Abstract

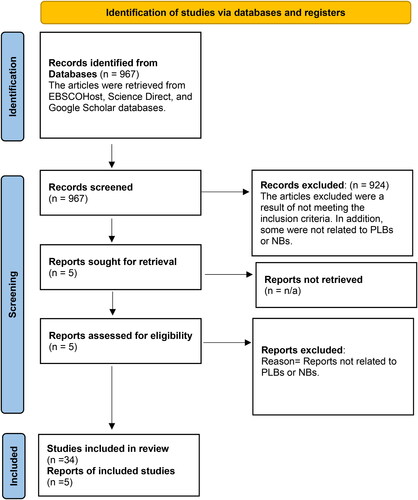

The rising phenomenon of private label brands across the globe has given grocery retailers new areas for competition and growth. As a result, this has spiralled competition between private label brands (PLBs) and national brands (NBs). With the grocery retail space undergoing various transitions over the years, the battleground between private label brands and national brands has also seen new trajectories. The purpose was to review earlier and current competition and identify future battle fronts between the two brands. To do this, a systematic literature review (SLR) of existing research between PLBs and NBs was undertaken. Studies from 2010 to 2022 were systematically reviewed to identify past, current, and future battle fronts to have emerged. In reviewing literature, a PRISMA flow chart structure, which details the searching, screening, including, and excluding of studies, was used. It was found that past competitive areas were largely price-quality schema. Currently, NBs continue with their higher pricing, to sustain their brand equity. On the other hand, grocery retailers continue to strategically position and reposition PLBs. In future, the study proposes strategic areas for consideration, product line expansion, newer pricing strategies, investments in both online and offline store formats, and strategic collaboration between both brands. Moreover, future areas of research were proposed.

REVIEWING EDITOR:

1. Introduction

The inception of private label brands has over the years been met with varying responses by consumers across different regions around the globe. This sparked rivalry and competition between private label brands and national brands, disrupting the already existing and established national branded products. This innovation led to an evolution within the grocery retailing industry (Bajpai, Citation2016; Rendón et al., Citation2023), leading to varying implications for grocery and brand management toward embracing the newly found product and competitive directions. National brands are calling for new brand strategies in dealing with the newly emergent competitive threat (Cuneo et al., Citation2019; Glover & Higgins, Citation2023).

Despite the innovation of private label brands, they have for the longest period fell behind national brands, with consumers often associating them with poor quality product offerings (Valaskova et al., Citation2018). Furthermore, private label brands, for some time, continued to be doubted for their functioning and quality, further quelling scepticism among consumers (Gangwani et al., Citation2020; Nielsen, Citation2018; Romaniuk et al., Citation2014), thereby allowing national brands to continue being dominant and favourable among consumers. In turn, this increases their market shares over private label brands. Interestingly, as this offsets the rise of PLBs, however, it has a positive effect in increasing a grocery retailer’s market share (Brüggemann et al., Citation2020). However, in response, retailers set lower prices for their private label products to ensure intensifying the level of competition between the two brand products (Chakraborty et al., Citation2022). The low pricing strategy has often led to the categorisation of PLBs to low-quality alternates of NBs. Consequently, the abovementioned has been the battle fronts between private label brands and national brands for the longest periods.

Considering the above, it is important to understand the past, current, and new potential battle fronts between private label brands and national brands. To this end, the private label brand value-based strategy deployed by grocery retailers has assisted them in gaining tractions of market shares (Agarwal et al., Citation2018; Singh & Singhal, Citation2020). However, Gielens et al. (Citation2021) cautioned the reliance of grocery retailers on the value-based competitive strategy, as consumers’ behaviours, retail structures, supply chains, and other new emergent changes within the retail landscape are rapid. Therefore, this review’s main purpose is an effort to understand the past known, current, and most importantly future competition battlefronts between private label brands and national brands. As this has the potential to create a future research agenda for private label and national brands research. Hence, this research aimed to conduct a systematic literature review (SLR). With that, this review aims to expand the existing body of knowledge through the following research questions:

What is the earlier competitive state between private label brands and national brands?

What are the current competitive areas between private label brands and national brands?

What are the future battle fronts between private label brands and national brands?

With that, this research is organised as follows: Section 2 provides an outline of the methodology used in conducting the review. Section 3 provides an overview of the discussion and results from the review of earlier, current, and possible future competitive areas between PLBs and NBs. Section 4 presents the conclusions, implications, and possible areas for further research.

