought to think about spending money on CRM initiatives to boost the beneficial effects of good marketing communications on their financial performance. Strong customer relationships may be developed and maintained by businesses with the aid of effective CRM strategies, increasing customer loyalty and enhancing financial success. Second, businesses should put more effort into developing targeted and successful marketing campaigns to increase the effectiveness of their marketing communications. Firms may strengthen their brand image, cultivate client loyalty, and eventually improve their financial performance by utilizing marketing communication tactics that connect with their target customers. Lastly, firms must make sure that their CRM initiatives complement their marketing communication plans. CRM and marketing communications can be successfully integrated to assist firms improve their client relationships and boost their financial performance. Furthermore, the discovery that customer relationship management (CRM) in Jordanian enterprises negatively modifies the association between customer value generation and financial success has significant managerial consequences. First, firms need to understand that improving financial performance might not be possible by concentrating only on customer value generation. While providing value to consumers is crucial, it is equally crucial to make sure that CRM operations are coordinated with efforts to provide value to customers in order to maximize the favorable impact on financial performance. Second, firms should think about implementing a more balanced strategy that combines CRM and customer value generation operations. By doing this, firms can make sure that they are adding value for their clients and developing trusting relationships with them, which will promote client loyalty and boost financial performance. Finally, firms should assess their CRM plans to find possible areas for development. Firms can lessen the negative moderating effect on the relationship between customer value creation and financial performance by improving the effectiveness of CRM efforts. Last but not least, the discovery that customer relationship management (CRM) has a considerable managerial impact on the relationship between product innovation and financial performance in Jordanian enterprises. First and foremost, firms should acknowledge that product innovation is a significant factor in financial success and should be a primary area of attention for firms trying to enhance their financial performance. To develop solid relationships with customers, firms should keep spending money on CRM initiatives. CRM is crucial for increasing customer loyalty and improving long-term financial performance even if it may not significantly influence the relationship between product innovation and financial performance. Lastly, firms should assess their approaches to product innovation to find any potential room for development. Firms can boost their capacity for product innovation, increase financial results, and maintain market competitiveness.

Author’s contributions

Hamzeh Alhawamdeh and Mahmoud Abdel Muhsen Irsheid Alafeef played a crucial role in supervising the research and approving the final submission. Mohammad Abdel Mohsen Al-Afeef made an important contribution by refining the manuscript and ensuring grammatical accuracy. Bashar Younis Alkhawaldeh was instrumental in working out the methodology, conducting a thorough analysis of the data, and deriving meaningful interpretations from it. Maher Nawasra was in charge of writing the discussion section and provided critical insights into the research findings. Hani Ali Aref Al-Rawashdeh skillfully wrote the conclusion, summarising the main findings of the study. Omar Zraqat was responsible for the important task of data collection and gathered the necessary information for the study. Lina Fuad Hussien and Ghaith N. Al-Eitan made important contributions by writing an extensive literature review, providing the basic context for the study. The contribution of each author was crucial in shaping the study and ensuring a comprehensive and well-rounded scholarly work.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Notes on contributors

Hamzeh Alhawamdeh

Hamzeh Alhawamdeh, Mohammad Al-Afeef, Bashar Alkhawaldeh, Maher Nawasra, Hani Al-Rawashdeh, Omar Zraqat, and Lina Hussien are professors and researchers specializing in administrative sciences, banking, finance, accounting, and human resource management at Jerash University, while Mahmoud Alafeef focuses on marketing at Al Baha University. Ghaith AlEitan specializes in finance and banking at Al al-Bayt University.

Mahmoud Abdel Muhsen Irsheid Alafeef

Hamzeh Alhawamdeh, Mohammad Al-Afeef, Bashar Alkhawaldeh, Maher Nawasra, Hani Al-Rawashdeh, Omar Zraqat, and Lina Hussien are professors and researchers specializing in administrative sciences, banking, finance, accounting, and human resource management at Jerash University, while Mahmoud Alafeef focuses on marketing at Al Baha University. Ghaith AlEitan specializes in finance and banking at Al al-Bayt University.

Mohammad Abdel Mohsen Al-Afeef

Hamzeh Alhawamdeh, Mohammad Al-Afeef, Bashar Alkhawaldeh, Maher Nawasra, Hani Al-Rawashdeh, Omar Zraqat, and Lina Hussien are professors and researchers specializing in administrative sciences, banking, finance, accounting, and human resource management at Jerash University, while Mahmoud Alafeef focuses on marketing at Al Baha University. Ghaith AlEitan specializes in finance and banking at Al al-Bayt University.

Bashar Younis Alkhawaldeh

Bashar Younis Alkhawaldeh, Assistant Professor at the Faculty of Economics at the University of Jerash, specialises in research in the field of administrative sciences. His work focuses on exploring the complex dynamics between marketing strategies and financial performance, especially in Jordanian SMEs operating in the service sector. The research he is involved in examines the correlations between marketing orientation, innovation, operational capabilities, and financial performance using sophisticated modelling techniques. This study emphasises the importance of customer relationship management (CRM) in enhancing the positive impact of these factors on the financial performance of SMEs. Alkhawaldeh’s research contributes to a broader discussion on SME management practises and offers valuable insights for optimising financial performance and improving customer relationships, not only at the local level but potentially for SMEs in various global contexts. Its contributions are in line with the evolving landscape of business strategies in the SME sector aimed at improving their competitiveness and financial viability.

Maher Nawasra

Hamzeh Alhawamdeh, Mohammad Al-Afeef, Bashar Alkhawaldeh, Maher Nawasra, Hani Al-Rawashdeh, Omar Zraqat, and Lina Hussien are professors and researchers specializing in administrative sciences, banking, finance, accounting, and human resource management at Jerash University, while Mahmoud Alafeef focuses on marketing at Al Baha University. Ghaith AlEitan specializes in finance and banking at Al al-Bayt University.

Hani Ali Aref Al_Rawashdeh

Hamzeh Alhawamdeh, Mohammad Al-Afeef, Bashar Alkhawaldeh, Maher Nawasra, Hani Al-Rawashdeh, Omar Zraqat, and Lina Hussien are professors and researchers specializing in administrative sciences, banking, finance, accounting, and human resource management at Jerash University, while Mahmoud Alafeef focuses on marketing at Al Baha University. Ghaith AlEitan specializes in finance and banking at Al al-Bayt University.

Omar Zraqat

Hamzeh Alhawamdeh, Mohammad Al-Afeef, Bashar Alkhawaldeh, Maher Nawasra, Hani Al-Rawashdeh, Omar Zraqat, and Lina Hussien are professors and researchers specializing in administrative sciences, banking, finance, accounting, and human resource management at Jerash University, while Mahmoud Alafeef focuses on marketing at Al Baha University. Ghaith AlEitan specializes in finance and banking at Al al-Bayt University.

Lina Fuad Hussien

Hamzeh Alhawamdeh, Mohammad Al-Afeef, Bashar Alkhawaldeh, Maher Nawasra, Hani Al-Rawashdeh, Omar Zraqat, and Lina Hussien are professors and researchers specializing in administrative sciences, banking, finance, accounting, and human resource management at Jerash University, while Mahmoud Alafeef focuses on marketing at Al Baha University. Ghaith AlEitan specializes in finance and banking at Al al-Bayt University.

Ghaith N. Al-Eitan

Hamzeh Alhawamdeh, Mohammad Al-Afeef, Bashar Alkhawaldeh, Maher Nawasra, Hani Al-Rawashdeh, Omar Zraqat, and Lina Hussien are professors and researchers specializing in administrative sciences, banking, finance, accounting, and human resource management at Jerash University, while Mahmoud Alafeef focuses on marketing at Al Baha University. Ghaith AlEitan specializes in finance and banking at Al al-Bayt University.

References

- Acikdilli, G., Mintu-Wimsatt, A., Kara, A., & Spillan, J. E. (2022). Export market orientation, marketing capabilities and export performance of SMEs in an emerging market: A resource-based approach. Journal of Marketing Theory and Practice, 30(4), 1–22. https://doi.org/10.1080/10696679.2020.1809461

- Algarni, M. A., Ali, M., Albort-Morant, G., Leal-Rodríguez, A. L., Latan, H., Ali, I., & Ullah, S. (2022). Make green, live clean! Linking adaptive capability and environmental behavior with financial performance through corporate sustainability performance. Journal of Cleaner Production, 346, 131156. https://doi.org/10.1016/j.jclepro.2022.131156

- Ali, S., Wu, W., & Ali, S. (2022). Adaptive marketing capability and product innovations: the role of market ambidexterity and transformational leadership (evidence from Pakistani manufacturing industry). European Journal of Innovation Management, 25(4), 1056–1091. https://doi.org/10.1108/EJIM-12-2020-0520