2. Methods

In conducting this systematic review, a PRISMA flow chart was employed to ensure rigour and credibility in the systematic review and reporting on the search, screening, including, and excluding studies, and flow of the SLR process. Moher et al. (Citation2009) posited that the quality and strength of systematic reviews are a result of credible documentation of what has been done, and what was found. Therefore, below details the PRISMA flow chart by indicating the steps followed in this systematic review.

Figure 1. PRISMA flowchart (source: Moher et al., Citation2009).

Firstly, the identification of studies was conducted through database search. The databases used were Google Scholar, Science Direct, and EBSCOhost. These databases yielded different search results (see ).

Table 1. Database search and search strings.

informs the database retrieval findings when the researchers used the determined search strings (see ). It is important to note that the retrieved articles, as per results in , were not all eligible to be included in this review. To include and exclude studies for this review, articles were screened against eligibility criteria. In screening the articles, the researchers checked for article titles and abstracts if they met the inclusion and exclusion criteria.

2. 1. Eligibility criteria

The study followed the below-set inclusion and exclusion criteria:

2.1.1. Inclusion criteria

The study included studies that met the following criteria:

Studies focusing on both private label brands and national brands

Studies focusing on private label brands

Studies focusing on national brands

Studies conducted through primary quantitative, qualitative, or mixed-method research approaches

Conference articles

Grocery retail reports

Theses

Studies conducted from 2010 to 2022 (before publication)

Studies conducted using the English language

2.1.2. Exclusion criteria

The study excluded articles that had the following:

Studies not focusing on both private label brands and national brands

Studies conducted through secondary research approaches, such as literature reviews

Studies in other languages than English

Having articulated the inclusion and exclusion criterion, the following step entailed the researchers screening the potential articles to include in the study out of the 967 (111 + 806 + 70) retrieved articles, using the search strings specified in . They were further screened, and in screening them, 42 journal articles, four conference articles, two theses, and five grocery retail reports made the set inclusion criteria and were then stored on Mendeley and EndNote reference managers.

3. Discussion and results

shows the number of articles from the different journals, indicating the distribution of articles according to journals, with the Journal of Retailing and Consumer Services, Journal of Brand Management, Journal of Marketing Research, and Journal of Retailing forming most of the included articles, with between three and four articles from each journal.

Table 2. Articles included in this review.

shows other published materials that were considered for this study, with four conference articles making the inclusion criteria. Furthermore, five grocery retail reports assisted in shedding pervading insights of the grocery retail industry. In addition, through careful reading, two theses were also included.

Table 3. Other included review materials.

After reading and analysing the articles in , articles are matched with the specific research question, as presented in the last column of the table, that is, RQ1 (What is the earlier competitive state between private label brands and national brands?), RQ2 (What are the current competitive areas between private label brands and national brands?), and RQ3 (What are the future battle fronts between private label brands and national brands?).

Table 4. Selected studies and their relation to the research question.

The systematic literature review is presented below to answer RQ1, RQ2, and RQ3.

3.1. Theoretical background

To address our research questions for this study, the defined research methodology for this study was comprehensively followed. In doing so, it allowed the researcher to delve to the pertinent future trajectories surrounding the competition between private label brands and national brands. The following literature topics were explored using the included articles to answer the set research questions.

3.2. Earlier competition between PLBs and NBs

It is argued that over the past three decades, private label brands have asserted their presence in the FMCG industry, competing for competitive space with the already established national brands (Gera et al., Citation2016). Within these decades, private label brands have aggressively gone on to grapple with further market shares previously held by national brands with no stringent competition in the past (Loganathan, Citation2016). Seeing these new trajectories and insurgence, national brand manufacturers often thrive and win as consumers trust their provision over that of private label brand manufacturers (Vargas-Hernandez & Noruzi Reza, Citation2011). This has always been reported and proven as the ever-standing battleground between the two.

Considering the above, in earlier competitive fronts, there is a pertinent question as to what the specific differentiating factors between the two brand products were. Historically, the introduction of private label products was a strategy by grocery retailers to introduce low-cost value-adding product choices for consumers. However, these new innovations, over the years, have been met with varying attitudes from consumers (Mazumder, Citation2020). This was due to retailers pricing PLBs below NBs, and as a result, that eroded the perceived image quality of PLBs (Beneke et al., Citation2013), thereby prompting sceptical attitudes toward private label brands among consumers. This was in favour of national brands, since consumers are and were aware of their product qualities and value offers. Responding to the new emergent threat, with the introduction of private label brands, national brands had numerous strategic directions to take in response (Geyskens et al., Citation2010). Firstly, to hold on and observe these new product lines; secondly, innovation and creation of new products; thirdly, offering more value for money through their products; fourthly, reducing their product prices in response; and fifthly, national brands could compete by also introducing lower-priced quality products (Harleman, Citation2015). Adopting either of the said possible strategic responses, national brands continued to thrive through loyal consumers’ in turn displaying weaker attitudes toward PLBs (Manzur et al., Citation2011). However, Steenkamp et al. (Citation2010) noted the drop in national brand sales around the globe, affirming the stiff competition from private label brands. This was largely attributed to the rampant copycatting by private labels, and as a result, in some part of the globe, consumers perceived national brands in the same light (Steenkamp et al., Citation2010).

3.3. Current battle fronts between PLBs and NBs

Current research points out that in recent times, grocery retailers have gone to revolutionise their private label branded products. This is accounted for as consumers are said to have improved perceived product quality (Abril & Sanchez, Citation2016). Reinforcing this, Nenycz-Thiel & Romaniuk (Citation2011) reiterated that private label brands’ rejection is seemingly declining, resulting from consumers now having better product experiences of PLBs. However, constant investment on R&D by national brands remains the main node for differentiation and capping the rise of private label brands over the years (Gielens et al., Citation2022). In recent responses, grocery retailers from developed contexts such as Carrefour, Tesco, Asda, and Walmart have in recent time invested in innovating their private label product lines (Gielens et al., Citation2021), supporting the assertions of Gera et al. (Citation2016), who concluded that for the last three decades, PLBs from various product categories have successfully positioned and repositioned themselves in consumers’ minds. In response, national brands are reiterating by confronting this insurgence by private labels (Kumar & Kothari, Citation2015).

Both private and national brands have been extensively recommended to move away from low-price competing strategies to increased price promotions while reinforcing product qualities (Olbrich et al., Citation2017). Interestingly, Olbrich et al. (Citation2017) further posit the keeping of national brands at higher prices, which has an attractive impact and results in them achieving higher market shares over the years. To confirm this, Iller (Citation2013), in his earlier study, found that consumers use price as an extrinsic cue to evaluate or purchase PLBs, while for national brands, they use the brand and quality as their cue. Furthermore, another current battle line would be the issue of decision-making between PLBs and NBs, where the strategic timing in pricing and advertising by the manufacturer of national brands and the retailer is of importance (Karray & Martín-Herrán, Citation2019). Prominently, within the recent competitive realms between the two brands, it is worth acknowledging that it has kept both on their feet in terms of inventing and innovating new pathways towards producing value offering products, thereby improving private label brand perceptions among consumers and further increasing the credibility of national brand offerings (Putra & Fadillah, Citation2022). This proves the assertions of Shankar et al. (Citation2011), who, in their futuristic study of innovation in shopper marketing, emphasised the positive aspect of a ‘win-win’ situation, where both manufacturers and retailers co-exist to both benefit. Within this context, both are operating and targeting almost the same customer segments. Moreover, they are in direct competition for consumers’ evaluations of their perceived quality (Putra & Fadillah, Citation2022).

3.4. Future private label and national brands battle fronts

The issues surrounding pricing, quality, packaging, and advertising have been widely studied when juxtaposing between private label brands and national brands. As a result, more studies have either shown consistent or slightly varying results, due to the exhaustion of the abovementioned variables. Therefore, the need arises for studies, including this one, to look at future battle spaces that will intensify the competition between these two brand types. This section deliberates on the possible future direction of the competition between the two:

3.5. Introduction of new product lines

As mentioned earlier, since the price and quality valuation for PLBs against NBs, consumers are likely to view them from the same perceptive lenses. Hence, Stanton et al. (Citation2015) in their earlier study postulated the need to innovate product line development, especially for national brands, since private label brands are dominant on consumers shopping baskets (Glanz et al., Citation2012). Along these calls, Hökelekli et al. (Citation2017) posit that maybe the introduction of kids, health, and other product extensions will burgeon a ‘win-win’ scenario for both manufacturers and retailers, realising increased sales and profit margins. To sustain a competitive edge over their counterparts, national brands, the introduction of new product lines seems an effective strategy to counter the hovering threat of private label brands (Abril & Sanchez, Citation2016), since the price reduction strategy, to lure customers in switching between brands, has been in the past downplayed as an effective strategy. On the other hand, in new product line introduction, seemingly, private label products have an opportunity to introduce new product lines of healthy products with less fat, calories, and sugar additives (Glanz et al., Citation2012).