- Alkhawaldeh, B. Y. S., Al-Zeaud, H. A., & Almarshad, M. N. (2022). Energy consumption as a measure of energy efficiency and emissions in the MENA countries: Evidence from GMM-based quantile regression approach. International Journal of Energy Economics and Policy, 12(5), 352–360. https://doi.org/10.32479/ijeep.13470

- Alkhawaldeh, B. Y., Alhawamdeh, H., Al_Shukri, K. S., Yousef, M., Shehadeh, A. Y. A., Abu-Samaha, A. M., & Alwreikat, A. A. (2023). The role of technological innovation on the effect of international strategic alliances on corporate competitiveness in Jordanian international business administration: Moderating and mediating analysis. Migration Letters, 20(6), 282–299. https://doi.org/10.59670/ml.v20i6.3479

- Al-Hawary, S. I. S., & Al-Fassed, K. J. (2022). The impact of social media marketing on building brand loyalty through customer engagement in Jordan. International Journal of Business Innovation and Research, 28(3), 365–387. https://doi.org/10.1504/IJBIR.2022.124126

- Alshurideh, M. (2022). Does electronic customer relationship management (E-CRM) affect service quality at private hospitals in Jordan? Uncertain Supply Chain Management, 10(2), 325–332. https://doi.org/10.5267/j.uscm.2022.1.006

- Alshurideh, M., Kurdi, B., AlHamad, A., Hamadneh, S., Alzoubi, H., & Ahmad, A. (2023). Does social customer relationship management (SCRM) affect customers’ happiness and retention? A service perspective. Uncertain Supply Chain Management, 11(1), 277–288. https://doi.org/10.5267/j.uscm.2022.9.015

- Atuahene-Gima, K. (2005). Resolving the capability–rigidity paradox in new product innovation. Journal of Marketing, 69(4), 61–83. https://doi.org/10.1509/jmkg.2005.69.4.61

- Barrales-Molina, V., Martínez-López, F. J., & Gázquez-Abad, J. C. (2014). Dynamic marketing capabilities: Toward an integrative framework. International Journal of Management Reviews, 16(4), 397–416. https://doi.org/10.1111/ijmr.12026

- Bruni, D. S., & Verona, G. (2009). Dynamic marketing capabilities in Science-based firms: An exploratory investigation of the pharmaceutical industry. British Journal of Management, 20(s1), S101–S117. https://doi.org/10.1111/j.1467-8551.2008.00615.x

- Cao, G., Tian, N., & Blankson, C. (2022). Big data, marketing analytics, and firm marketing capabilities. Journal of Computer Information Systems, 62(3), 442–451. https://doi.org/10.1080/08874417.2020.1842270

- Cassia, F., & Magno, F. (2022). Cross-border e-commerce as a foreign market entry mode among SMEs: the relationship between export capabilities and performance. Review of International Business and Strategy, 32(2), 267–283. https://doi.org/10.1108/RIBS-02-2021-0027

- Cheah, S. L. Y., Ho, Y. P., & Li, S. (2021). Search strategy, innovation and financial performance of firms in process industries. Technovation, 105, 102257. https://doi.org/10.1016/j.technovation.2021.102257

- Chen, Z., & Xie, G. (2022). ESG disclosure and financial performance: Moderating role of ESG investors. International Review of Financial Analysis, 83, 102291. https://doi.org/10.1016/j.irfa.2022.102291

- Das, S., & Hassan, H. K. (2022). Impact of sustainable supply chain management and customer relationship management on organizational performance. International Journal of Productivity and Performance Management, 71(6), 2140–2160. https://doi.org/10.1108/IJPPM-08-2020-0441

- DasGupta, R. (2022). Financial performance shortfall, ESG controversies, and ESG performance: Evidence from firms around the world. Finance Research Letters, 46, 102487. https://doi.org/10.1016/j.frl.2021.102487

- Day, G. S. (1994). The capabilities of market-driven organizations. Journal of Marketing, 58(4), 37–52. http://www.jstor.org/stable/1251915?origin=JSTOR-pdf https://doi.org/10.2307/1251915

- Del Vecchio, P., Mele, G., Siachou, E., & Schito, G. (2022). A structured literature review on Big Data for customer relationship management (CRM): toward a future agenda in international marketing. International Marketing Review, 39(5), 1069–1092. https://doi.org/10.1108/IMR-01-2021-0036