3.6. Change in pricing

Pricing has always been a delicate debate between private label and national branded products. One concern fuelling this debate is that of value perceptions from consumers, stuck between a rock and hard place. Where national brands maintain their superior value status by setting their product prices higher, PLBs are set below NBs price levels. National brands engage in this pricing activity to maintain their equity status and private label brands to penetrate and entice high sales volumes (Aw & Chong, Citation2019; Lourenço & Gijsbrechts, Citation2013). Over the years, this has a brand identification effect among consumers, where, due to both brands’ pricing strategies, consumers tend to associate quality and value based on the pricing of both, in turn affecting their brand choice and their consumption (Reinders & Bartels, Citation2017). Within some contexts, the price-quality schema is still weak for private label products. However, a conundrum persists, as grocery retailers’ efforts to strengthen the price-quality schema are somehow limited. For private label brands, much is at stake, since consumers have grown and been accustomed to private label brands being lower priced than national brands (Nenycz-Thiel & Romaniuk, Citation2011).

Recently, Gielens et al. (Citation2021), interestingly, found that the prices of private label and national brands are moving closer to each other. With predictions that the price gap between the brands has declined from an average of 1.9 to 1.6 (Gielens et al., Citation2022). This indicates a differentiation effort by grocery retailers to bridge the existing gap between private label and national brand pricing as it influences consumers’ purchasing decision between the two brand products (Pradhan, Citation2014). Previously, private label brands’ pricing has always been set at 50 to 70% lower than national brands. However, in recent times, with the sustained competitiveness assisted by quality improvements, PLBs are gradually closing the price gap (Gielens et al., Citation2021; Loganathan, Citation2016; Song, Citation2012). In contrast, other studies are of the general view that grocery retailers should persist in their low pricing strategy as it has been winning over consumers, in the process gathering more market shares (Lu et al., Citation2021). This development is an area of concern not only for national brands, but also for private label brands. The more they close the price positioning, they simultaneously close the debated quality of private label products. As a result, grocery retailers, together with their manufacturers of private label brands, need to strategise and innovate private label brands further; the same would suffice for national brands to keep their superior competitive advantage (Abril & Martos-Partal, Citation2013).

3.7. Innovation

It is only fair to note the general conception that has over the years been consistently found, that national branded products are ranked superior by consumers. Metrics used by customers to rank this superiority were based on national brands’ quality of their product lines, product packaging, innovation, and status (Kasotakis & Chountalas, Citation2014). This depicts the competitive trajectory between the brands, clearly placing an emphasis on the need for newer innovative competitive space or metrics. As the price-quality schema is gradually being exhausted, therefore, calling for newer innovation from all market contexts. As the strategies will not fit into all markets, as they differ in context (Gielens et al., Citation2022; Olbrich et al., Citation2017).

In light of the above, Wilson (Citation2022), in his article, posits that future growth and battlefronts among the two brands will largely be a result of constant innovation. In support, the Food Industry Association (2022) in Wilson (Citation2022) found that 81% of grocery retailers offered that their main strategy to gain more private label brand market share was through innovation. In retaliation, national brand manufacturers have a choice to produce cheaper product lines, risking their competitive advantage or persist on product innovations (Olbrich et al., Citation2017; Ter Braak et al., Citation2014). A future innovation point for both brands is the adoption of product add-ons, ensuring variety exists for different consumer segments. This can be achieved by both, through the introduction of fresh quality ingredients, variety, reduced waste and convenience products (Roy, Citation2022). Other grocery retailers can position their innovation toward the establishment of new premium private label products, products with simpler ingredients, and products with a greater emphasis on price-value schema (Wilson, Citation2022). With vast areas and niche areas for innovation, there are, however, concerns of retailers insisting that they are innovating while recycling similar products. Hence, Margulis (Citation2022), in analysing and reviewing the Private Label Manufacturers Association (PLMA) 2022 expo, critiqued the lack of innovation from grocery retailers in their private label brands, pointing out the sluggish efforts in innovating their private label products, citing similarities in the supposed innovations by grocery retailers. In the same light, Margulis (Citation2022) also noted the absence of innovation from the national brand side. National brands have, however, over the years sustained their competitive edge and held greater market share through constant innovations (Abril et al., Citation2015).

3.8. Online and offline store formats

In recent developments, both brands are actively engaged in competition through offline brick and mortar store formats and now on online channels. Daymon (Citation2020) reiterated that this was not a new but accelerated battlefront between the two. Earlier, Amrouche & Yan (Citation2012) concluded that channel introduction for either has a positive potential in profit generation. Therefore, implementing an expansion strategy, investing in both traditional stores and online store channels can generate greater profitability. The adoption of multichannel store formats can also influence consumer purchasing decisions (Shankar et al., Citation2011). Recently, grocery retailers have been aggressively expanding private label brands’ offering in e-commerce spaces. Grocery retail giants are already, with established e-commerce channels, taking advantage of this opportunity. Interestingly, in 2019, online private label product sales were reported to have reached $1.7 billion, a 87% year-on-year increase (Daymon, Citation2020). With big retail giants such as Walmart, Casino, Inditex, Tesco, Sainsbury, Target, and others optimally exploiting the e-commerce space, intensifying their expansion and sales. On the other hand, national brands have always been regarded as first movers in exploiting e-commerce channels. This coincides with the assertions of Gielens et al. (Citation2022), who affirm that traditionally, national brands would have a competitive edge over private label brands in e-commerce formats. However, recently, grocery retailers’ investments in e-commerce have progressed their probe toward garnering more market shares.

The assistance of technology has enabled the ease of access for grocery retailers to reach their targeted customers. It remains that traditional store formats will still be in existence. To explain, Aw & Chong (Citation2019) and Pangriya & Kumar (Citation2018), in their findings, highlight the importance of what they called visual merchandising and retail activities –that physical visual displays and grocery store activities induce positive brand attitude, thereby signalling the tremendous impact of grocery retail store atmospherics. This reinforces the need not only to invest in the opportunity presented by e-commerce, but also focus on their (grocery retailers) physical stores, allowing customers the physical comparison of perceived quality between national and private label brands (Aw & Chong, Citation2019; Baek et al., Citation2020). With that, the adoption of online store formats was further advanced by the Covid-19 pandemic. This adaptation contributed by the pandemic has made it a new normal, and in the process, this retail digitalisation has contributed to changing consumer behaviour – redefining store formats (Fortuna et al., Citation2021).

3.9. Internationalisation of PLBs and retail collaborations

The grocery retail industry has, in recent years, witnessed a rise in new introductions, competition, and innovation trends. Consumer behaviour, consumption needs, and product choices will always influence marketers, to react dynamically in their strategies to cater for this dynamism. Globalisation has impacted many changes in consumer behaviour, and, on the other hand, shaped new innovation and competitive realms in the grocery retail industry (Shankar et al., Citation2011). Through globalisation, international grocery retail giants have conquered in their home nation and managed to explore international markets and succeeded. This includes international grocery giants such as Aldi, Lidl, Amazon, Walmart, Morrisons, Carrefour, Target, and AEON, among others, who all have in one way or the other managed to apply their trade footprints in different markets across the globe. This has exposed them to different reception, perceptions, and new competition for market shares, not only creating a challenge, but also different opportunities.

Provided the number of opportunities for international grocery retailers, the prominent one has been the taking over of foreign supermarkets and occupying an already existing consumer base, which has proved to be an easy entry toward succeeding and occupying international market shares. However, other avenues have been explored, such as having a centralised supply chain and logistic network between grocery retailers. Therefore, further strategic thinking by grocery retailers is needed to strategically enrich the co-existence between PLBs and NBs (Chimhundu et al., Citation2015). As manufacturer brand does offer grocery retailers sufficient support such as financial support, manufacturer support, meeting consumer expectations, and brand equity (Glynn et al., Citation2012). Therefore, both brands can continue to compete while being in strategic co-existence since consumers will always make a choice between the two brand types.

4. Conclusions, implications, and limitations

4.1. Conclusion

The purpose of this review was to explore the phenomenon of the past, current, and future competitive areas between national and private label brands. It is significant to understand the previous competitive sphere between these dynamic brand offerings, more importantly, mapping the state of research and paving new research agendas to be explored.

Much of the research on NBs vs PLBs has been centred around pricing-quality, consumer perceptions, risk, purchase intentions, and consumer attitudes among others. Along with this, over the years, NBs have held the upper hand over PLBs. Recently, prodigious investments by grocery retailers have set PLBs on a positive trajectory. In response, NBs fast track their investment on research and development toward ensuring the maintenance of their place ahead of their PLB counterparts, as these have been battle areas.

4.2. Implications

Based on the results of this study, some implications can be drawn. This work contributes to possible areas that grocery retailers and manufacturers in the FMCG industry can venture into. This includes grocery retailers innovating product lines, putting forward that both brands have an opportunity to introduce new fresh product lines, for example, kids’ lines, healthy products, and products with less sugar and fat, among others. Through this, both brands can induce more consumers to prefer their products. However, the effectiveness of prolonged product innovation is doubted over time.

On the other hand, the future of both brands looks set for newer competitive areas. This represents opportunities for manufacturers and grocery retailers to explore more markets where strategic operations and collaborations are critical in the broader growth of NBs and PLBs. Significantly, both PLBs and NBs can benefit from direct competition or strategic coexistence.