- Deligönül, Z. S., & Çavuşgil, S. T. (1997). Does the comparative advantage theory of competition really replace the neoclassical theory of perfect competition? Journal of Marketing, 61(4), 65–73. https://www.researchgate.net/publication/235362106 https://doi.org/10.1177/002224299706100405

- Dickson, P. R. (1996). The static and dynamic mechanics of competition: A comment on Hunt and Morgan’s comparative advantage theory. Journal of Marketing, 60(4), 102–106. https://doi.org/10.1177/002224299606000409

- Duffett, R. G., & Cromhout, D. H. (2022). The influence of student-imparted marketing skills and knowledge instruction on small businesses’ satisfaction: A service learning programme in South Africa. Journal for Advancement of Marketing Education, 30(1), 1–17.

- El Khoury, R., Nasrallah, N., & Alareeni, B. (2023). ESG and financial performance of banks in the MENAT region: concavity–convexity patterns. Journal of Sustainable Finance & Investment, 13(1), 406–430. https://doi.org/10.1080/20430795.2021.1929807

- Fang, E., & Zou, S. (2009). Antecedents and consequences of marketing dynamic capabilities in international joint ventures. Journal of International Business Studies, 40(5), 742–761. https://doi.org/10.1057/jibs.2008.96

- Gofwan, H. (2022). Effect of accounting information system on financial performance of firms: A review of literature. DEPARTMENT oF ACCOUNTING (BINGHAM UNIVERSITY)-2nd Departmental Seminar Series with the Theme–History of Accounting Thoughts: A Methodological Approach, 2(1), 57–60.

- Hagen, D., Risselada, A., Spierings, B., Weltevreden, J. W. J., & Atzema, O. (2022). Digital marketing activities by Dutch place management partnerships: A resource-based view. Cities, 123, 103548. https://doi.org/10.1016/j.cities.2021.103548

- Hair, J., & Alamer, A. (2022). Partial Least Squares Structural Equation Modeling (PLS-SEM) in second language and education research: Guidelines using an applied example. Research Methods in Applied Linguistics, 1(3), 100027. https://doi.org/10.1016/j.rmal.2022.100027

- Hamida, A., Alshehhia, A., Abdullaha, A., & Mohamed, E. (2022). Key success factors for customer relationship management (CRM) projects within SMEs. Emirati Journal of Business, Economics and Social Studies, 1(2), 73-85. https://doi.org/10.54878/EJBESS.176

- Hanaysha, J. R., & Al-Shaikh, M. E. (2022). An examination of customer relationship management dimensions and employee-based brand equity: A study on ride-hailing industry in Saudi Arabia. Research in Transportation Business & Management, 43, 100719. https://doi.org/10.1016/j.rtbm.2021.100719

- Homburg, C., & Wielgos, D. M. (2022). The value relevance of digital marketing capabilities to firm performance. Journal of the Academy of Marketing Science, 50(4), 666–688. https://doi.org/10.1007/s11747-022-00858-7

- Hunt, S. D. (1997). Resource-advantage theory: An evolutionary theory of competitive firm behavior? Journal of Economic Issues, 31(1), 59–78. https://doi.org/10.1080/00213624.1997.11505891

- Hunt, S. D., & Goolsby, J. (1988). The rise and fall of the functional approach to marketing: a paradigm displacement perspective. In Historical perspectives in marketing: Essays in honor of Stanley C. Hollander (pp. 35–52).

- Hunt, S. D., & Madhavaram, S. (2020). Adaptive marketing capabilities, dynamic capabilities, and renewal competences: The “outside vs. inside” and “static vs. dynamic” controversies in strategy. Industrial Marketing Management, 89, 129–139. https://doi.org/10.1016/j.indmarman.2019.07.004

- Hunt, S. D., & Morgan, R. M. (1995). The comparative advantage theory of competition. Journal of Marketing, 59(2), 1–15. https://doi.org/10.1177/002224299505900201

- Hunt, S. D., & Morgan, R. M. (1997). Resource-advantage theory: A snake swallowing its tail or a general theory of competition? Journal of Marketing, 61(4), 74–82. https://doi.org/10.1177/002224299706100406

- Jalil, M. F., Ali, A., & Kamarulzaman, R. (2022). Does innovation capability improve SME performance in Malaysia? The mediating effect of technology adoption. The International Journal of Entrepreneurship and Innovation, 23(4), 253–267. https://doi.org/10.1177/14657503211048967