4.3. Limitations

Since this is a systematic literature review, this study was limited to only previously published works and grocery retail reports using search strings, inclusion, and exclusion criteria of previous works around private and national brands research. Despite the existence of research around private label brands, it is inevitable to explore private label branded products without the juxtaposition with national branded products. Therefore, future research should focus on smart future strategies to ensure sustainability and more value-offering products (Gielens et al., Citation2021). Future market forces are equally important for future research, as markets are dynamic and consumer behaviour changes over time (Gielens et al., Citation2022). They can instrumentalise grocery retailers’ (PLBs) and manufacturers’ (NBs) strategies around their respective brands. Lastly, future researchers need to consider more qualitative studies on NBs vis PLBs, to gather and assess new trajectories for grocery retailers’ and manufacturers’ foundation for future strategies since reliance on past and current competitive strategies might not be effective in the long term.

Disclosure statement

No potential conflict of interest was reported by the author(s).

Additional information

Notes on contributors

Sbonelo Gift Ndlovu

Sbonelo Gift Ndlovu is a PhD candidate in Marketing Management, under the school of Management Sciences at the North-West university, Mahikeng, South Africa. He lectures services and digital marketing modules in the Marketing department. His research interest spans consumer behaviour, with focus on private label brands, entrepreneurship, and multidisciplinary research.

References

- Abril, C., & Martos-Partal, M. (2013). Is product innovation as effective for private labels as it is for national brands? Innovation, 15(3), 1–13. https://doi.org/10.5172/impp.2013.15.3.337

- Abril, C., & Sanchez, J. (2016). Will they return? Getting private label consumers to come back: Price, promotion, and new product effects. Journal of Retailing and Consumer Services, 31, 109–116. https://doi.org/10.1016/j.jretconser.2016.03.010

- Abril, C., Sanchez, J., & García-Madariaga, J. (2015). The effect of product innovation, promotion, and price on consumer switching to private labels. Journal of Marketing Channels, 22(3), 192–201. https://doi.org/10.1080/1046669X.2015.1071604

- Agarwal, S., Agarwal, Y., & Patel, I. (2018). The effect of store image and private label brands on sales of women’s apparel in Bangalore. International Journal for Advance Research and Development, 3(2), 199–201.

- Amrouche, N., & Yan, R. (2012). Implementing online store for national brand competing against private label. Journal of Business Research, 65(3), 325–332. https://doi.org/10.1016/j.jbusres.2011.04.008

- Aw, E. C.-X., & Chong, H. X. (2019). Understanding non-private label consumers’ switching intention in emerging market. Marketing Intelligence & Planning, 37(6), 689–705. https://doi.org/10.1108/MIP-11-2018-0514

- Baek, E., Choo, H. J., Wei, X., & Yoon, S.-Y. (2020). Understanding the virtual tours of retail stores: how can store brand experience promote visit intentions? International Journal of Retail & Distribution Management, 48(7), 649–666. https://doi.org/10.1108/IJRDM-09-2019-0294

- Bajpai, V. (2016). History and evolution of private label brands. International Journal of Marketing and Technology, 6(6), 119–137.

- Beneke, J., Flynn, R., Greig, T., & Mukaiwa, M. (2013). The influence of perceived product quality, relative price and risk on customer value and willingness to buy: a study of private label merchandise. Journal of Product & Brand Management, 22(3), 218–228. https://doi.org/10.1108/JPBM-02-2013-0262

- Brüggemann, P., Olbrich, R., & Schultz, C. D. (2020). Competition between national brands and private labels: determinants of the market share of national brands [Paper presentation]. International Conference on Advances in National Brand and Private Label Marketing.

- Chakraborty, T., Chauhan, S. S., & Huang, X. (2022). Quality competition between national and store brands. International Journal of Production Research, 60(9), 2703–2732. https://doi.org/10.1080/00207543.2021.1901154

- Chimhundu, R., McNeill, L. S., & Hamlin, R. P. (2015). Manufacturer and retailer brands: Is strategic coexistence the norm? Australasian Marketing Journal, 23(1), 49–60. https://doi.org/10.1016/j.ausmj.2014.11.004

- Cuneo, A., Milberg, S. J., del Carmen Alarcon-del-Amo, M., & Lopez-Belbeze, P. (2019). Private label and manufacturer brand choice in a new competitive reality: strategic directions and the future of brands. European Management Journal, 37(1), 117–128. https://doi.org/10.1016/j.emj.2018.05.003

- Daymon. (2020). The future of private label brands. Daymon. https://www.daymon.com/wp-content/uploads/2020/08/Daymon-PB-Intelligence-Report-2020.pdf

- Fortuna, F., Risso, M., & Musso, F. (2021). Omnichannelling and the predominance of big retailers in the post-Covid Era. Symphonya. Emerging Issues in Management, 2(2), 142–157. https://doi.org/10.4468/2021.2.11fortuna.risso.musso

- Gangwani, S., Mathur, M., & Shahab, S. (2020). Influence of consumer perceptions of private label brands on store loyalty–evidence from Indian retailing. Cogent Business & Management, 7(1), 1751905. https://doi.org/10.1080/23311975.2020.1751905

- Gera, N., Bajaj, R., & Mishra, N. K. (2016). A comparative study on the growth prospects of private label brands to that of national brands in FMCG retail in Delhi with special reference to ATTA. International Journal of Applied Business and Economic Research, 14(6), 4419–4442.

- Geyskens, I., Gielens, K., & Gijsbrechts, E. (2010). Proliferating private-label portfolios: How introducing economy and premium private labels influences brand choice. Journal of Marketing Research, 47(5), 791–807. https://doi.org/10.1509/jmkr.47.5.791

- Gielens, K., Dekimpe, M. G., Mukherjee, A., & Tuli, K. (2022). The future of private-label markets: A global convergence approach. International Journal of Research in Marketing, 40(1), 248–267. https://doi.org/10.1016/j.ijresmar.2022.07.006

- Gielens, K., Ma, Y., Namin, A., Sethuraman, R., Smith, R. J., Bachtel, R. C., & Jervis, S. (2021). The future of private labels: towards a smart private label strategy. Journal of Retailing, 97(1), 99–115. https://doi.org/10.1016/j.jretai.2020.10.007

- Glanz, K., Bader, M. D., & Iyer, S. (2012). Retail grocery store marketing strategies and obesity: an integrative review. American Journal of Preventive Medicine, 42(5), 503–512. https://doi.org/10.1016/j.amepre.2012.01.013

- Glover, Nikolas, and David M. Higgins, eds. (2023). National brands and global markets: An historical perspective. Taylor & Francis.

- Glynn, M. S., Brodie, R. J., & Motion, J. (2012). The benefits of manufacturer brands to retailers. European Journal of Marketing, 46(9), 1127–1149. https://doi.org/10.1108/03090561211247856

- Harleman, R. (2015). National brands in the discount supermarket: does brand image transfer occur on national brands when they are available in the discount supermarket? University of Twente.

- Hökelekli, G., Lamey, L., & Verboven, F. (2017). Private label line proliferation and private label tier pricing: a new dimension of competition between private labels and national brands. Journal of Retailing and Consumer Services, 36, 39–52. https://doi.org/10.1016/j.jretconser.2016.12.014

- Iller, M. (2013). Emerging issues in French grocery sector. Actual customers’ perceptions and motivations toward private label and manufacturer brands [Dublin Business School].

- Karray, S., & Martín-Herrán, G. (2019). Fighting store brands through the strategic timing of pricing and advertising decisions. European Journal of Operational Research, 275(2), 635–647. https://doi.org/10.1016/j.ejor.2018.11.066

- Kasotakis, D., & Chountalas, P. (2014). Consumer attitudes towards private label products: An empirical investigation. Proceedings of the eRA-9 International Scientific Conference (ISSN-1791-1133), 18–26.

- Kumar, S., & Kothari, M. (2015). A study on consumer perception regarding private label branding in India. European Journal of Business and Management, 7(10), 225–232.

- Loganathan, D. (2016). A conceptual study on private label brands and its impacts in India. Asia Pacific Journal of Research, 2, 158–162.

- Lourenço, C. J., & Gijsbrechts, E. (2013). The impact of national brand introductions on hard-discounter image and share-of-wallet. International Journal of Research in Marketing, 30(4), 368–382. https://doi.org/10.1016/j.ijresmar.2013.04.005

- Lu, G., Song, Y., & Pan, B. (2021). How university entrepreneurship support affects college students’ entrepreneurial intentions: An empirical analysis from China. Sustainability, 13(6), 3224. https://doi.org/10.3390/su13063224

- Manzur, E., Olavarrieta, S., Hidalgo, P., Farías, P., & Uribe, R. (2011). Store brand and national brand promotion attitudes antecedents. Journal of Business Research, 64(3), 286–291. https://doi.org/10.1016/j.jbusres.2009.11.014

- Margulis. (2022). Where is the innovation we should be seeing in store brands? https://retailwire.com/discussion/where-is-the-innovation-we-should-be-seeing-in-store-brands/

- Mazumder, R. (2020). Customers’ attitude and purchase intention towards private label brands and national brands of men’s apparel. Globsyn Management Lobsyn Management Conference Proceedings Proceedings.

- Moher, D., Liberati, A., Tetzlaff, J., Altman, D. G., & Group, P, and the PRISMA Group. (2009). Reprint—preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. Physical Therapy, 89(9), 873–880. https://doi.org/10.1093/ptj/89.9.873

- Nenycz-Thiel, M., & Romaniuk, J. (2011). The nature and incidence of private label rejection. Australasian Marketing Journal, 19(2), 93–99. https://doi.org/10.1016/j.ausmj.2011.02.001

- Nielsen. (2018). Global Private Label Report. The Nielsen Company. https://www.nielsen.com/wp-content/uploads/sites/3/2019/04/global-private-label-report.pdf

- Olbrich, R., Jansen, H. C., & Hundt, M. (2017). Effects of pricing strategies and product quality on private label and national brand performance. Journal of Retailing and Consumer Services, 34, 294–301. https://doi.org/10.1016/j.jretconser.2016.01.012

- Pangriya, R., & Kumar, M. R. (2018). My store my brand’–a critical review of online and offline private label brands in India. International Journal of Indian Culture and Business Management, 16(2), 223–244. https://doi.org/10.1504/IJICBM.2018.090095

- Pradhan, S. (2014). Store Brands: Who Buys them and Why? (pp. 136). BS Publications.

- Putra, R. Y., & Fadillah, S. N. (2022). In-store marketing strategies towards customer attitude to private label brands using cue utilization theory. The Winners, 23(1), 25–33. https://doi.org/10.21512/tw.v23i1.7091

- Reinders, M. J., & Bartels, J. (2017). The roles of identity and brand equity in organic consumption behavior: Private label brands versus national brands. Journal of Brand Management, 24(1), 68–85. https://doi.org/10.1057/s41262-016-0019-z

- Rendón, W. M., Bayona, A. A., Montoya, S. B., & Hernandez, L. S. (2023). Determinants of attitude towards and purchase intention of private label brands in Ecuador. Revista Venezolana de Gerencia: RVG, 28(101), 352–368.

- Romaniuk, J., Dawes, J., & Nenycz-Thiel, M. (2014). Generalizations regarding the growth and decline of manufacturer and store brands. Journal of Retailing and Consumer Services, 21(5), 725–734. https://doi.org/10.1016/j.jretconser.2014.05.005

- Roy. (2022). Is innovation the new battleground between brands and private label? https://www.warc.com/newsandopinion/opinion/is-innovation-the-new-battleground-between-brands-and-private-label/en-gb/5769

- Shankar, V., Inman, J. J., Mantrala, M., Kelley, E., & Rizley, R. (2011). Innovations in shopper marketing: Current insights and future research issues. Journal of Retailing, 87, S29–S42. https://doi.org/10.1016/j.jretai.2011.04.007

- Singh, A., & Singhal, R. K. (2020). Emerging third generation private label brands: retailers’ and consumers’ perspectives towards leading Indian retail chains. International Journal of Business and Emerging Markets, 12(2), 179–203. https://doi.org/10.1504/IJBEM.2020.107727

- Song, W. (2012). Possible causes inhibiting the purchase of Chinese grocery own brands: a preliminary study. Journal of Business Economics and Management, 13(2), 207–222. https://doi.org/10.3846/16111699.2011.620160

- Stanton, J. L., Wiley, J., Hooker, N. H., & Salnikova, E. (2015). Relationship of product claims between private label and national brands: the influence of private label penetration. International Journal of Retail & Distribution Management, 43(9), 815–830. https://doi.org/10.1108/IJRDM-11-2013-0212

- Steenkamp, J.-B E., Van Heerde, H. J., & Geyskens, I. (2010). What makes consumers willing to pay a price premium for national brands over private labels? Journal of Marketing Research, 47(6), 1011–1024. https://doi.org/10.1509/jmkr.47.6.1011

- Ter Braak, A., Geyskens, I., & Dekimpe, M. G. (2014). Taking private labels upmarket: Empirical generalizations on category drivers of premium private label introductions. Journal of Retailing, 90(2), 125–140. https://doi.org/10.1016/j.jretai.2014.01.003

- Valaskova, K., Kliestikova, J., & Krizanova, A, University of Žilina. (2018). Consumer perception of private label products: An empirical research. Journal of Competitiveness, 10(3), 149–163. https://doi.org/10.7441/joc.2018.03.10

- Vargas-Hernandez, J., & Noruzi Reza, M. (2011). A study on different perspectives on private labels. International Journal of Humanities and Social Science, 1(2), 95–97.

- Wilson. (2022). Innovation key to private label growth. https://www.foodbusinessnews.net/articles/22386-innovation-key-to-private-label-growth